Ten Times Higher Than the Same Period Last Year

"Due to Provision for Bad Debts, Enhancing Loss Absorption Capacity"

Saemaeul Geumgo's net loss for the first half of this year reached 1.2019 trillion KRW, which is ten times the level of the first half of last year.

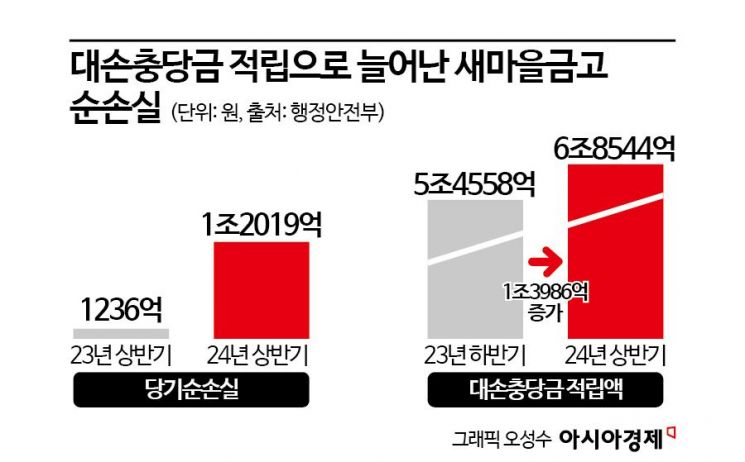

The Ministry of the Interior and Safety announced the operating performance of 1,284 Saemaeul Geumgo nationwide for the first half of 2024 on the 30th. Saemaeul Geumgo recorded a net loss of 1.2019 trillion KRW, a sharp increase compared to the net loss of 123.6 billion KRW in the first half of last year. This was due to a significant increase in the provision for loan losses to enhance loss absorption capacity. The provision for loan losses, which was 5.4558 trillion KRW at the end of last year, increased by 1.3986 trillion KRW to 6.8544 trillion KRW as of June this year.

Saemaeul Geumgo's net loss for the first half of 2024 amounted to 1.2019 trillion KRW. This represents an 872.4% increase compared to the same period last year.

Saemaeul Geumgo's net loss for the first half of 2024 amounted to 1.2019 trillion KRW. This represents an 872.4% increase compared to the same period last year.

The Ministry of the Interior and Safety explained, “The net loss occurred as a result of strictly setting aside provisions for loan losses and actively selling and writing off delinquent loans to absorb losses caused by deteriorating asset soundness,” but added, “Considering the accumulated provision size and the net capital ratio, which exceeds regulatory ratios by more than twice, the level is manageable.” At the end of last year, Saemaeul Geumgo’s retained earnings were 8.3 trillion KRW, with an additional 5.6 trillion KRW set aside beyond the legally required reserves to cover losses and other purposes.

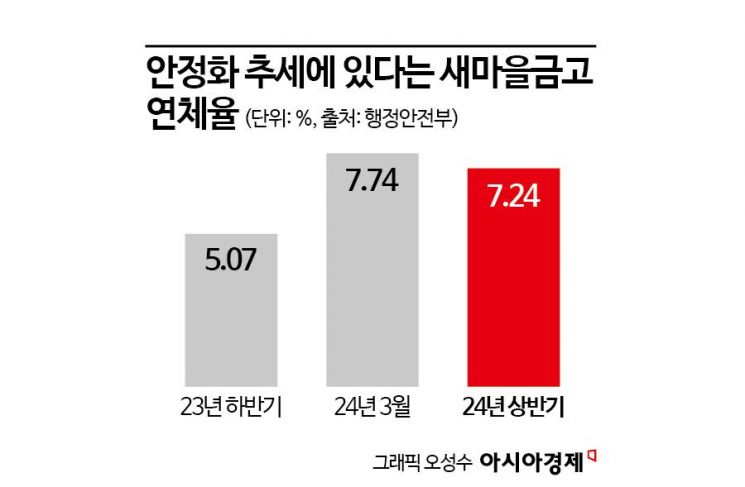

Looking at asset soundness, all delinquency-related figures worsened. The overall delinquency rate rose by 2.17 percentage points to 7.24% compared to 5.07% at the end of last year. In particular, the corporate loan delinquency rate increased by 3.41 percentage points to 11.15% from 7.74% at the end of last year. Household loan delinquency also rose by 0.25 percentage points to 1.77% from 1.52% at the end of last year. A representative from the National Saemaeul Geumgo Federation explained, “Due to the downturn in the real estate and construction markets, borrowers who took loans from Saemaeul Geumgo have increasingly become delinquent,” adding, “We are increasing provisions and focusing on managing corporate loan delinquency rates through the sale of non-performing loans.”

As delinquency rates increased, the ratio of non-performing loans classified as substandard or below (the proportion of loans overdue for more than three months among total bank loans) also rose. As of June this year, it stood at 9.08%, up 3.53 percentage points from 5.55% at the end of last year. However, it decreased by 0.5 percentage points compared to March this year (7.74%). The provision coverage ratio, which is the ratio of provisions for loan losses to the required provision amount, was 105.61%, similar to 106.13% at the end of last year, and remained above 100%.

The net capital ratio, an indicator of capital adequacy, was 8.21% as of June this year, down 0.39 percentage points from 8.6% at the end of last year. It remains above the minimum regulatory ratio (4% or higher).

Saemaeul Geumgo’s total assets increased by 1.9 trillion KRW to 288.9 trillion KRW compared to 287 trillion KRW at the end of last year. Total loans recorded 180.8 trillion KRW, down 7.3 trillion KRW from 188.1 trillion KRW at the end of last year. Both corporate loans (105.4 trillion KRW) and household loans (75.4 trillion KRW) decreased by 2 trillion KRW and 5.3 trillion KRW respectively during the same period. Total deposits increased by 5 trillion KRW to 259.9 trillion KRW compared to the end of last year.

The Ministry of the Interior and Safety evaluated that despite the continued rise in delinquency rates across all financial sectors due to high interest rates and delayed recovery in the real estate market in the first half of this year, the delinquency rate of Saemaeul Geumgo is gradually stabilizing through the sale of delinquent loans.

For the second half of the year, it is expected that the economic recovery trend will continue due to factors such as U.S. interest rate cuts and the effects of housing supply expansion measures, leading to gradual improvement in operating performance. However, considering the scale of losses in the second half of this year, the Ministry stated that it will manage deposits, which are gradually increasing, to maintain an appropriate scale. The Ministry of the Interior and Safety added, “Since potential risk factors still exist, we will continue active and focused soundness management and, through close cooperation with financial authorities, proceed smoothly with restructuring of real estate development projects and activation of auctions and sales.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)