Publication of 2024 National Assembly Legislative Research Service National Audit Issue Analysis

126% Rule Causes Side Effects of Reverse Jeonse and Monthly Rent Increase

Ministry of Land, Infrastructure and Transport Should Expand Jeonse Deposit Return Guarantee Scope

On the 9th, a view of the villa-dense area in Yongsan-gu from Namsan, Jung-gu, Seoul. Photo by Jin-Hyung Kang aymsdream@

On the 9th, a view of the villa-dense area in Yongsan-gu from Namsan, Jung-gu, Seoul. Photo by Jin-Hyung Kang aymsdream@

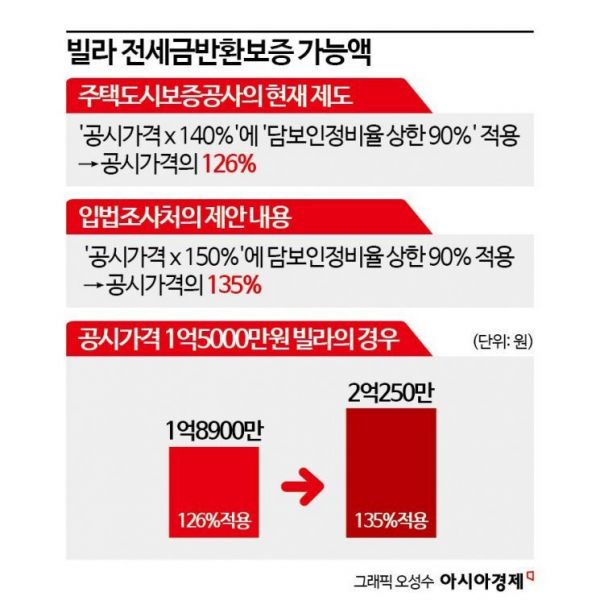

There is an analysis suggesting that the ‘126% rule,’ which is causing side effects in the non-apartment jeonse market such as villas, should be raised to 135%. To encourage tenants to actively use the jeonse deposit refund guarantee (hereafter ‘refund guarantee’) and landlords to receive jeonse prices aligned with market value, the subscription threshold needs to be lowered. This is expected to be a major issue at the upcoming National Assembly Land, Infrastructure and Transport Committee’s audit next month. The refund guarantee is a product where the Housing and Urban Guarantee Corporation (HUG) pays the tenant the deposit if the landlord fails to return the jeonse deposit.

Publicly Announced Price Lowered... Need to Change to ‘135% Rule’

The National Assembly Legislative Research Office pointed out in its ‘2024 National Audit Issue Analysis’ that it is realistic to expand the refund guarantee coverage for villa jeonse from 126% to 135% of the publicly announced housing price. This would help landlords repay deposits on time and prevent reverse jeonse problems, as well as reduce cases of converting jeonse to monthly rent. For tenants, it is expected to become easier to find jeonse houses eligible for the refund guarantee.

The Ministry of Land, Infrastructure and Transport strengthened subscription requirements last May to prevent the refund guarantee from being used in jeonse fraud. They recognized housing prices only up to 140% of the publicly announced price and lowered the loan-to-value ratio to 90%. This led to the so-called ‘126% rule,’ where the refund guarantee can only be obtained up to 126% of the publicly announced price.

Originally, housing prices were recognized up to 150% of the publicly announced price, and the loan-to-value ratio was 100%, but the scope was narrowed. The government adjusted this because jeonse fraudsters were exploiting this for ‘zero-capital gap speculation,’ which triggered jeonse fraud.

A villa neighborhood in Yangcheon-gu, Seoul, where villa transaction volumes are increasing on the 11th. Photo by Mun Ho-nam munonam@

A villa neighborhood in Yangcheon-gu, Seoul, where villa transaction volumes are increasing on the 11th. Photo by Mun Ho-nam munonam@

Since then, tenants have only sought jeonse houses eligible for the refund guarantee under the 126% rule to avoid the risk of jeonse fraud institutionally. On the other hand, landlords like Mr. A have found it difficult to blindly subscribe to the refund guarantee, fearing reverse jeonse if they lower the deposit by tens of millions of won.

As the villa market froze and the publicly announced prices dropped, landlords’ situations worsened. If the publicly announced price had been maintained, the impact of reducing the refund guarantee coverage would have been less severe. However, with the publicly announced price falling over the past two years and the guarantee coverage narrowing, landlords have been hit twice. For example, a villa on Hwagok-ro in Gangseo-gu, Seoul, had a publicly announced price of 140 million won on January 1, 2022. At that time, the refund guarantee deposit could be up to 210 million won. If the publicly announced price had been maintained until January this year, the refund guarantee coverage would have been reduced but still allowed up to 176 million won.

However, the publicly announced price of this villa dropped to 133 million won as of January this year. Applying the reduced refund guarantee coverage, the guaranteed deposit amount is 167 million won. Over two years, the refund guarantee deposit shrank from 210 million won to 167 million won. Considering that the refund guarantee deposit is effectively regarded as the market price, this means the jeonse price fell by 43 million won. The landlord is now in a situation where they must pay the previous tenant 43 million won out of their own pocket to renew the contract.

Due to the ‘126% Rule’... Concerns Over Reverse Jeonse and Increase in Monthly Rent

Jang Kyung-seok, a researcher at the Legislative Research Office’s Economic and Industrial Research Division, pointed out, "As the refund guarantee subscription range shrinks, landlords can no longer return deposits to previous tenants using deposits from new tenants. The number of jeonse properties that cannot subscribe to the refund guarantee has increased, making it difficult for tenants to find houses."

He also analyzed that the increase in the proportion of monthly rent transactions is due to the ‘126% rule.’ Researcher Jang said, "As the deposit level landlords can demand decreases, many have shifted to ‘monthly rent with deposit,’ where the deposit is limited by the 126% rule and the remaining amount is converted into monthly rent." He added, "The proportion of monthly rent transactions in the entire rental market in the Seoul metropolitan area rose from 53.6% in 2022 to 67.3% in April this year, increasing the burden on low-income tenants as monthly rents rise."

The Legislative Research Office’s position is that the refund guarantee coverage for villa jeonse should be expanded for the sake of tenants. Currently, only up to 140% of the publicly announced price is recognized when calculating housing prices, but they proposed raising this to 150%, while maintaining the loan-to-value ratio at 90%. This would change the existing ‘126% rule’ to a ‘135% rule.’ For example, for a house with a publicly announced price of 150 million won, the refund guarantee amount would increase from 189 million won to 202.5 million won.

To implement this, HUG’s internal regulations would need to be revised, but since it has a significant market impact, the Ministry of Land, Infrastructure and Transport must decide. However, the Ministry still maintains the 126% rule, judging that expanding the refund guarantee coverage again would expose the market to jeonse fraud risks and that HUG’s financial condition is poor, leaving no room for expansion.

From This Month, Using HUG Appraised Value, Effectiveness Uncertain

As public opinion in the villa jeonse market heated up, the Ministry of Land, Infrastructure and Transport proposed in June an alternative to calculate the refundable guarantee amount using the appraised value recognized by HUG, in addition to the 126% rule. In the past, the appraised value was also used. The difference now is that only appraisal firms selected by HUG can conduct appraisals to prevent ‘appraisal value inflation.’ This system started on the 12th of this month.

A villa owner said, "It will take two or three months for landlords who have used the HUG appraised value to spread word of mouth like ‘the prices don’t come out well and it’s useless’ or ‘it’s more reasonable than the 126% rule.’ Whether this system will help will only be known in the second half of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)