Global Stock Markets Plunge Amid US Recession Fears

KOSPI Drops Below 2700 and 2600 Levels

Rebound Momentum Limited Due to Lack of Catalysts

Foreign Selling Pressure Must Ease for Market Stabilization

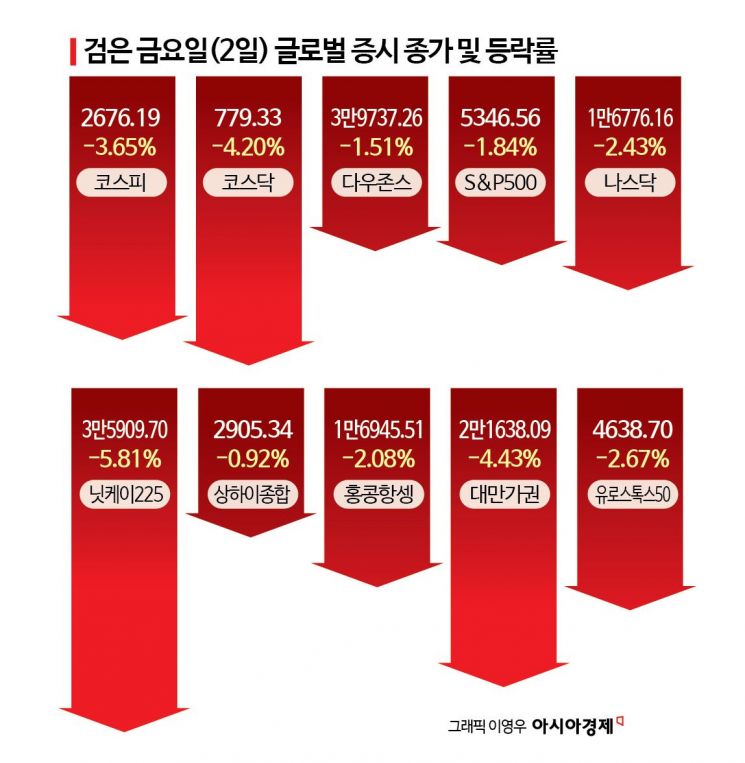

Global stock markets are fluctuating amid concerns over a U.S. economic recession. On the 2nd, global markets simultaneously plunged, creating a 'Black Friday.' The KOSPI fell over 3% for two consecutive days, dropping below the 2600 mark. With limited momentum to change the market sentiment in the near term, worries about further declines are growing.

Following fears of a recession in the United States, the U.S. stock market plummeted, and the domestic stock market also crashed after 'Black Friday.' On Monday the 5th, the domestic stock market plunged from the opening, falling more than 100 points at one point. Various indices are displayed on the electronic board as employees work in the dealing room of Hana Bank in Euljiro, Seoul. Photo by Heo Younghan younghan@

Following fears of a recession in the United States, the U.S. stock market plummeted, and the domestic stock market also crashed after 'Black Friday.' On Monday the 5th, the domestic stock market plunged from the opening, falling more than 100 points at one point. Various indices are displayed on the electronic board as employees work in the dealing room of Hana Bank in Euljiro, Seoul. Photo by Heo Younghan younghan@

As of 10:30 a.m. on the 5th, the KOSPI was trading at 2553.32, down 122.87 points (4.59%) from the previous session. The KOSDAQ recorded 742.35, down 36.98 points (4.75%). Following the breach of the 2700 level on the 2nd, the KOSPI also fell below the 2600 level on this day.

Not only the domestic market but also global markets showed sharp declines. On the 2nd (local time), the Dow Jones Industrial Average fell 1.51%, the S&P 500 dropped 1.84%, and the Nasdaq Composite declined 2.43%. Additionally, Japan's Nikkei 225 fell 5.81%, China's Shanghai Composite dropped 0.92%, Hong Kong's Hang Seng Index declined 2.08%, Taiwan's TAIEX fell 4.43%, and the Euro Stoxx 50 dropped 2.67%.

Han Ji-young, a researcher at Kiwoom Securities, explained, "Given the sharp decline in a short period, one would hope the situation would stabilize, but on the 2nd, the U.S. stock market plunged again due to an employment shock, spreading recession fears, which cannot erase concerns about further adjustments in the domestic market."

