Chairman Shin Orders Profitability Improvement at Second Half VCM

Executives Work 6 Days a Week Amid Emergency Management

Affiliates Record Net Loss in Q1 Due to Profit Decline

Biologics and Healthcare See Increased Interest Costs from Funding

Duty-Free Shops and Chemicals Continue Emergency Management System

Lotte Holdings has abruptly entered an emergency management system. This is a preemptive response amid expectations of an uncertain business environment, including a global economic recession.

According to Lotte Group on the 2nd, Lotte Holdings recently officially declared an emergency management system. A Lotte Holdings official explained, "We declared emergency management as a holding company to fulfill our role and responsibility to support affiliates in order to proactively respond to potential crises ahead," adding, "The current situation is more of a declarative measure to prepare for the future rather than a crisis."

"Tightening the Belt under the Special Mission of 'Profit Generation and Strengthening Financial Soundness'"

Lotte Holdings plans to directly oversee management improvement activities of affiliates whose recent performance has deteriorated. There is even talk of executives working six days a week, including Saturdays, to hold meetings and carry out tasks.

Lotte Holdings' declaration of emergency management is interpreted as a measure to improve profitability for both the holding company and its affiliates. Earlier, Shin Dong-bin, Chairman of Lotte Group, presented four management guidelines for the second half of the year at the VCM (President's Meeting): strengthening the fundamental competitiveness of existing businesses, generating stable profits in global businesses, expanding high value-added businesses for future growth, and strengthening financial soundness management.

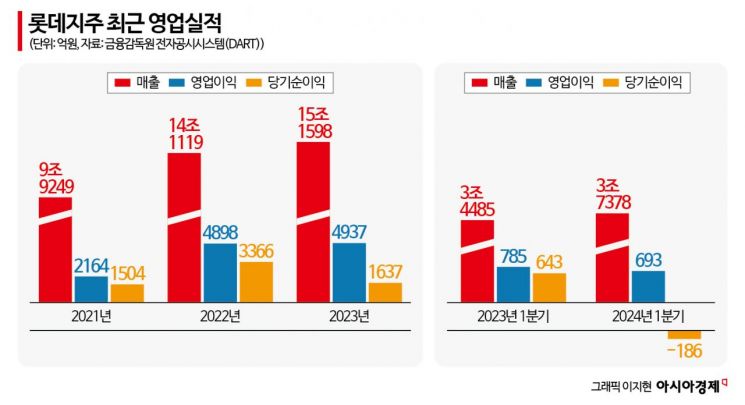

In the case of Lotte Holdings, the separate basis performance in the first quarter showed improvement compared to last year, but the consolidated net profit recorded a loss. Lotte Holdings' separate operating revenue is generated through trademark income and dividend income paid by affiliates. While separate revenue improved due to increased dividend income in the first quarter, consolidated profitability declined as the profitability of affiliates worsened. Since the decline in affiliates' performance affects the holding company, it is analyzed that emergency management was initiated to respond to potential future crises.

In fact, according to the Financial Supervisory Service's electronic disclosure system, Lotte Holdings' separate operating revenue was 176 billion KRW, and operating profit was 130 billion KRW, showing increases of 11% and 13% respectively compared to the same period last year. However, on a consolidated basis, the company's operating profit was 69.3 billion KRW, down by about 10 billion KRW from 78.4 billion KRW last year. Sales increased by 8.4% year-on-year due to the inclusion of Pepsi Philippines, a subsidiary of Lotte Chilsung, but operating profit decreased due to costs incurred during the consolidation process. The cost of incorporating Ministop into Korea Seven also had an impact.

The decline in consolidated net profit was even greater. The company's net loss for the first quarter was 18.6 billion KRW. While it recorded a net profit of 64.3 billion KRW last year, it turned into a net loss in just over a year. Net profit is calculated by subtracting financial costs and corporate tax expenses from operating profit, and in the case of Lotte Holdings, the increase in financial costs is analyzed as the cause of the poor performance.

Financial costs (financial expenses) in the first quarter were 158.2 billion KRW, about 48 billion KRW higher than 113.1 billion KRW the previous year. Financial costs include interest expenses, financial transaction costs, and fees incurred when the company raises funds, with interest expenses being the core. Interest expenses refer to amounts used for corporate loans and corporate bond interest. The company's interest expenses for the first quarter were 98.8 billion KRW, an increase of 20 billion KRW compared to 77.1 billion KRW a year earlier. Derivative valuation losses of about 30 billion KRW also occurred.

Financial expenses for Lotte Holdings alone also increased from 47.6 billion KRW to 69.1 billion KRW. This was due to issuing corporate bonds and private commercial paper (CP) to support affiliates, including a paid-in capital increase related to the expansion of Lotte Biologics' new plant and investment in Lotte Healthcare. Recently, to manage the financial structure, the company issued hybrid bonds (2 trillion KRW) classified as capital rather than debt, with an interest rate reaching 5.7%.

Duty-Free Shops and Chemicals with Poor Performance Also Enter Emergency Management

As Lotte Holdings, the 'control tower' of Korea's Lotte Group, has abruptly entered emergency management, other affiliates of Lotte Group are expected to also take steps to improve their management situation, such as cost reduction. Some affiliates already facing deteriorating business conditions, such as Lotte Chemical and Lotte Duty Free, have independently entered emergency management. Lotte Chemical is struggling due to sluggish petrochemical industry conditions amid high oil prices. Lotte Duty Free has also been clouded by poor performance as the recovery of Chinese tourists, considered major customers after the COVID-19 pandemic, has been slow.

On the 25th of last month, Lotte Duty Free announced through an internal message from CEO Kim Ju-nam that it had entered an emergency management system including workforce restructuring, business division restructuring, and executive salary cuts. Accordingly, on the 19th, personnel changes were made, and about 20 headquarters employees and downtown sales staff were reassigned to work at the airport delivery area as part of workforce restructuring.

Lotte Chemical has also been implementing emergency management guidelines since the 1st of last month, including a 20% reduction in travel expense budgets in the basic materials division. The number of personnel allowed on business trips is limited to a maximum of two, and executives' airline ticket classes are downgraded by one level for flights under 10 hours. A focused work system is also in place, discouraging smoking and non-work-related messenger use from 10 a.m. to 12 p.m. and 2 p.m. to 4 p.m.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.