KB Asset Management Lowers Fees on 13 ETFs

Industry: "Aim to Promote ETF Brand and Increase Market Share"

"Other Asset Managers May Also Join"

KB Asset Management has drastically reduced the total expense ratios of 13 types of exchange-traded funds (ETFs). This decision came less than a month after changing the ETF brand name. It is analyzed that KB Asset Management, which ranks in the mid-to-upper tier among ETF providers, decided to lower fees to increase its market share. This fee reduction has drawn attention to whether other mid-tier asset managers will also lower their ETF fees.

According to the financial investment industry on the 31st, KB Asset Management lowered the total expense ratios of 13 'RISE ETF' products to an annual rate of 0.01%, effective immediately.

The fee-reduced products include ETFs tracking major U.S. indices such as ‘RISE US S&P 500’ and ‘RISE US Nasdaq 100’, as well as global thematic ETFs like ‘RISE US AI Value Chain TOP3 Plus’, ‘Global Realty Income’, and ‘Berkshire Portfolio TOP10’. KB Asset Management decided in June this year to change its ETF brand name from 'KBSTAR' to 'RISE'. The brand name was uniformly changed to RISE on the 17th of this month. This decision was made less than a month after the brand change.

KB Asset Management explained that this decision was made for the benefit of investors. They considered that many investors seek overseas products (taxable) over domestic equity products (tax-exempt) by utilizing tax benefits of pension accounts. Since pension accounts cannot directly purchase ETFs listed overseas, investors must choose overseas ETFs listed domestically.

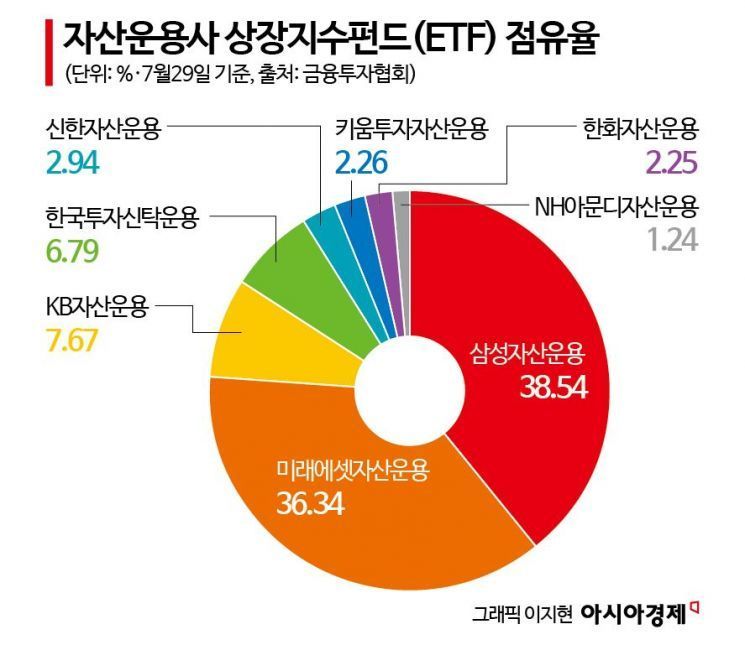

However, the industry views this decision as KB Asset Management’s move to expand its ETF market share. As of the 29th of this month, Samsung Asset Management holds the top ETF market share at 38.54%. Following is Mirae Asset Global Investments with 36.34% in second place. KB Asset Management and Korea Investment Management hold 7.67% and 6.79%, ranking third and fourth respectively.

In particular, Korea Investment Management is aggressively pursuing KB Asset Management. As of the end of last year, Korea Investment Management’s ETF net assets increased nearly twofold from 5.9179 trillion KRW to 10.7054 trillion KRW as of the 29th of this month. Meanwhile, KB Asset Management’s assets grew from 9.7223 trillion KRW to 12.0892 trillion KRW during the same period.

An asset management industry insider said, "KB Asset Management changed its brand name, but it seems they judged that this alone would not attract investors. While other asset managers are competing in the market with ETFs specialized to their firms, KB Asset Management does not yet have a killer product, so it appears they lowered fees to promote the brand and attract investors."

Another insider explained, "It seems KB Asset Management is now forced into market share competition. Looking at the products whose fees were lowered, most are overseas ETFs, so it appears the total expense ratio was reduced to increase market share in this segment."

Currently, asset management companies are fiercely competing by renewing ETF brand names and lowering product fees. For example, in April this year, Samsung Asset Management set the total expense ratios of four ETFs, including 'KODEX S&P500TR', at 0.0099%, the lowest level in the domestic ETF market. Mirae Asset Global Investments and Hanwha Asset Management also applied similarly low total expense ratios to some products. Additionally, Hanwha Asset Management changed its ETF brand name from ARIRANG to PLUS, and Hana Asset Management changed from KTOP to 1Q.

As competition intensifies, it is expected that other asset managers will also join in lowering fees. Korea Investment Management, which is competing with KB Asset Management for third place, has stated it has no plans to reduce ETF fees. However, the industry explains that since Korea Investment Management is competing closely with KB Asset Management for the third spot, it is highly likely they will lower fees. An industry official said, "Korea Investment Management has been rapidly catching up to KB Asset Management. The responses of Korea Investment Management and other asset managers are also of great interest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)