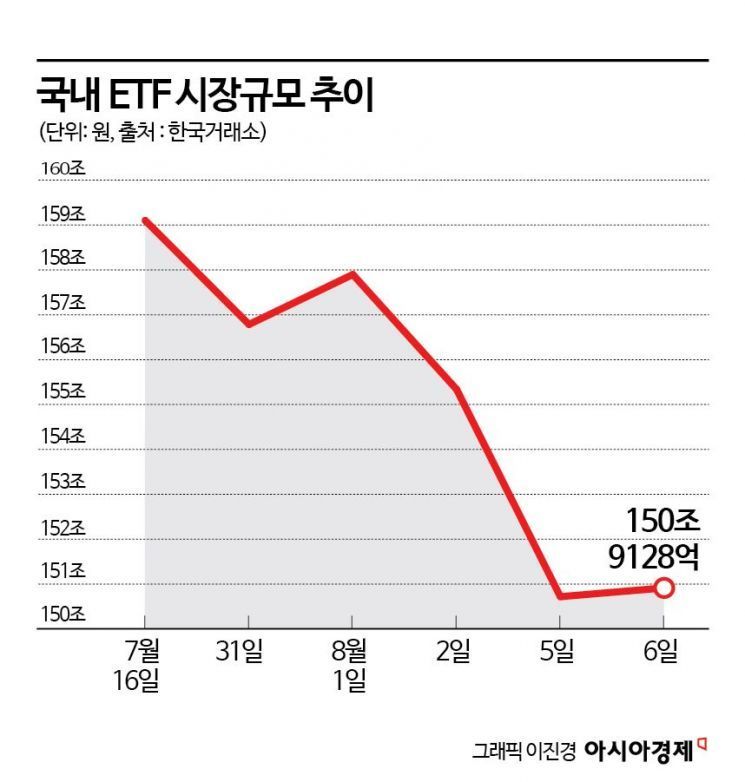

Decrease from 156 trillion in July to 152 trillion on August 6

"Volatility increases as investors rebalance"

Inverse ETF returns jump amid stock market anxiety

As the domestic stock market shows unstable trends, the exchange-traded fund (ETF) market, which had been continuously growing, has also come to a halt.

According to the Korea Exchange on the 8th, as of the 6th of this month, the total net assets of domestic ETFs stand at 150.9128 trillion won. This is a 3.75% decrease compared to the end of last month. In particular, the amount had increased to 159.1017 trillion won on the 16th of last month, but it appears to be shrinking recently due to instability in the stock market.

The domestic ETF market has grown rapidly until now. The total net assets of ETFs, which were 121.0657 trillion won in 2023, increased to 145.566 trillion won in May this year and 152.6363 trillion won in June. However, last month, it only grew by 2.7% compared to the previous month, reaching 156.7849 trillion won. The growth rate in the previous month was 4.86%.

The reason for the ETF market's slowdown seems to be the instability in the global stock market. This year, driven by expectations for the blossoming of the global artificial intelligence (AI) market, the U.S. stock market led rapid growth. However, concerns about the growth of the AI market have caused related stocks to falter, compounded by worries about an economic recession. Additionally, the recent sharp decline in the domestic stock market has increased volatility.

An asset management company official said, "With recent increased volatility and the approach of interest rate cuts, it seems investors are rebalancing their assets. Until now, a lot of funds flowed into ETFs related to big tech, but recently, as outlooks have become more diverse, this kind of trend is emerging."

Due to the stock market instability, funds are moving from equity-type ETFs to bond-type ETFs, which are classified as safer assets. From the 26th of last month to the 1st of this month, about 1.9 trillion won flowed into bond-type ETFs centered on 30-year U.S. Treasury bonds in the domestic ETF market.

In particular, as the domestic stock market has recently shown instability, interest in inverse ETFs, which invest in falling stock prices, is also increasing. According to the Korea Exchange, from the 5th of last month to the 7th of this month, the top 1 to 5 domestic ETF returns were all inverse 2X products.

The first place was KOSEF 200 Futures Inverse 2X, recording a return of 20.55%. It was followed by TIGER 200 Futures Inverse 2X (20.41%), KODEX 200 Futures Inverse 2X (20.33%), PLUS 200 Futures Inverse 2X (20.19%), and RISE 200 Futures Inverse 2X (19.99%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)