If Financial Investment Tax Is Enforced, Private Equity Fund Redemption Tax Rate Will Decrease

Minimum Investment '300 Million KRW'...Opposition Refutes Wealth Tax Logic

Some Argue Applying Financial Investment Tax Is Reasonable

Han Dong-hoon, the leader of the People Power Party, brought up 'private equity funds' as a keyword to criticize the Democratic Party of Korea's (DPK) push for the financial investment income tax (FIIT). The DPK has claimed that the FIIT is a tax on the wealthy, but in fact, if the FIIT is implemented, the highest tax rate on private equity funds?a high-value investment vehicle with a minimum investment amount of 300 million KRW?could be lowered. However, some experts argue that applying the FIIT to redemptions of private equity funds is actually reasonable.

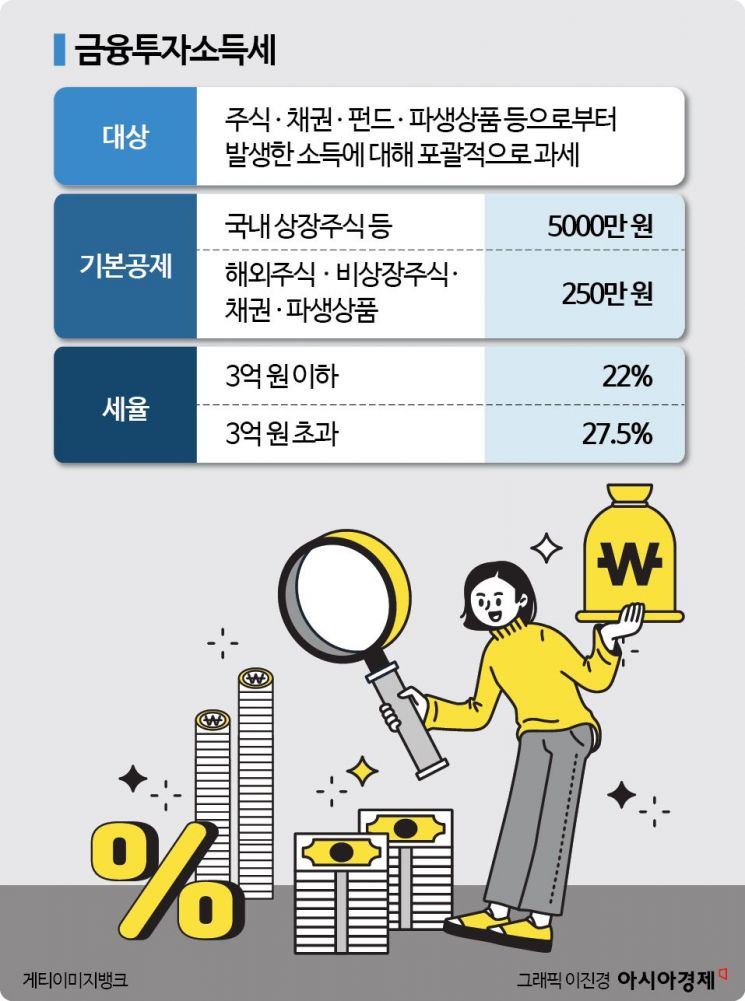

On the 8th, at the Supreme Council meeting held at the party headquarters in Yeouido, Seoul, Representative Han said, "Currently, profits from redemptions of private equity funds are taxed as dividend income. Under the comprehensive taxation system, the maximum tax rate is 49.5%." He added, "Private equity funds are also subject to the FIIT, and if the FIIT is enforced, the highest tax rate will be 27.5%." Under the current system, investors’ profits from private equity funds are subject to comprehensive taxation with a maximum rate of 49.5%, but if the FIIT is implemented, the highest tax rate on redemptions of private equity funds could be reduced to 27.5%.

Private equity funds are funds that manage money collected from a small number of investors by investing in stocks, bonds, and other assets. The minimum investment amount is set at 300 million KRW or more. Redeeming a private equity fund simply means that the investor withdraws their invested capital. The FIIT would apply to the capital gains from such redemptions, potentially resulting in a lower tax rate. However, dividend income received while holding private equity funds is subject to comprehensive financial income taxation, so even if the FIIT is implemented, the highest tax rate of 49.5% may apply depending on the case. The financial sector has expressed concerns that the implementation of the FIIT could trigger a large-scale redemption crisis in private equity funds. Representative Han’s mention of private equity fund redemptions is interpreted as a rebuttal to the DPK’s argument that the tax targets the wealthy.

The DPK has argued that the FIIT is a tax imposed only on about 150,000 investors, or 1%, out of approximately 14 million stock market investors. In response, the People Power Party pointed out that if the FIIT reduces the attractiveness of the market, major investors in the top 1% and foreign investors might leave, which could negatively affect the domestic stock market. Jin Seong-jun, the DPK Policy Committee Chair, said at an emergency economic inspection meeting held at the National Assembly the day before, "The government and ruling party want to cut taxes for huge asset owners," and questioned, "Will abolishing the FIIT for the ultra-wealthy, who make up only 1% of stock investors, revive the domestic economy?"

Professor Kim Woo-cheol of the Department of Taxation at City University said in an interview, "Private equity funds can be seen as organizations or companies. Until now, money received from such organizations has been considered dividends and taxed as comprehensive income." He added, "Private equity funds need to receive payments, and investors also want to redeem regularly, but even if it is regular, it is investment income with risk. Taxing this as comprehensive income is not appropriate." He continued, "However, if the FIIT is implemented, the profits from private equity fund redemptions will be properly regarded as investment income," and added, "It is reasonable to correct the situation where private equity fund investors pay excessively high tax rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)