House Price Surge + Household Debt Concerns... Bank of Korea Holds Interest Rate Steady for 13th Consecutive Time

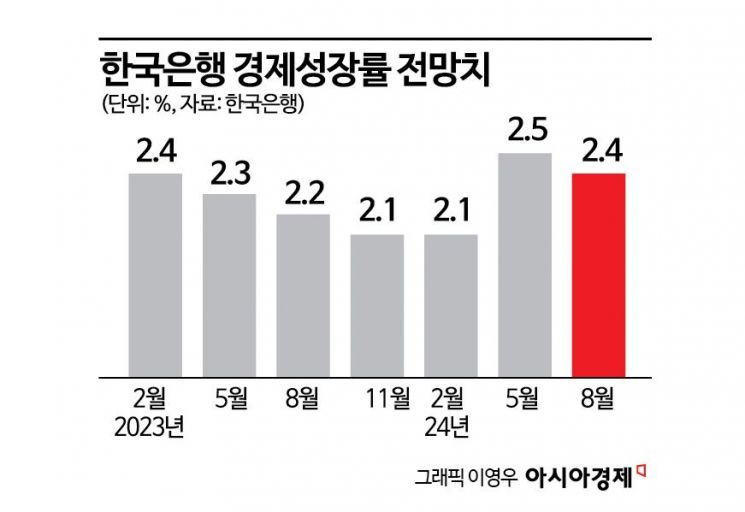

Domestic Demand Slump Lowers This Year's Economic Growth Forecast from 2.5% to 2.4%

No Rapid Rate Cuts, Warning to Real Estate Leveraged Buyers

Bank of Korea Governor Lee Chang-yong is speaking at the monetary policy direction press conference held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 22nd. (Photo by Bank of Korea)

Bank of Korea Governor Lee Chang-yong is speaking at the monetary policy direction press conference held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 22nd. (Photo by Bank of Korea)

The Bank of Korea has slightly lowered its economic growth forecast for South Korea this year from 2.5% to 2.4%. Although exports, centered on semiconductors, continue to perform well, the growth forecast was reduced due to persistent domestic demand weakness. With inflation stabilizing, the consumer price inflation forecast was also lowered from 2.6% to 2.5%.

The base interest rate was kept steady at 3.50% per annum for the 13th consecutive time. Concerns over rising housing prices in the Seoul metropolitan area and increasing household debt are seen as factors preventing a rate cut. Bank of Korea Governor Lee Chang-yong also warned about the so-called 'real estate yeongkkeuljok'?people who excessively borrow to purchase homes.

Economic Growth Forecast Lowered to 2.4% Due to Domestic Demand Weakness

In the revised economic outlook announced on the 22nd, the Bank of Korea lowered South Korea's GDP growth forecast for this year from 2.5% to 2.4%, a 0.1 percentage point downgrade from the May forecast.

This reflects the fact that South Korea's economic growth rate recorded a negative 0.2% quarter-on-quarter in Q2, and domestic demand indicators such as private consumption have not significantly improved entering Q3.

The Bank of Korea expects exports, led by semiconductors, to continue to perform well in the second half of the year as in the first half, but anticipates that weak consumption and investment will persist for some time.

The Bank of Korea's 2.4% forecast is lower than the government and OECD forecasts (2.6%), as well as those of the Korea Development Institute (KDI) and the International Monetary Fund (IMF) (2.5%).

On the 8th, KDI also lowered its annual forecast by 0.1 percentage points from 2.6% to 2.5%, citing prolonged high interest rates and domestic demand weakness. KDI analyzed, "While export growth is expanding, the recovery of private consumption and facility investment is delayed," and "growth is being adjusted mainly around domestic demand."

The expected consumer price inflation rate for this year was slightly lowered from 2.6% to 2.5%. This is due to a baseline effect caused by a downward trend in inflation and the sharp rise in international oil and agricultural product prices over several months since August last year, which is expected to result in a deceleration of inflation.

Kang Sung-jin, a professor of economics at Korea University, said, "Semiconductor exports are still strong, but domestic demand is weak, so it seems the economic growth forecast was lowered," adding, "The downward revision of the inflation forecast likely reflects the recent stabilization of consumer prices in the mid-2% range."

Base Interest Rate Maintained at 3.5% per Annum, 13th Consecutive Freeze

At the monetary policy meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, on the morning of the same day, the Monetary Policy Board unanimously decided to keep the base interest rate at 3.50% per annum. The Board has maintained the current rate for 13 consecutive meetings since February last year, marking the longest freeze in history.

