Tax Revenue Shortfall of 10 Trillion Won in First Half of This Year

Tax Revenue at Risk Except for Capital Gains Tax in Second Half

Opposition Proposes Fiscal Law Mandating Supplementary Budget in Case of Tax Revenue Shortfall

Following last year, projections indicate that a tax revenue shortfall is inevitable this year as well. Due to the unavoidable large-scale tax revenue deficit, it is pointed out that supplementary budgets need to be formulated for expenditure adjustments or government bond issuance.

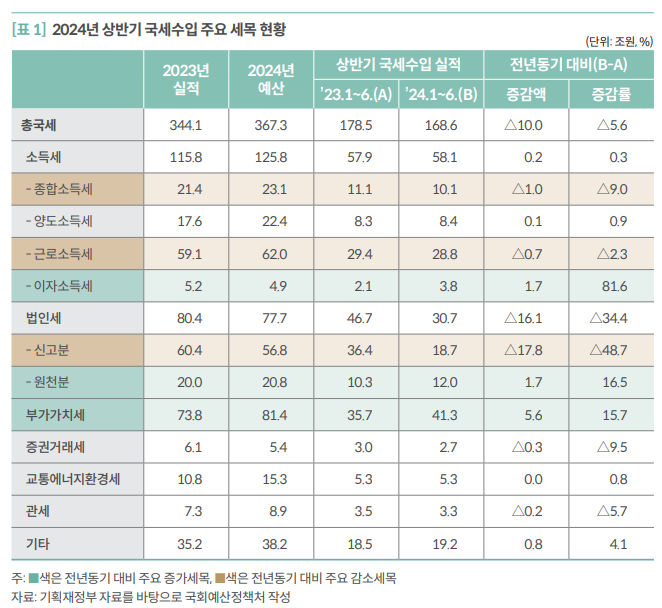

According to the National Assembly Budget Office's "Analysis of National Tax Revenue Performance and Future Revenue Conditions for the First Half of 2024" on the 27th, national tax revenue in the first half of this year amounted to 168.6 trillion won, a 5.6% decrease compared to the same period last year. The tax revenue shortfall reached 10 trillion won. Corporate tax and others decreased by 17.8 trillion won, comprehensive income tax dropped by 1 trillion won due to a reduction in the number of taxpayers subject to diligent reporting verification, and earned income tax fell by 7 billion won as bonuses declined amid poor corporate performance. However, this was partially offset by increases in value-added tax (+5.6 trillion won), interest income tax (+1.7 trillion won), and corporate tax withholding (+1.7 trillion won).

The problem is that the outlook for the second half of the year is also unfavorable. The Budget Office explained, "Interim corporate tax payments (collected from August to October) are usually half of the previous fiscal year's calculated tax amount, so when first-half filings decrease, interim payments in the second half tend to decrease as well." Additionally, the economic situation is poor, putting consumption-related tax revenues such as value-added tax, which had somewhat compensated for the revenue decline, in a precarious position. On the bright side, capital gains tax may increase somewhat due to a rise in real estate transactions.

Including the second half, the Budget Office forecasted regarding this year's tax revenue situation, "Considering the level of the original budget formulation and the revenue conditions in the second half, a significant scale of tax revenue shortfall is expected to occur."

In this context, the Budget Office pointed out the need to strengthen discussions with the National Assembly, including the formulation of supplementary budgets. A Budget Office official stated, "When a large-scale tax revenue shortfall occurred in 2023, the government responded without formulating a supplementary budget by not allocating local transfer tax, suspending expenditures, and utilizing fund resources," adding, "In cases where a large-scale tax revenue shortfall is expected, it is principle to respond through supplementary budget formulation, including revenue revisions and expenditure plan adjustments, so the government needs to strengthen discussions with the National Assembly regarding responses to tax revenue shortfalls."

In the event of an unavoidable tax revenue shortfall, a bill to amend the National Finance Act has been proposed to the National Assembly, mandating the formulation of supplementary budgets and National Assembly deliberations to reduce revenue and adjust expenditures. Assemblyman Ando Geol of the Democratic Party of Korea proposed an amendment to the National Finance Act requiring the government to re-estimate revenue budgets in June and August each year and report the analysis results to the National Assembly. To prevent unilateral fiscal management by the government, the amendment mandates the formulation of supplementary budget bills for revenue revisions in case of large-scale tax revenue shortfalls. The purpose is to require submission of revenue revision bills and National Assembly review to change approved expenditure plans and fund operation plans. Assemblyman Ando stated, "If a large-scale tax revenue shortfall occurs like last year, responding through revenue revisions and National Assembly review will make national finances sound."

Lee Sang-min, senior research fellow at the Nara Salrim Research Institute, said, "If there is a tax revenue shortfall, either additional government bonds must be issued or expenditures reduced, but either way, a supplementary budget is necessary," adding, "The supplementary budget is the government's accurate submission to the National Assembly of how much the shortfall will be."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)