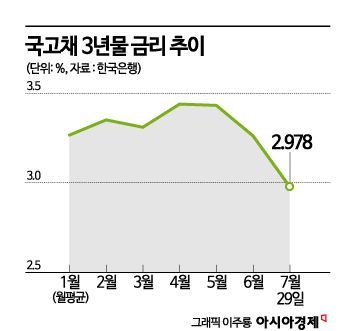

3-Year Korean Treasury Bond Below 3% for the First Time in 2 Years and 2 Months

① Anticipation of US-Korea Interest Rate Cuts Priced In

② Possibility of Inclusion in World Government Bond Index (WGBI)

③ Inflow of Foreign Buyer Funds

Government bond yields have hit their lowest level in over two years. This is attributed to growing expectations of interest rate cuts in both the United States and South Korea, as well as the potential inclusion in the World Government Bond Index (WGBI). However, there are also assessments that the market has excessively priced in expectations of rate cuts, as the 3-year government bond yield has fallen more than 0.5 percentage points below the benchmark interest rate.

3-Year Government Bond Hits Lowest in 2 Years and 2 Months Amid Rate Cut Expectations

On the 30th, in the Seoul bond market, the 3-year government bond yield was trading at 2.968% as of 9:50 a.m., down 1 basis point (1bp = 0.01 percentage points) from the previous trading day.

The previous day, the 3-year government bond yield closed at 2.978%, down 4.6bp from the prior day. The 3-year government bond yield falling into the 2% range is the first time in 2 years and 2 months since May 30, 2022 (2.942%).

The 3-year government bond, a representative indicator of market interest rates, is the most actively traded and is interpreted as reflecting the Bank of Korea's monetary policy well. Since the Bank of Korea's benchmark interest rate is currently 3.5%, it is assessed that the 3-year government bond yield has already priced in more than two rate cuts.

Not only the 3-year bonds but also government bonds with other maturities have all declined. The 10-year bond yield fell 6.2bp to 3.046%. The 5-year and 2-year yields dropped 5.5bp and 4.3bp respectively, closing at 2.990% and 3.057%. The 30-year bond yield recorded 2.942%, and the 50-year bond yield hit 2.887%, marking the lowest levels of the year.

The simultaneous decline in government bond yields is due to increased expectations of rate cuts, which have sustained foreign investor inflows. The June core Personal Consumption Expenditures (PCE) index in the U.S., released last week, rose only 0.2% month-over-month, further boosting expectations for rate cuts.

The market expects the U.S. Federal Reserve (Fed) to cut the benchmark interest rate in September. According to the FedWatch indicator by the Chicago Mercantile Exchange (CME) Group, the futures market fully prices in a 100% probability of a rate cut in September. Consequently, U.S. Treasury yields continue to decline, influencing South Korean government bond yields as well.

Domestic price stability has increased the likelihood of a rate cut by the Bank of Korea, also contributing to the decline in yields. The market anticipates that a dissenting opinion for a rate cut may emerge at the Bank of Korea's Monetary Policy Committee meeting next month. Following a dissenting opinion in August, there is speculation that the benchmark rate could be lowered around October.

Kim Myung-sil, a researcher at Hi Investment & Securities, said, "As rate cuts in the U.S. and South Korea approach, the bond market is significantly affected," adding, "The possibility of central banks cutting benchmark rates will continue to influence government bond yields."

Potential Inclusion in the World Government Bond Index (WGBI) Also Drives Foreign Buying of Government Bonds

The possibility of South Korea's government bonds being included in the WGBI is another supply-demand factor attracting foreign purchases. The South Korean government aims for inclusion in the WGBI by September. If included, more than 50 trillion won of foreign bond capital could flow in over the next year, and it is analyzed that preemptive investment is already occurring ahead of this.

Kim Sang-hoon, a researcher at Hana Securities, said, "As government expectations for WGBI inclusion remain, foreign investors are entering government bond betting funds."

However, concerns persist that current market interest rates are excessively pricing in expectations of rate cuts. Jo Yong-gu, a researcher at Shin Young Securities, evaluated, "The bond market's expectations are running ahead of the Fed."

Bank of Korea Governor Lee Chang-yong also stated at a press conference after maintaining the benchmark rate on the 11th, "Market interest rates are somewhat excessively pricing in expectations of rate cuts."

Although speculative funds have temporarily driven market interest rates sharply lower, a rebound phase is expected in the future. Kim Sung-soo, a researcher at Hanwha Investment & Securities, said, "Government bond yields have fallen due to expectations of central bank rate cuts and WGBI inclusion," but added, "For the 3-year bond, yields below 3% are excessive, and rates are expected to rise slightly in August."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)