Capital Research Report Published... "Open Markets and PG Companies Must Be Separated"

"PG Companies' Proprietary Accounts and Payment Settlement Accounts Must Be Separated"

"Financial Authorities' Strengthened Supervision of Non-Financial Businesses Is Not the Solution"

An analysis has emerged that the key to preventing a recurrence of the Timeff (Timon + Wemakeprice) incident lies in separating the roles of electronic payment gateway (PG) companies from open markets and segregating the PG companies' fund accounts. Shortening the settlement period and strengthening financial authorities' supervision could be solutions that deviate from the core of the issue.

According to the report titled "Key Issues and Tasks of the Timeff Incident" published by the Korea Capital Market Institute on the 20th, the online commerce market size grew about sixfold over ten years, from 38 trillion won in 2013 to 227 trillion won last year. During this process, the large online commerce platform Timeff also rapidly expanded, and the aftermath of this incident is becoming bigger than expected.

Before open markets like Timon and Wemakeprice became active, sellers sold the products they owned through online stores they opened themselves. However, due to the burden of homepage setup costs and low brand recognition, the margins were not favorable. This led to the emergence of open markets that aggregate multiple online stores.

When consumers pay for products or services with a card at an online store, the purchase payment is processed and settled in the order of 'card company → PG company → online store (seller)'. PG companies help consumers make easy payments with any card at online stores. From the online store's perspective, using a PG company is convenient because it allows handling multiple cards at once without needing to contract with individual card companies.

Assuming a customer pays for a product at an online store using a card issued by Card Company A. Card Company A checks for loss, theft, or limit excess of the card and sends payment approval information to the PG company. The PG company then forwards this information to the online store. Upon confirming this information, the online store sends a message to the buyer confirming the purchase, thereby concluding the contract. After the contract is concluded, Card Company A pays the sales amount to the PG company within two business days. The PG company holds this amount and periodically transfers it to the online store. No particular issues arose during this payment and settlement process.

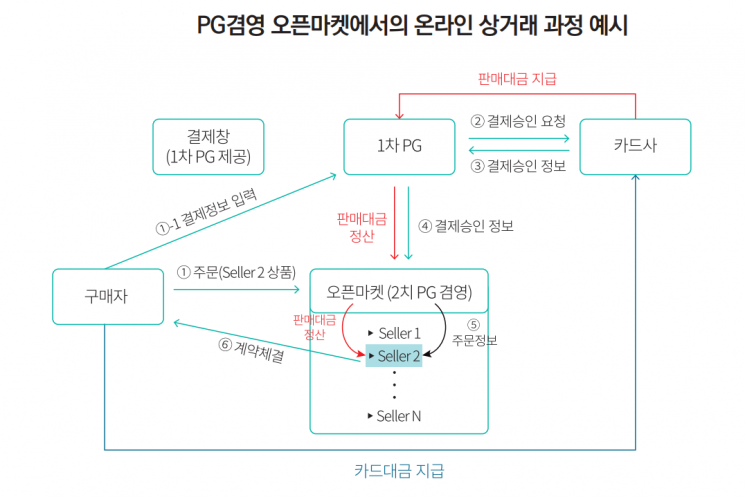

The problem arose when open markets began to concurrently operate PG businesses. In PG-concurrent open markets, when a customer pays for a product, the structure changes to 'card company → 1st PG company → open market (2nd PG concurrent) → seller'. Here, payment information approval is similar to that of an online store, with the open market added. However, the process of settling the sales amount is different. Card Company A pays the sales amount to the 1st PG company within two business days from the purchase contract date, as in normal transactions. The 1st PG company, upon receiving the amount, does not settle directly with the seller but immediately transfers it to the open market, which concurrently operates as the 2nd PG company. In other words, the 1st PG company handles payment information transmission and settlement with the 2nd PG company, while the 2nd PG company handles settlement with the seller. Timon and Wemakeprice, which concurrently operated as the 2nd PG, delayed paying sellers' settlement funds for up to 70 days for private gain, leading to financial difficulties and triggering this incident.

In the past, Timon and Wemakeprice acted as large distributors who directly purchased products to sell and as intermediaries providing open market platforms. At that time, Timon and Wemakeprice were subject to regulations regarding settlement deadlines. However, in 2019, both companies transitioned to open markets providing only online platforms, thus escaping regulatory oversight. Consequently, the settlement of sellers' payments was entirely left to the discretion of the open markets, naturally extending the settlement deadlines significantly.

Senior Research Fellow Shin Boseong of the Korea Capital Market Institute pointed out that to prevent the misuse of settlement funds by open markets concurrently operating as 2nd PG companies, their concurrent PG operations must be prohibited. Shin explained, "By banning PG concurrency, the risk of mixing business funds of operators like open markets with payment funds for commerce can be blocked."

There is also a call to strengthen regulations on PG companies themselves. Shin said, "PG companies' own fund accounts and accounts for sellers' settlement must be separated because payment and settlement, which serve as the lifeblood of the economy, must guarantee 100% certainty."

He criticized the recent discussions by financial authorities on shortening the sales settlement period as not being an essential approach to resolving the issue. Shin stated, "Shortening the settlement period is not a fundamental solution in terms of ensuring the completeness of payment and settlement. While it may reduce the possibility of misappropriating sales funds, it does not eliminate it entirely." He added, "If the ban on PG concurrency by open markets and the segregation of PG companies' accounts are implemented, the shortening of the settlement period will be naturally achieved without additional regulations. Since online commerce involves exchanges, refunds, and misdeliveries requiring reverse settlements, uniformly shortening the settlement period may not necessarily yield desirable results."

He also argued that strengthening financial authorities' supervision of open markets is not the right solution. Shin said, "Financial authorities are specialized regulatory and supervisory bodies for financial industries, so it is challenging for them to handle non-financial sectors like open markets in terms of knowledge and information. Financial authorities should focus on securing the stability of payment funds by banning PG concurrency in open markets and, based on this, allow non-financial operators including open markets to be exempt from financial authorities' regulation and supervision."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.