Quarterly Profit Turnaround Led by New Epilepsy Drug

Increase in Prescriptions Due to Higher Efficacy Compared to Competing Treatments

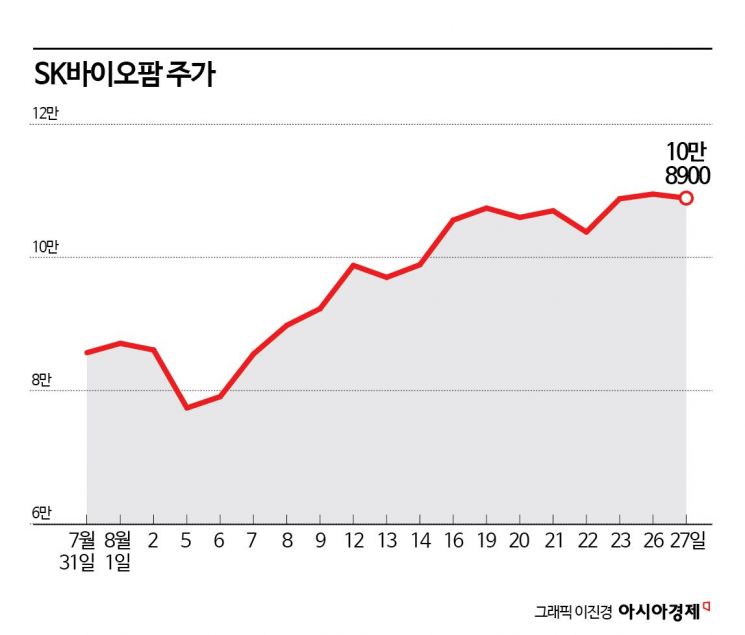

SK Biopharm's stock price has been rebounding since announcing its second-quarter earnings this year. Domestic institutional investors, confirming strong sales of the epilepsy treatment new drug 'Cenobamate' in the United States, have purchased 50 billion KRW worth of shares, driving the stock price up.

According to the financial investment industry on the 28th, SK Biopharm's stock price rose 27% this month. Considering that the KOSPI fell about 3% during the same period, the market-relative return reaches 30 percentage points.

SK Biopharm achieved consolidated sales of 133.995 billion KRW and operating profit of 26.046 billion KRW in the second quarter of this year. Compared to the same period last year, sales increased by 74.0%, and operating profit turned positive. Since the earnings announcement on the 8th, institutions have been actively buying SK Biopharm shares. The cumulative net purchase from the 8th to the 27th reached 51.4 billion KRW.

SK Biopharm is developing new drugs for central nervous system (CNS) diseases. Despite challenges in new drug development projects, the company invested a total of 800 billion KRW to develop treatments such as the sleep disorder drug (Solriamfetol) and the epilepsy treatment drug (Cenobamate). Epilepsy is a brain disorder characterized by repeated temporary paralysis symptoms of brain function, such as seizures and behavioral changes, caused by temporary abnormalities in brain nerve cells.

The flagship product Cenobamate was approved by the U.S. Food and Drug Administration (FDA) in November 2019. Since 2020, it has been directly sold in the U.S. under the product name 'Xcopri.' In 2021, it obtained final sales approval from the European Commission (EC).

Of the cumulative sales of 248 billion KRW in the first half of this year, Cenobamate sales accounted for 239.8 billion KRW, or 96.7%. Lee Seon-kyung, a researcher at SK Securities, explained, "SK Biopharm, which has low recognition in the U.S., is growing rapidly in a conservative prescription environment," adding, "U.S. sales in the second quarter increased by 65.8% compared to the same period last year." She further stated, "Its efficacy is better compared to competing products approved in the last 10 years," and "Sales will steadily increase based on competitive drug pricing."

Due to the nature of epilepsy treatment, which emphasizes long-term safety, even if new drugs are introduced, the initial market penetration speed is slow. Because the effects of existing prescribed drugs are not significant, when switching to other drugs, sufficient time is taken to reduce the dosage while discontinuing the existing medication. Over time, Cenobamate sales are likely to increase rapidly.

Heo Hye-min, a researcher at Kiwoom Securities, estimated, "U.S. sales this year will increase by 62% from last year to 437.3 billion KRW," and analyzed, "Aggressive sales activities are expected to begin in the second half of this year."

Kim Seung-min, a researcher at Mirae Asset Securities, explained, "The number of Xcopri prescriptions in the U.S. in June was about 28,000, approximately 2.2 times the average at 50 months after the launch of competing treatments," adding, "Xcopri sales in the second quarter exceeded selling and administrative expenses for the first time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)