NVIDIA Earnings Release After Market Close on 28th

July PCE Inflation and Unemployment Claims Also Released This Week

The three major indices of the U.S. New York Stock Exchange showed mixed trends in the early session on the 27th (local time), hovering around the flat line. Market participants are adopting a cautious stance ahead of Nvidia's earnings announcement, which is seen as a key indicator for the AI rally and the direction of the stock market.

As of 11:18 a.m. in the New York stock market, the Dow Jones Industrial Average, focused on blue-chip stocks, was down 0.06% from the previous trading day at 41,215.99. The S&P 500, centered on large-cap stocks, rose 0.16% to 5,625.92, while the tech-heavy Nasdaq Composite increased 0.24% to 17,768.58.

The previous day, the New York stock market closed mixed amid concerns over Nvidia's earnings. The Dow Jones Industrial Average rose 0.16%, hitting an all-time high, but the S&P 500 and Nasdaq Composite fell 0.32% and 0.85%, respectively.

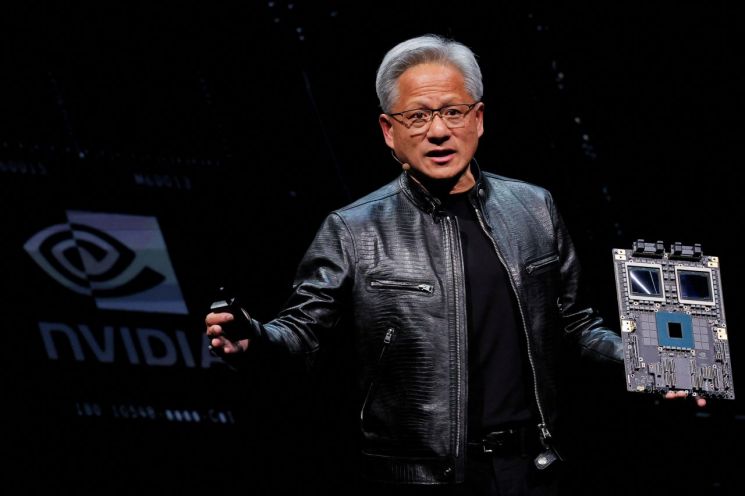

Investors are showing heightened caution ahead of Nvidia's earnings, which have become a barometer for the AI rally. Nvidia will announce its fiscal 2025 second-quarter results (May to July) after the market closes on the 28th. Revenue and operating profit are expected to more than double to $28.6 billion and $18.7 billion, respectively. Through Nvidia's earnings, investors will be able to gauge whether the tech stocks and market rally driven by AI expectations will continue.

Alberto Torchio, portfolio manager at Kairos Partners, said, "Nvidia's earnings will be good," but added, "The important thing will be the earnings outlook that can determine whether demand remains healthy." He continued, "If bad news comes out, the market, which is still heavily concentrated in large-cap stocks, will likely see an even stronger rotation from big tech to small and mid-cap stocks."

This week, the July Personal Consumption Expenditures (PCE) price index and last week's initial jobless claims will also be released. The initial jobless claims for last week, to be announced on the 29th, are expected to slightly increase to 234,000 from 232,000 the previous week. The July PCE price index, to be released on the 30th, is forecasted to rise 0.2% month-over-month and 2.5% year-over-year. As a result, the core PCE inflation rate is expected to have slowed to 2.1% over the past three months, approaching the Fed's target of 2%.

Investors are raising their expectations for a rate cut in September. Fed Chair Jerome Powell hinted at this during his speech at the Jackson Hole meeting on the 23rd, creating confidence in a September pivot (policy direction shift). According to the Chicago Mercantile Exchange (CME) FedWatch, the federal funds futures market fully prices in a more than 0.25 percentage point rate cut by the Fed in September. The probability of a 0.25 percentage point cut is 71.5%, while the chance of a 0.5 percentage point 'big cut' is 28.5%.

Government bond yields are rising slightly. The U.S. 10-year Treasury yield, a global bond yield benchmark, rose 3 basis points to 3.85%, while the 2-year Treasury yield, sensitive to monetary policy, increased 1 basis point to 3.94%.

Among individual stocks, Nvidia, which is set to announce earnings tomorrow, rose 1.73%. Food company Hein Celestial surged 27.16% after reporting better-than-expected quarterly results. AI company Super Micro Computer fell 1.61% after Hindenburg Research, a U.S. short-selling firm, announced it would target the company for short selling.

International oil prices surged due to concerns over escalation in the Middle East and the potential closure of Libyan oil fields, then paused their rise and started to decline. West Texas Intermediate (WTI) crude oil traded at $77.02 per barrel, down $0.40 (0.5%) from the previous day, while Brent crude, the global oil price benchmark, fell $0.36 (0.4%) to $81.07 per barrel.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)