The stock market plunge was driven by a combination of recession fears and geopolitical uncertainties in the Middle East. Kim Yong-gu, a researcher at Sangsangin Securities, said, "The early recession fears triggered by the simultaneous weakness in the July U.S. ISM manufacturing index and employment data, concerns over the unwinding of the global yen carry trade following the Bank of Japan's rate hike at the end of July and the subsequent yen appreciation, and the intensifying U.S. political and Middle East geopolitical uncertainties severely impacted both domestic and international markets, as well as global leading stocks led by U.S. big tech companies. These cascading external negative factors led to a panic in the market, including foreign investors' aggressive selling hedges in KOSPI 200 derivatives, the breach of the 2700 level in the KOSPI, and price declines in top market capitalization stocks," he analyzed.

The Speed of Stock Price Decline Is Too Fast... Limited Reversal Triggers

Concerns are rising over the rapid pace of the stock price decline. Kim Dae-jun, a researcher at Korea Investment & Securities, said, "Although the index level has not reached a yearly low, the speed of the decline is worrisome. The KOSPI dropped about 215 points in 16 trading days from the yearly high on the 11th of last month. Coincidentally, the recent decline was driven by the semiconductor sector, which was a leading sector, further dampening investor sentiment."

The market had expected the 2600 level to act as a support line, but after two days of sharp declines, the KOSPI quickly broke below the 2600 level.

There is a forecast that a 'V-shaped' rebound in the domestic market will be difficult. Park Seok-jung, a researcher at Shinhan Investment Corp., explained, "The Korean market is the most sensitive to U.S. economic slowdown in terms of corporate earnings and index performance. Since IT and infrastructure sectors, which have led the earnings market, are heavily influenced by the U.S. economy, it is difficult to predict a V-shaped rebound."

There is also a lack of momentum to trigger a market rebound. Researcher Kim Yong-gu said, "The likelihood of an immediate reversal trigger that can stabilize the recent series of domestic and international market sentiment anxieties is limited. As the Q2 earnings season, which had been a smooth sailing period for domestic and international markets, enters its final phase, it is inevitable to pass through a period lacking earnings-related materials and positive news. Whether the U.S. Federal Reserve's stance on interest rate cuts changes will likely be confirmed at the Jackson Hole meeting from August 23 to 25. The U.S. presidential election campaign, which intensifies from August, and unpredictable Middle East geopolitical risks also have a high potential to further stimulate psychological and supply-demand anxieties," he analyzed.

For the market sentiment to reverse, foreign selling pressure needs to ease. On the 2nd, foreign investors net sold 847.8 billion KRW in the KOSPI and 150 billion KRW in the KOSDAQ, while selling over 2 trillion KRW in the futures market. Kim Dae-jun said, "For further reduction in index volatility, the intensity of foreign investors' net selling in both spot and futures markets must weaken. The net short position in KOSPI 200 futures on the 2nd was about 20,000 contracts, the fourth largest since 2000, and foreign investors have been exiting the market for three consecutive weeks, mainly in semiconductors. A change in capital flow must be detected to expect a stabilization in the index decline," he explained.

Even If Short-Term Sharp Decline Recovers, Sideways Market Expected Until U.S. Election

Even if the short-term sharp decline recovers, the market is expected to remain in a sideways range until the U.S. presidential election. Kim Byung-yeon, a researcher at NH Investment & Securities, said, "The recent short-term stock market plunge will recover to some extent, but the stock market is likely to remain in a downgraded box range or continue a downward trend until the U.S. election. The KOSPI will secure short-term support around a trailing price-to-book ratio (PBR) of 0.95, supported by the value-up program planned for the second half of the year and still solid corporate earnings. After the U.S. election, when policy momentum is reconfirmed, the market will aim to return to an upward trend," he predicted.

Experts advise that although the market situation is unfavorable, panic selling is not advisable. One researcher said, "Although there will be additional adjustment pressure, the recession narrative is likely exaggerated, so participating in panic selling at this point is not beneficial. Currently, a strategy of phased buying focusing on sectors with good earnings momentum among those that have fallen excessively?such as semiconductors, shipbuilding, bio stocks benefiting from easing interest rate pressures, and financials with value-up momentum?would be an alternative," he said.

The same researcher added, "With the KOSPI breaking below the previous low of 2700, a change in course is inevitable, but given the current price level and valuation, chasing the market is not beneficial. Although short-term fluctuations may continue, maintaining or even increasing exposure is a valid strategy. From a short-term trading perspective, it is necessary to pay attention to semiconductors, automobiles, and transportation, which are undervalued relative to earnings amid recession fears. Also, increasing exposure to overlooked sectors such as secondary batteries and internet stocks during the rotation phase is a valid strategy," he added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)