The Bank of Korea's decision to hold the base rate is due to growing concerns over rising housing prices in the Seoul metropolitan area and increasing household debt. According to the Korea Real Estate Board, the housing sales price index in Seoul rose 0.76% month-on-month in July, the largest increase in 4 years and 7 months since December 2019 (0.86%).

Household debt is also rising sharply. At the end of Q2, domestic household credit (household debt) stood at 1,896.2 trillion won, an increase of 13.8 trillion won from the previous quarter, marking a record high. Mortgage loan balances alone surged by 16 trillion won quarter-on-quarter in Q2. The five major banks’ household loan balances also increased by 4.1795 trillion won this month alone, reaching 719.9178 trillion won as of the 14th.

This is interpreted as an increase in people borrowing to buy homes as prices rise. In this situation, lowering the base interest rate could further raise the household debt ratio, which is already among the highest in the world.

Professor Ahn Dong-hyun of Seoul National University’s Department of Economics explained, "The Bank of Korea’s goals are price stability and financial stability, so lowering the base rate would naturally lead to increased household debt and rising housing prices," adding, "Maintaining high interest rates is aimed at normalizing the market." Seo Ji-su, a senior researcher at Woori Financial Management Research Institute, stated, "The recent overheating of the housing market centered on the Seoul metropolitan area and concerns over rising household debt are the main reasons for the base rate freeze."

Inflation is also not yet a situation to be fully reassured about. The consumer price index (CPI) inflation rate rebounded from 2.4% in June to 2.6% in July. This is still far from the Bank of Korea’s inflation target of 2.0%. The Bank expects the inflation deceleration trend to continue but notes that uncertainties remain due to factors such as geopolitical risks and weather conditions affecting the inflation path.

The fact that the United States has not yet lowered its base interest rate also weighs against a rate cut by the Bank of Korea. If South Korea lowers rates first while the interest rate differential with the U.S. is large, the gap would widen further, potentially burdening the market. Professor Kang emphasized, "The U.S. has not yet cut rates, and with a large interest rate gap between Korea and the U.S., there is no benefit in preemptively lowering rates."

The market widely expects the U.S. Federal Reserve (Fed) to cut its base interest rate next month. Many anticipate that if the U.S. cuts rates in September, South Korea will follow with a rate cut in October. Joo Won, head of economic research at Hyundai Research Institute, said, "Given the current economic situation, the possibility of South Korea cutting rates before the U.S. is close to zero," adding, "If the U.S. cuts rates in September, we expect Korea to cut rates in October or November."

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee's plenary meeting at the Bank of Korea headquarters in Jung-gu, Seoul, on the 22nd. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee's plenary meeting at the Bank of Korea headquarters in Jung-gu, Seoul, on the 22nd. Photo by Joint Press Corps

Bank of Korea Governor Warns 'Real Estate Yeongkkeuljok'

Bank of Korea Governor Lee Chang-yong also warned about the so-called 'real estate yeongkkeuljok'?people who excessively borrow to purchase homes.

At a press conference that day, Governor Lee said, "Currently, Monetary Policy Board members clearly agree that the Bank of Korea will not conduct monetary policy in a way that excessively supplies liquidity to fuel real estate price increases," adding, "People should not think that interest rates will quickly fall to around 0.5% as before, reducing the burden of yeongkkeul."

Governor Lee emphasized, "If yeongkkeuljok expect real estate prices to rise rapidly as they did from 2018 to 2021, they should consider two things." The first is, "The current government's housing supply measures are realistic and bold," and "We hope the government's real estate supply policies will be realized through the National Assembly, which could constrain continuous real estate price increases."

The second is government demand policies such as the application of the Debt Service Ratio (DSR). He said, "Yesterday, the Financial Services Commission chairman stated that if the recently announced demand measures are insufficient, additional policies will be implemented to respond to real estate prices," expressing expectations for the policy's effectiveness.

At the Bank of Korea Monetary Policy Board meeting that day, the number of members who believe the possibility of a base rate cut within three months should be kept open increased significantly.

Governor Lee said, "Among the six Monetary Policy Board members excluding myself, four expressed the view that the possibility of a base rate cut within the next three months should be kept open," adding, "The remaining two believe it is appropriate to maintain the rate at 3.5% even after three months."

Compared to the Monetary Policy Board meeting on July 11, the number of members supporting keeping the possibility of a rate cut open increased from two to four.

Regarding the basis for keeping the possibility of a rate cut open, Governor Lee explained, "Since the inflation rate is expected to converge to the target level and government real estate policies will be implemented, the idea is to keep the possibility of a cut open while monitoring financial stability and then decide on the rate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.