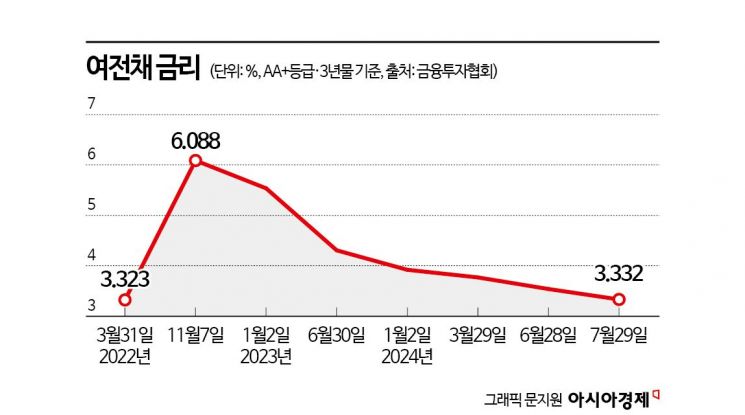

Yeojeonchae AA+ 3-Year Average Interest Rate 3.332%

Lowest Since March 31, 2022

"Franchise Fee Reform Needed for Business Recovery"

The interest rates on specialized credit bonds (yeojeonchae), a funding channel for card companies, have fallen to their lowest level in 2 years and 4 months amid expectations of a base rate cut by the Bank of Korea.

According to the Korea Financial Investment Association on the 31st, the average interest rate for 3-year yeojeonchae with a credit rating of AA+ stood at 3.332% per annum as of the 29th. This is the lowest level in about 2 years and 4 months since March 31, 2022 (3.323%). Yeojeonchae are bonds issued by specialized credit companies such as credit card companies and capital companies that do not have their own deposit functions. When yeojeonchae interest rates fall, the funding costs for card companies decrease. Yeojeonchae rates entered the 6% range on November 7, 2022, influenced by incidents such as the Legoland case, and have steadily declined since then due to expectations of base rate changes in the US and Korea.

The easing of burdens due to the decline in yeojeonchae interest rates is also reflected in earnings. The net income for the first half of this year for five card companies (Shinhan, Samsung, KB Kookmin, Woori, and Hana Card), whose results have been disclosed so far, reached 1.1984 trillion won, a 25.5% increase compared to the same period last year. Except for Woori Card, all recorded double-digit growth rates.

As yeojeonchae interest rates decreased, the issuance volume of yeojeonchae by card companies has also increased. From the 1st to the 30th of this month, the net issuance amount of other financial bonds, including yeojeonchae, was 2.1048 trillion won, an increase of about 2.5 trillion won compared to the previous month (-647 billion won). Major card companies such as Shinhan, Samsung, KB Kookmin, and Lotte Card, which have breathed a sigh of relief, have started offering interest-free installment benefits for up to 5 months in sectors such as online shopping, insurance, travel, and duty-free shops.

However, the industry expects that it will take time for the business conditions to recover as there are still borrowings raised during the high-interest rate period. The scale of card bonds maturing in the second half of this year for eight domestic card companies is 14.3 trillion won. Of this, long-term card bonds issued until the end of 2021, before the sharp rise in interest rates, account for more than 90%. Additionally, the delinquency rate, a soundness indicator, is approaching the risky level of 2% for most card companies, so the situation cannot be considered safe. An industry official said, "The strong performance in the first half was a recession-type profit achieved through cost reduction," adding, "The business conditions can improve only if the merchant fees directly related to the core business are restructured."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.