With Prolonged High Interest Rates and Inflation, Ordinary People Turn to Secondary Financial Institutions

Document Review Simpler Compared to Banks

Insurance Companies' SME Loan Delinquency Rate Soars to 0.77%

In the second quarter of this year, insurance policy loans from insurance companies surged by more than 1 trillion won compared to the same period last year. As the burden of high interest rates and high inflation increased, many low-income households who could not borrow money from first-tier financial institutions sought to secure funds by using their insurance policies as collateral.

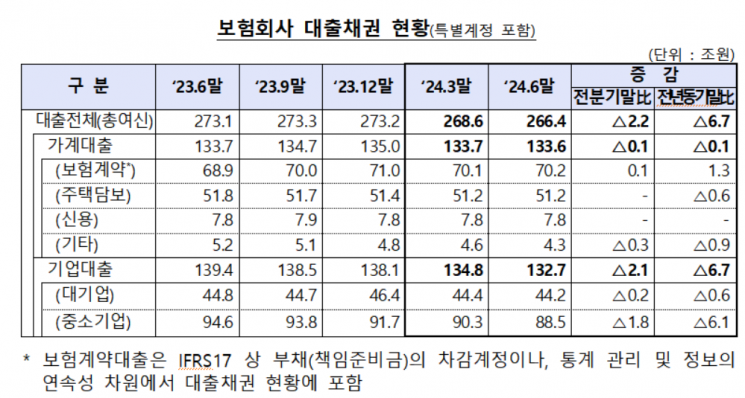

According to the "Status of Insurance Company Loan Claims" released by the Financial Supervisory Service on the 26th, as of the end of June, the outstanding loan claims of insurance companies stood at 266.4 trillion won, down 6.7 trillion won from the same period last year. During the same period, household loans decreased by 100 billion won, and corporate loans fell by 6.7 trillion won.

Overall, the outstanding loan claims of insurance companies decreased, but insurance policy loans were an exception. As of the end of June, insurance policy loans amounted to 70.2 trillion won, an increase of 1.3 trillion won compared to the same period last year. Insurance policy loans are a typical recession-type product, allowing borrowers to receive up to 95% of the surrender value they would get upon canceling their insurance contract. Unlike banks that require complicated documentation, these loans can be obtained without a separate screening process. As of last month, the average interest rate on insurance policy loans was around 4-8%.

Recently, as mortgage loan interest rates in the banking sector soared, there was a reversal phenomenon where insurance companies’ mortgage loan rates became lower than those of banks. Regarding this, Lee Bok-hyun, Governor of the Financial Supervisory Service, appeared on KBS's "Sunday Diagnosis" live broadcast yesterday and said, "The interest rate inversion between first-tier and second-tier financial institutions is a kind of distortion, and we will communicate with banks about the issues. If this is perceived as intervention, it cannot be helped, but the financial authorities must take responsibility and manage the problem." As of the end of June, the outstanding mortgage loan claims of insurance companies were 51.2 trillion won, down 600 billion won compared to the same period last year but maintained the same level as the previous quarter. There is a possibility that the outstanding mortgage loans of insurance companies will increase in the second half of the year.

As of the end of June, the delinquency rate on insurance company loan claims was 0.55%, up 0.25 percentage points from the same period last year. During the same period, the delinquency rate on household loans increased by 0.16 percentage points, and corporate loans rose by 0.29 percentage points. Among corporate loans, the delinquency rate for small and medium-sized enterprises (SMEs) surged by 0.44 percentage points to 0.77% compared to the same period last year.

The ratio of non-performing loans (NPLs) for insurance companies was 0.75%, up 0.32 percentage points from the same period last year. During the same period, household loans increased by 0.06 percentage points, and corporate loans rose by 0.44 percentage points. Regarding the NPL ratio, large corporations recorded 0.07%, down 0.04 percentage points from the same period last year, while SMEs surged to 1.33%, up 0.69 percentage points.

An official from the Financial Supervisory Service stated, "We will continuously monitor the soundness indicators of insurance company loans, such as delinquency rates," and added, "We plan to enhance loss absorption capacity through sufficient provisioning for loan losses and induce early normalization of non-performing assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)