Amazon Invests $17.6 Billion in AI Infrastructure in Q2

MS and Google Join Spending Race

Wall Street Says "Bubble Concerns Are Overblown"

Top 10 US Companies Have 27x PER

Comparison to Dotcom Bubble Is Unwise

Big tech companies (large information technology firms) that announced their earnings confirmed their intention to continue investing despite the burden of sharply increased spending related to artificial intelligence (AI). While some in the market have raised concerns about these companies' AI investments being excessive relative to demand, drawing parallels to the dot-com bubble era, Wall Street analysts have been issuing counterarguments against this so-called 'AI bubble theory.'

Amazon's AI-related capital expenditures exceed market expectations

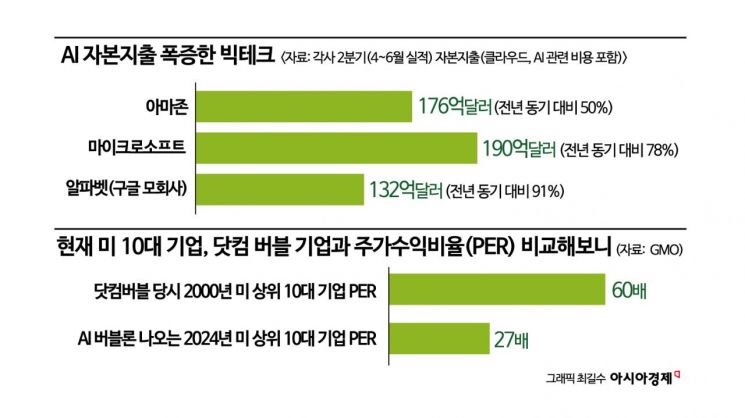

Amazon announced after the market closed on the 1st (local time) that its capital expenditures for the second quarter (April to June), including investments in cloud and generative AI infrastructure, increased by 50% year-over-year to $17.6 billion. This figure surpasses the market expectation of $16.41 billion.

As a result, Amazon expects its third-quarter operating profit to range between $11.5 billion and $15 billion, lower than analysts' forecast of $15.1 billion. However, the company also emphasized its plan to expand AI investments. Brian Olsavsky, Amazon's Chief Financial Officer (CFO), explained, "AI-related capital expenditures will increase further in the second half of the year," adding, "Most of it is for cloud infrastructure."

This trend is similarly observed in Microsoft (MS) and Google Alphabet, which had previously released their quarterly earnings. AI-related capital expenditures for MS and Alphabet increased by 78% and 91%, respectively. This reflects their competition to secure a leading position in the AI services market, where a clear winner has yet to emerge.

Big tech's AI capital expenditures surge... investment continues to expand

Additionally, these companies reiterated their plans to increase AI investments going forward. Sundar Pichai, CEO of Google Alphabet, emphasized, "If we don't invest to be at the forefront, much larger negative consequences could occur." Given that Alphabet's search engine, Google, faces a threat of market share decline due to OpenAI's launch of its own search engine, SearchGPT, the company is expected to pursue even more aggressive investments.

Ahead of the big tech earnings season, a kind of 'bubble theory' had already spread in the market, suggesting that these companies' AI-related investments are excessive relative to demand. This diagnosis likens the current situation to the dot-com boom era when companies massively installed fiber optic cables. Notably, concerns about an AI bubble raised by major investment banks such as Goldman Sachs and Barclays have led to sharp declines in related stocks.

Some on Wall Street say "This is not an AI bubble phase"

However, following the earnings announcements reaffirming big tech's commitment to AI investments, recent reports from Wall Street have described the stock price declines driven by bubble concerns as "excessive investor worries about AI prospects."

Jeremy Grantham, portfolio manager at investment advisory firm GMO, stated in a client memo that "It is meaningless to compare major companies like the so-called Magnificent 7 to companies during the late 1990s dot-com bubble," and he compared the price-to-earnings ratios (PER) of major companies then and now. PER is calculated by dividing the stock price by earnings per share (EPS), with higher values indicating overvaluation.

Grantham noted, "During the dot-com bubble, the PER of the top 10 companies reached 60 times in 2000, whereas as of 2024, the PER of the top 10 U.S. companies is only 27 times," emphasizing, "Today's risks are not comparable to those of the dot-com bubble."

Vincent Deluard, an analyst at financial services firm StoneX, also pointed out that the external environment differs from the dot-com bubble era regarding current AI investments, stating, "It is very risky for investors to bet that big tech stock prices will continue to fall."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)