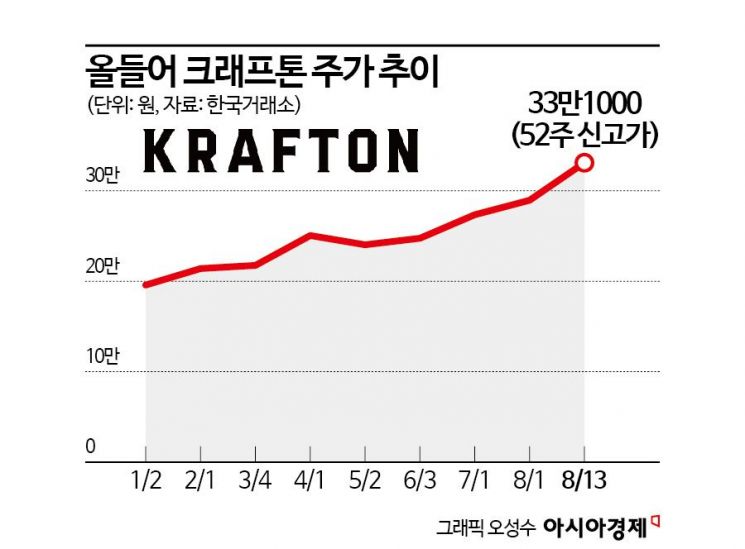

Krafton Surpasses 300,000 Won After 2.5 Years, Hits 52-Week High

Kakao Games Falls Below 17,000 Won Intraday, Hits 52-Week Low

Q2 Earnings Create Mixed Stock Trends

Krafton Q2 Earnings Surprise, Target Price Raised Consecutively

Game companies Krafton and Kakao Games experienced contrasting stock price movements, recording new highs and lows respectively. Earnings results determined the divergent stock performances. While Krafton posted an earnings surprise, Kakao Games saw a significant decline in operating profit, leading to differing market expectations.

According to the Korea Exchange on the 14th, Krafton closed at 331,000 KRW, up 38,000 KRW (12.97%) from the previous day, setting a new 52-week high. This marked the first time since February 7, 2022, that the closing price surpassed 300,000 KRW. Krafton's stock price has risen about 71% since the beginning of the year, steadily climbing from the 190,000 KRW range at the start of the year to over 300,000 KRW.

In contrast, Kakao Games hit a 52-week low during the day, dropping to 16,960 KRW. It closed at 17,000 KRW, down 400 KRW (2.3%) from the previous day. Kakao Games started the year in the 26,000 KRW range but has maintained a sluggish trend throughout, falling more than 34% year-to-date.

The divergent stock prices are attributed to earnings results. Krafton posted an earnings surprise in Q2, exceeding market expectations, while Kakao Games delivered results significantly below expectations.

Krafton reported consolidated Q2 sales of 707 billion KRW, an 82.7% increase year-over-year, and operating profit of 332.1 billion KRW, up 152.6%. The operating profit far exceeded the consensus estimate of 199.2 billion KRW. Following Q1, Krafton set a new quarterly sales record again in Q2. Lee Hyo-jin, a researcher at Meritz Securities, said, "Krafton's earnings surprise was mainly driven by mobile, with July mobile sales hitting an all-time high, suggesting the Q2 momentum will continue into Q3."

Kakao Games reported consolidated Q2 sales of 235.6 billion KRW and operating profit of 2.8 billion KRW, down 13% and 89% year-over-year, respectively. Lee Ji-eun, a researcher at Daishin Securities, analyzed, "Both sales and operating profit fell short of consensus due to rapid sales declines in existing games and increased costs in non-gaming business segments."

Not only Q2 results but also outlooks and corresponding market expectations show a divided sentiment. Securities firms have raised target prices for Krafton but lowered those for Kakao Games.

Mirae Asset Securities raised Krafton's target price from 410,000 KRW to 470,000 KRW. Hanwha Investment & Securities increased it from 340,000 KRW to 410,000 KRW, Kyobo Securities from 370,000 KRW to 410,000 KRW, and Yuanta Securities from 320,000 KRW to 450,000 KRW. In total, 15 securities firms raised Krafton's target price following the Q2 earnings announcement.

Kim So-hye, a researcher at Hanwha Investment & Securities, explained the target price adjustment for Krafton: "Reflecting strong performance in PC and mobile, we raised this year's expected operating profit forecast by 21%, leading to a target price increase to 410,000 KRW. Among sectors with slowing growth, Krafton is not just relatively attractive but absolutely so. It is the only domestic game company whose existing live game revenues are not declining but rebounding, with new releases imminent."

On the other hand, Eugene Investment & Securities lowered Kakao Games' target price from 24,000 KRW to 17,000 KRW, iM Securities from 26,000 KRW to 23,000 KRW, and Mirae Asset Securities from 28,000 KRW to 23,000 KRW. Daishin Securities cut it from 20,000 KRW to 17,000 KRW, and Meritz Securities from 21,000 KRW to 18,000 KRW.

Researcher Lee Ji-eun said, "Kakao Games is experiencing continued sales declines in existing games, and some titles scheduled for release in 2024 have been delayed. The release schedules for anticipated titles in 2025 and participation in Gamescom events are also planned for the second half of 2025, indicating a prolonged momentum gap."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)