KOSPI Records Largest Ever Drop... Foreigners and Institutions 'Sell'

Nvidia-Driven AI Skepticism and US Recession Concerns

Market Experts Hold Both Optimistic and Pessimistic Views

Amid skepticism about U.S. artificial intelligence (AI) stocks and concerns over a U.S. economic slowdown, the domestic stock market experienced a 'Black Monday.' The KOSPI index fell more than 230 points at the close due to heavy selling by foreigners and institutions, marking the largest drop in history. As listed companies' stock prices declined one after another, the KOSPI market capitalization shrank below 2,000 trillion won. Market experts advised caution in investing for the time being and urged risk management.

KOSPI's 'Largest Ever' 234-Point Drop

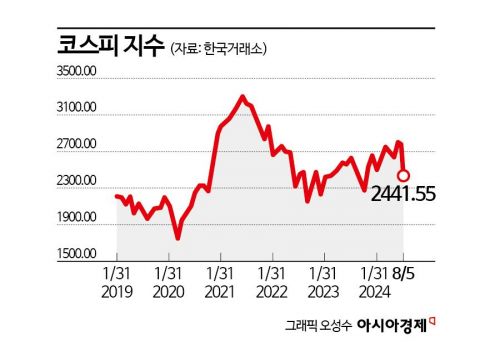

According to the Korea Exchange on the 5th, the KOSPI index closed at 2,441.55, down 234.64 points (8.77%) from the previous day. This is the largest drop ever at the closing price. During the session, it fell to a low of 2,386.96, losing the 2,400 level. Market capitalization also evaporated by about 192 trillion won, breaking the 2,000 trillion won barrier. The number of declining stocks was also at a high level with 924 issues falling.

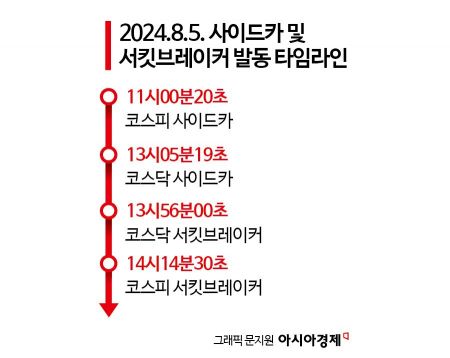

The Korea Exchange, responsible for market surveillance, became busy as well. For the first time in four years, the exchange simultaneously triggered sell-side sidecar and circuit breakers (CB) in both the KOSPI and KOSDAQ markets. This was about 1,600 days since the COVID-19 pandemic market in March 2020. The sidecar system restricts program trading in the stock market for five minutes to mitigate shocks to the rapidly changing market. The circuit breaker is triggered if the index falls more than 8% from the previous day's closing price and remains so for one minute.

Foreigners led the sharp index drop by selling nearly 1.53 trillion won in a single day, and institutions fueled the decline by offloading 270 billion won worth of stocks. On the previous 'Black Friday' on the 2nd, foreigners and institutions also sold 850 billion won and 780 billion won worth of stocks, respectively.

Samsung Electronics, which saw concentrated net selling by foreigners, dropped more than 10% to close at 71,400 won. This magnitude of decline is the first since the 2008 global financial crisis. Even during COVID-19, the largest drop was limited to the 7% range. SK Hynix, which also faced heavy selling pressure, retreated 9.87% to close at 156,100 won. However, market experts assessed that the medium- to long-term outlook for the semiconductor industry remains bright as the cloud market growth trend has not weakened.

Experts cited the possibility of a U.S. recession as the cause of the panic market. The recently released U.S. unemployment rate for July was 4.3%, exceeding the expected 4.1%. On Wall Street, according to the 'Rule of Three,' concerns grew that the U.S. is facing a recession. The Rule of Three judges that if the three-month moving average of the U.S. unemployment rate is more than 0.5 percentage points higher than the lowest rate recorded in the previous 12 months, the economy is considered to be in recession. The July manufacturing Purchasing Managers' Index (PMI), released on the 1st (local time), was also weaker than expected, negatively impacting market investor sentiment.

In fact, not only the domestic stock market but also Asian markets showed similar trends. The Nikkei 225 index of Japan, which had been rising for 10 years supported by Prime Minister Shinzo Abe's 'Revitalization Strategy,' plunged 12.4% in a single day. Taiwan's TAIEX fell 8.35%, and China's Shanghai Composite Index dropped 1.54%.

No Geun-chang, head of the Hyundai Motor Securities Research Center, said, "The index plunged as the possibility of a U.S. recession and instability in the Middle East overlapped," adding, "(This sharp drop) occurred particularly as skepticism about Nvidia's new product launch delay and AI investment emerged." Oh Tae-dong, head of NH Investment & Securities Research Center, said, "Negative factors such as recession fears, geopolitical risks, concerns over Enkeri liquidation, and uncertainty over the U.S. presidential election overlapped," and predicted, "Volatility will subside once forced sales and loss cuts are completed."

Market Outlook Remains Gloomy for the Time Being

Market experts are generally negative about the future trajectory of the domestic stock market. Kang Hyun-ki, head of the stock strategy part at DB Financial Investment, said, "When the momentum of the U.S. labor market begins to slow, it often deteriorates trend-wise afterward," and added, "It is reasonable to see the recent decline in the U.S. market not as an end but as just the beginning." He urged a reassessment of the leading stocks that had recently experienced a rally and emphasized risk management.

Center head Oh Tae-dong also said, "Considering the current U.S. growth rate level, industrial production, and consumption, the possibility of the U.S. growth rate entering two consecutive quarters of negative growth immediately is low," but predicted, "(For KOSPI) the short-term sharp drop will recover to some extent, but a box range or downward trend is inevitable until the U.S. presidential election in November."

However, there is also a view that additional declines will be limited as the domestic stock market is currently undervalued. Yoon Seok-mo, head of Samsung Securities Research Center, said, "This sharp drop is likely the peak for this week," and pointed out, "The mid-2,500 points range of KOSPI corresponds to a price-to-book ratio (PBR) below 0.9 times, which is a limited range for further declines at this point." A PBR below 1 means the stock is trading at a price lower than the company's total asset liquidation value.

Meanwhile, the KOSDAQ index closed at 691.28, down 88.05 points (11.30%) from the previous session. The index started with a decline of about 1% and widened the loss during the session. There were 23 advancing stocks and 1,633 declining stocks on the day. In the KOSDAQ market, individuals sold stocks worth 677.9 billion won, while foreigners and institutions bought stocks worth 547.2 billion won and 117.2 billion won, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)