Maintaining High Growth with Stable Costs and Improved Performance

Worst Heatwave Expected in Q3... Growing Optimism

As the early heatwave and health and wellness trends drove the sales of 0㎉ frozen desserts to soar, Lotte Wellfood achieved strong performance in the second quarter of this year. With the stabilization of the soaring cost of processed oils due to supply instability, operating profit improved significantly. Expectations for Lotte Wellfood's third-quarter performance are also rising as this summer is forecasted to bring the worst heatwave in history.

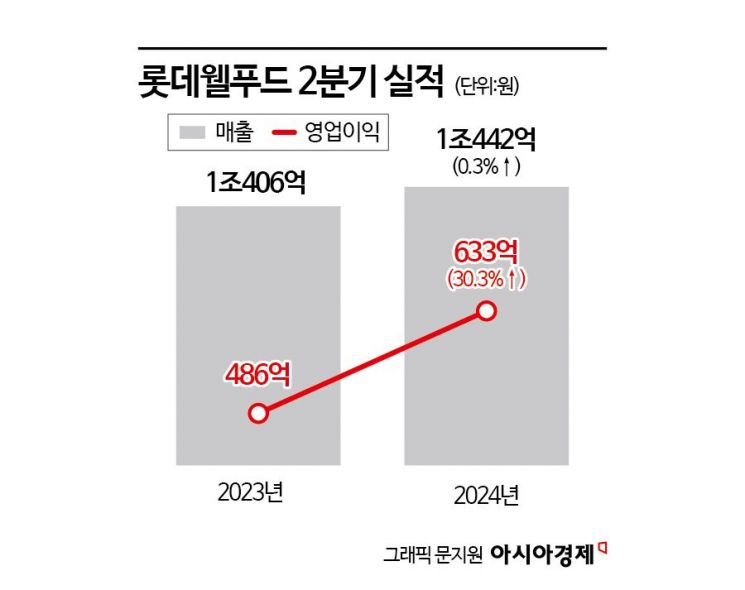

Lotte Wellfood announced on the 2nd that its consolidated operating profit for the second quarter reached 63.3 billion KRW, a 30.3% increase from 48.6 billion KRW a year earlier. Sales remained at a similar level with 1.0442 trillion KRW compared to 1.0406 trillion KRW the previous year.

Thus, Lotte Wellfood's sales for the first half of this year totaled 1.9952 trillion KRW, with operating profit reaching 100.6 billion KRW. While sales decreased by 0.2% compared to the same period last year, operating profit surged by 49.8%.

Lotte Wellfood's strong performance was partly driven by the booming frozen dessert business due to the early heatwave. Although the peak season for frozen desserts is the third quarter (July to August), this year’s early heatwave benefited Lotte Wellfood. According to the Korea Meteorological Administration, the nationwide average temperature in June was 22.7°C, the highest since 1973. The nationwide average number of heatwave days also reached a record high of 2.8 days.

Additionally, Lotte Wellfood’s successful capture of the 0㎉ ice cream market amplified the positive effect. In April, Lotte Wellfood became the first in the frozen dessert industry to launch 0㎉ ice creams, ‘Jaws Bar 0㎉’ and ‘Screw Bar 0㎉’. Earlier this month, they released the zero-calorie version of the Watermelon Bar, ‘Seedless Watermelon Bar 0㎉’, completing the so-called ‘Joke Bar lineup’. The Jaws·Screw·Bar 0㎉ series sold over 20 million units within three months.

Meanwhile, operating profit improved significantly as the price of processed oils, which had soared due to supply instability last year, stabilized. A Lotte Wellfood official explained, "Domestic business sales declined due to rationalization of food ingredient channels, but the increase in frozen dessert sales during the peak season offset the sales decline, and the reduction of high-cost processed oil inventory contributed to the improvement in operating profit."

Sales and operating profit in the global business also increased by 5.6% and 37.6%, respectively. In particular, Lotte Wellfood is achieving results in the Indian frozen dessert market, where it has directly entered. Lotte Wellfood acquired the local Indian frozen dessert company Havmore in 2017 and currently produces ice cream locally. Havmore’s sales increased from 154.4 billion KRW in 2022 to 165.6 billion KRW last year. This year, sales are expected to reach 190 billion KRW.

With the worst heatwave in history expected domestically in the third quarter, expectations for Lotte Wellfood’s second-half performance are growing. The recent merger of Indian subsidiaries Lotte India and Havmore to establish an integrated corporation is also expected to promote management efficiency. Lotte Wellfood’s strategy is to enhance management efficiency and maximize synergy effects between the two companies through the merger of its Indian subsidiaries. They plan to focus their efforts on strengthening local brand power through the integration of logistics and production bases and expanding product lines.

IBK Investment & Securities forecasted, "Lotte Wellfood’s confectionery division is expected to see a 10.9% increase in operating profit due to price hikes of domestic chocolate products such as Pepero," adding, "Frozen desserts are also expected to grow by 13% due to improved production efficiency from a reduction in the number of domestic product items and strong sales of frozen desserts in India."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)