Q2 Earnings Season Wraps Up... More Than Half Exceed Estimates

CS Wind Surpasses Operating Profit Estimates by the Largest Margin... Up 221%

EcoPro BM, HD Hyundai Mipo, NCSoft Turn Expected Losses into Profits

As the Q2 earnings season of this year has concluded, it was found that more than half of the companies posted results exceeding market expectations. The company with the largest earnings surprise compared to the consensus (average forecast by securities firms) was CS Wind.

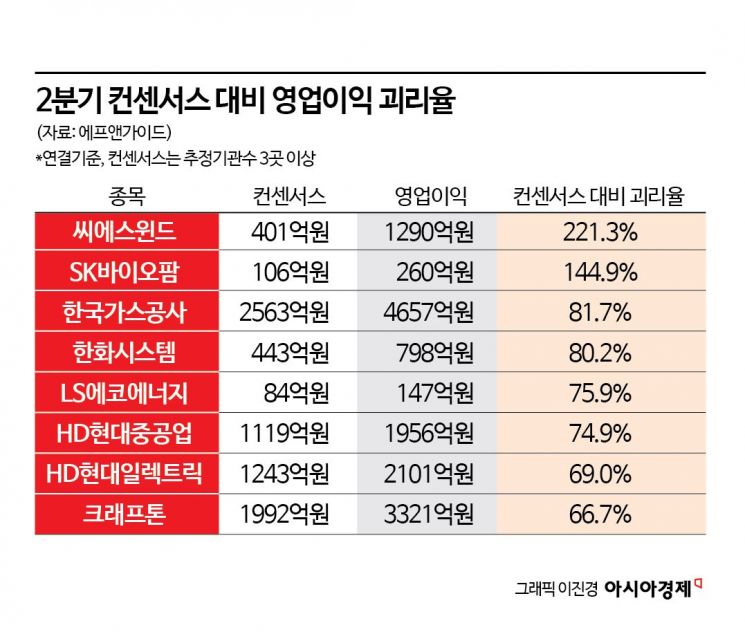

According to financial information provider FnGuide on the 19th, an analysis of the earnings of 250 companies with at least three operating profit estimates in the consensus showed that CS Wind's Q2 operating profit exceeded estimates by 221.3%, recording the largest deviation rate. CS Wind's Q2 operating profit was recorded at 129 billion KRW, while the consensus was 40.1 billion KRW. Lee Ju-young, a researcher at LS Investment & Securities, analyzed, "CS Wind's Q2 operating profit recorded an earnings surprise that greatly exceeded the consensus," adding, "This was due to one-time income recognized as the offshore corporation (formerly Bladt) OSS (Offshore Substation) project, which caused a large loss in Q1, succeeded in negotiating a price increase."

Along with this, SK Biopharm (144.9%), Korea Gas Corporation (81.7%), Hanwha Systems (80.2%), LS Eco Energy (75.9%), HD Hyundai Heavy Industries (74.9%), HD Hyundai Electric (69.0%), and Krafton (66.7%) also recorded results that significantly exceeded the consensus.

There were also companies that were initially expected to post losses but recorded profits, including Ecopro BM, HD Hyundai Mipo, NCSoft, ITM Semiconductor, Cheonbo, and Devsisters. Ecopro BM was expected to have an operating loss of 13.5 billion KRW in Q2 but recorded an operating profit of 3.9 billion KRW. HD Hyundai Mipo was also expected to have an operating loss of 5.4 billion KRW but recorded an operating profit of 17.4 billion KRW.

Among the 250 companies, 137 companies, or 54.8%, posted Q2 operating profits exceeding the consensus forecasts.

On the other hand, 111 companies posted results below market expectations. The company with the largest shortfall compared to estimates was Amorepacific. Amorepacific's Q2 operating profit estimate was 69.5 billion KRW, but the actual result was only 4.2 billion KRW, showing a deviation rate of -94%. Due to Amorepacific's poor performance, AmoreG also posted weak results, recording an earnings shock. AmoreG's Q2 operating profit was 12.2 billion KRW, falling 87.1% short of the estimate (94.6 billion KRW). Ha Hee-ji, a researcher at Hyundai Motor Securities, said, "Amorepacific's operating profit fell 94% short of the consensus due to domestic duty-free sales slump and significant losses in China," adding, "While expectations for increased contributions from COSRX and North America/Europe remain valid, the impact of domestic duty-free sales slump and restructuring in China on poor performance is expected to continue into Q3."

POSCO Future M (-85.6%), Hansol Paper (-77.8%), Kakao Games (-76.5%), and Hana Tour (-69.7%) also posted results far below expectations.

Additionally, SK Innovation, Hanwha Ocean, Jeju Air, YG Entertainment, HanAll Biopharma, and Modetour recorded unexpected losses. In the case of SK Innovation, the market expected an operating profit of 269.7 billion KRW in Q2, but it recorded an operating loss of 45.8 billion KRW. Hanwha Ocean's Q2 operating profit consensus was 26.3 billion KRW, but it recorded an operating loss of 9.7 billion KRW.

The Q2 earnings are evaluated as favorable. Cho Chang-min, a researcher at Yuanta Securities, said, "As expected, the Q2 earnings season ended with results exceeding forecasts," adding, "Due to the strong Q2 performance, the outlook for the second half of the year is also being revised upward." He continued, "However, the overall market outlook is being revised upward mainly led by the semiconductor and equipment sectors in the second half, while other sectors are showing a downward trend, so a review of sector-specific profits is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)