Concerns Over US Recession Rise, US Long-Term Bond Yields Fall

US Treasury Bond ETFs Exposed to Yen Show Strong Returns

As global stock market volatility increases, the domestic exchange-traded fund (ETF) market, classified as a safe asset, is receiving more attention. In particular, this month, the inflow of funds into bond-type ETFs in the domestic market is accelerating. Experts in the financial investment industry advise that yen-exposed ETFs among bond-type ETFs will be promising, as the yen is expected to continue strengthening due to the narrowing interest rate gap between the US and Japan.

According to the financial investment industry and Hanwha Investment & Securities on the 6th, about 1.9 trillion KRW flowed into bond-type ETFs centered on 30-year US Treasury bonds in the domestic ETF market from the 26th of last month to the 1st of this month. As of the 1st, the yields on 10-year and 30-year US Treasury bonds fell by 26.5 basis points (bp) and 20.7 bp from the previous week, recording 3.976% and 4.276%, respectively. ETFs such as TIGER US 30-Year Treasury STRIPS Active ETF, RISE US 30-Year Treasury Active ETF, KODEX US 30-Year Treasury Ultra Futures ETF, and KODEX US 30-Year Treasury Active ETF are showing favorable returns.

Not only domestically but also overseas, the preference for safe assets is spreading, leading to a surge of funds into bond-type ETFs. In the US ETF market, bond-type ETFs attracted $7 billion in inflows. Due to the economic indicators slowing down and interest rates plunging, long-term ETFs with maturities over 20 years are gaining popularity.

Seunghyun Kim, head of ETF marketing at Korea Investment Trust Management, explained, "Given that the US is expected to cut interest rates in the second half of this year, an investment strategy in US long-term bonds that can enjoy capital gains is valid," adding, "From a portfolio perspective, bond-type products are good investment tools to use when stock volatility intensifies."

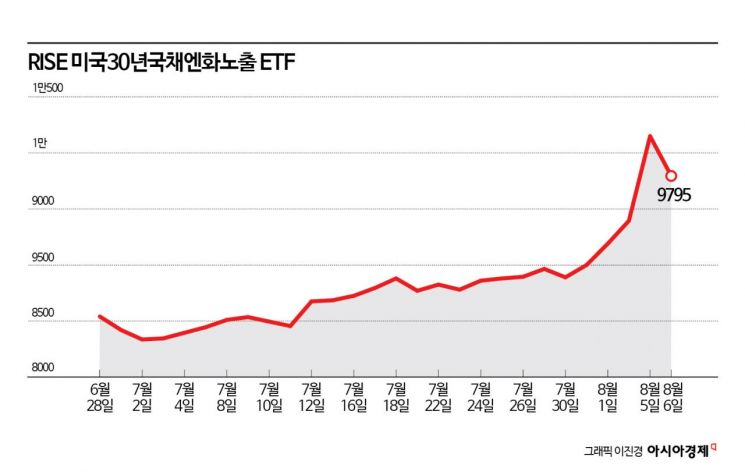

Among bond-type ETFs, yen-exposed ETFs are rising sharply as they can generate additional returns from the yen's appreciation. The RISE US 30-Year Treasury Yen-Exposed ETF rose 15.0% in the second half of this year. During the same period, the ACE US 30-Year Treasury Yen-Exposed Active ETF increased by 14.2%. This reflects the impact of the yen's strength and the rapid decline in US long-term bond yields amid rising concerns about a US economic recession.

The dollar-yen exchange rate, which was above 160 yen at the end of June, recently dropped to around 140 yen. Jinyoung Kim, a researcher at Kiwoom Securities, explained, "This was influenced by the Bank of Japan (BOJ) interest rate hike, foreign exchange intervention, and expectations of a US Federal Reserve (Fed) rate cut," adding, "The BOJ decided at the July Monetary Policy Meeting to implement an additional rate hike and reduce long-term government bond purchases."

With the narrowing interest rate gap between the US and Japan continuing in the second half of this year, the outlook for gradual yen appreciation is gaining momentum. Researcher Kim analyzed, "The combination of yen strength and falling US long-term yields led to a rebound in yen-exposed US Treasury ETFs," and added, "If additional yen carry trade liquidation occurs and the decline in US Treasury yields continues, yen-exposed US Treasury ETFs can be utilized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)