Special Act on Insurance Fraud Prevention Enforced from the 14th

Intensive Publicity Period Operated Until September 30

The financial authorities will present coffee coupons to those who report insurance fraud advertisements until the 30th of next month. This event aims to promote the key contents of the 'Special Act on the Prevention of Insurance Fraud' (hereinafter referred to as the Insurance Fraud Prevention Act), which will be enforced starting from the 14th.

On the 12th, the Financial Supervisory Service (FSS) announced that it will operate an intensive promotional period to publicize the main points of the Insurance Fraud Prevention Act in collaboration with the National Police Agency, the National Health Insurance Service, and the Life Insurance and Non-life Insurance Associations.

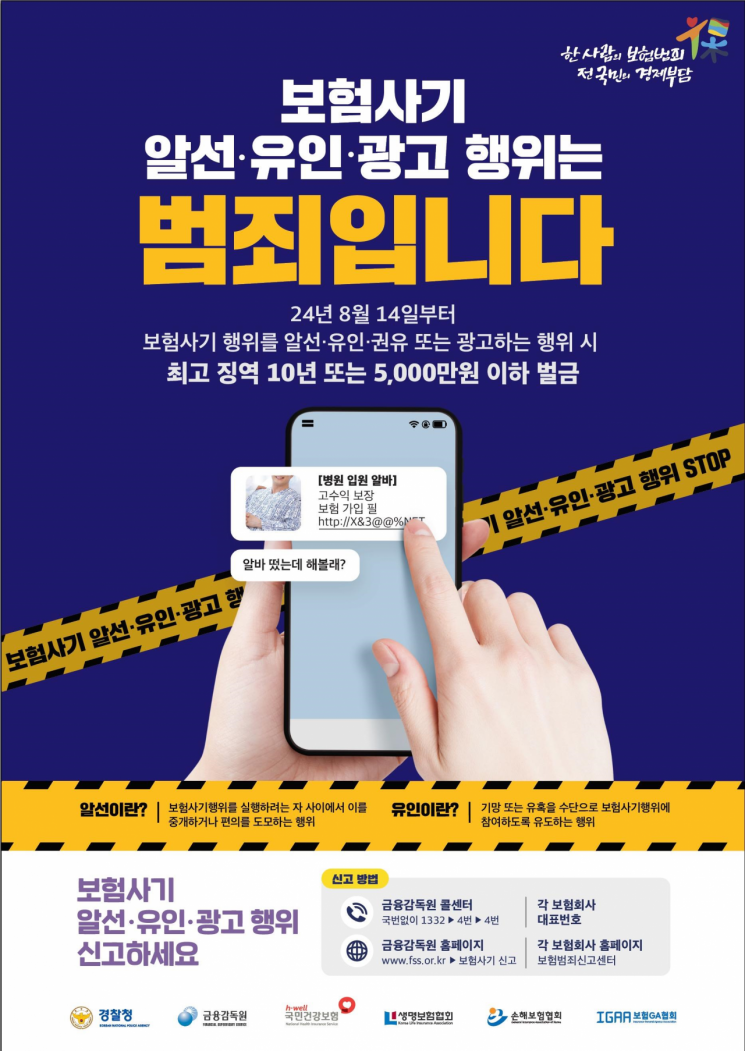

During the intensive promotional period, it will be actively communicated through various media that acts of facilitating, enticing, soliciting, or advertising insurance fraud will be strictly punished. From the 14th, under the Insurance Fraud Prevention Act, acts of facilitating, enticing, soliciting, or advertising insurance fraud are prohibited, and violators may face imprisonment for up to 10 years or a fine of up to 50 million KRW. This will be promoted through notices on cafe and blog homepages, major portal banner ads, and health insurance premium statements.

Additionally, an event will be held where citizens who report online insurance fraud advertisements through the FSS Insurance Fraud Reporting Center will receive coffee coupons. This offer is limited to the first 500 people.

An FSS official stated, "The FSS, National Police Agency, National Health Insurance Service, and Life and Non-life Insurance Associations will closely cooperate to actively respond to insurance fraud in accordance with the purpose of the special law amendment," adding, "We will work closely to ensure that the practical standards for requesting data from the National Health Insurance Service and requesting investigations into insurance fraud facilitation acts operate effectively."

The insurance industry will also actively respond to insurance fraud in line with the purpose of the law enforcement and will strengthen victim relief efforts. On the 27th, a meeting is scheduled for about 100 executives and department heads of insurance company SIUs.

Furthermore, an FSS official emphasized, "Since insurance fraud facilitation and enticement are conducted secretly through brokers, insider reports are crucial to detect and punish them," and urged, "We ask for active reports from those who have received proposals or solicitations that are not reasonably understandable through brokers and who possess concrete evidence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)