U.S. Labor Department to Soon Release Revised Nonfarm Payrolls

"Employment Slowdown → Recession" Market Shock Concerns

Amid prolonged high interest rates, an analysis has emerged indicating that the number of jobs in the United States was increasing much more slowly than the government had initially expected. On the 21st (local time), the U.S. Department of Labor is scheduled to release revised nonfarm payroll figures for the 12 months up to March, and if this is confirmed, there are concerns that the market could be shaken once again.

Investment banks (IB) Goldman Sachs and Wells Fargo have predicted that the revised nonfarm payroll figures for the 12 months up to March will be at least 600,000 lower than currently reported. They forecast a decrease of about 50,000 per month on average. In particular, Goldman Sachs also suggested that the revision could be as much as a 1 million reduction. JP Morgan predicted a possible decrease of 360,000 compared to the previously announced figures.

According to the Bureau of Labor Statistics (BLS), nonfarm payrolls increased by 2.9 million over the 12 months up to March, which translates to an average monthly increase of 242,000.

If a downward revision in jobs is announced, it is expected to highlight that the U.S. labor market has been cooling for a much longer period than the government had anticipated.

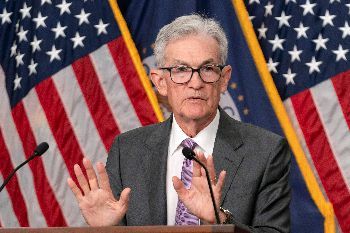

Bloomberg News analyzed that this will also affect Federal Reserve (Fed) Chair Jerome Powell’s remarks at the upcoming Jackson Hole meeting scheduled for the 23rd. Investors are closely watching Powell’s statements to gain hints about the Fed’s future monetary policy stance, including the scale and frequency of interest rate cuts.

The revised job figures are likely to reignite debates over whether the labor market slowdown could trigger a recession. Recently, the market’s main focus has shifted from inflation to U.S. employment indicators. Earlier this month, the unemployment rate rose for the fourth consecutive month, causing the so-called 'Black Monday' that shook global stock markets. Quincy Crosby, Chief Global Strategist at LPL Financial, said, "The market, having recently experienced fear due to concerns that the Fed was lagging behind economic developments, is paying close attention to this revision announcement."

If the market reacts with shock, the 'missed opportunity controversy'?whether the Fed missed the right timing for rate cuts?could resurface.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.