GDP Shrinks for the First Time in 6 Quarters

Government Maintains Domestic Demand Improvement Outlook for Three Months

"Export Trickle-Down Effect Expected to Be Limited"

Amid South Korea's economy contracting in the second quarter, concerns are emerging that domestic demand weakness will persist for a long time even if the base interest rate is cut in the second half of the year.

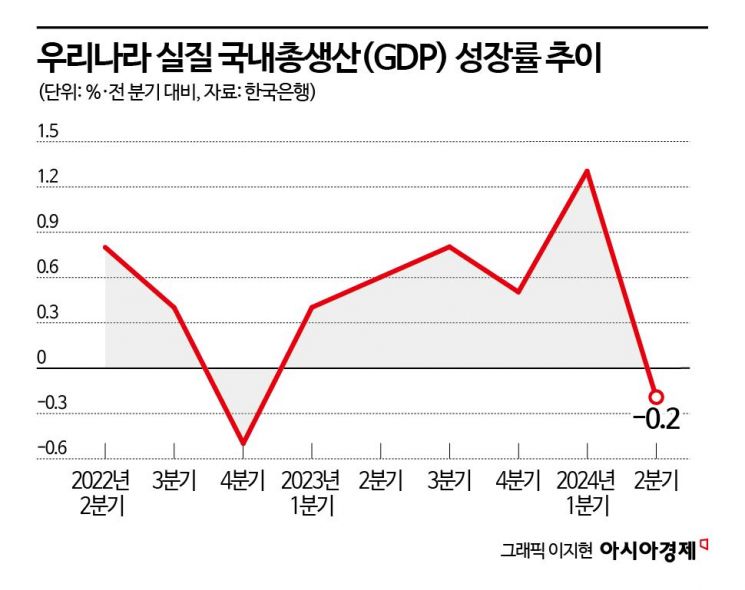

According to the Bank of Korea on the 30th, South Korea's real gross domestic product (GDP) growth rate in the second quarter of this year recorded -0.2% compared to the previous quarter, falling short of market expectations (0~0.1%). This marks negative growth for the first time in six quarters since the fourth quarter of 2022 (-0.5%).

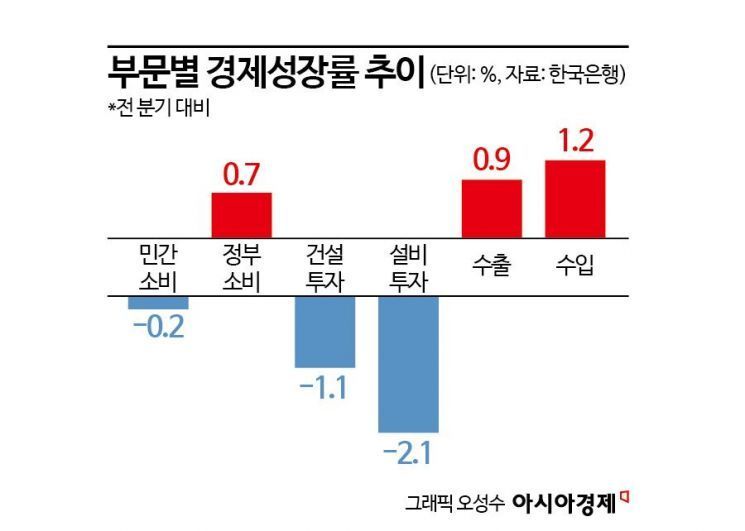

The biggest cause of the negative growth is cited as 'domestic demand weakness.' In the second quarter, private consumption saw a slight improvement in services, but consumption of goods such as passenger cars and clothing decreased, resulting in a 0.2% decline compared to the previous quarter. Private consumption in the first quarter (0.7%) temporarily improved significantly due to the government's early execution of the first half budget, but this effect was offset in the second quarter, proving that domestic demand recovery remains weak. Investment was also sluggish across all categories. Construction investment decreased by 1.1%, and facility investment fell by 2.1% compared to the previous quarter.

Corporate business outlooks are also pessimistic. According to the Bank of Korea, the Composite Business Survey Index (CBSI) for all industries in July was 95.1, marking a decline for the first time in five months and maintaining a pessimistic stance for 22 consecutive months. The top future business management difficulty cited was 'domestic demand weakness.'

The employment situation is also showing signs of slowdown. According to Statistics Korea, the increase in the number of employed persons in May (80,000) was the lowest in three years and three months, and last month saw an increase of 96,000, falling below 100,000 for two consecutive months.

The market views domestic demand in the second half pessimistically. While the Bank of Korea expects domestic demand to gradually improve in the second half, it assessed that a strong recovery would be difficult. Shin Seung-chul, head of the Economic Statistics Department at the Bank of Korea, said at a press briefing held immediately after the second quarter GDP announcement on the 25th, "In the second half, domestic demand is expected to show a gradual improvement centered on private consumption and facility investment," but added, "However, it will be difficult for domestic demand to completely overcome weakness and shift to a strong recovery."

Economic research institutes also see a short-term rebound in domestic demand as unlikely. In this month's report titled 'Recent Domestic and International Economic Issues and Implications,' Hyundai Research Institute diagnosed that "due to prolonged high interest rates, rising labor and raw material costs, and expanded domestic and international uncertainties leading to weakened corporate sentiment, a rebound in facility and construction investment is unlikely to be realized in the short term," concluding that a short-term domestic demand rebound is difficult.

The Korea Development Institute (KDI), a government-funded research institution, also maintained its diagnosis of domestic demand weakness for the third consecutive month in its 'July Economic Trends,' stating, "Exports continue to show a favorable trend centered on ICT items, but domestic demand is not showing signs of recovery due to the continuation of the high interest rate stance."

On the other hand, the government has maintained an optimistic stance on domestic demand for three months. The Ministry of Economy and Finance evaluated in the 'Recent Economic Trends (Green Book) July issue' that "Our economy is gradually expanding its recovery trend as signs of domestic demand recovery join the stable inflation trend, manufacturing, and export upturn." The government began mentioning domestic demand recovery from May, noting that export growth has led to an expansion in private consumption, continuing domestic demand recovery.

Strong Domestic Demand Recovery Difficult... Limited Export Spillover Effect

As small business owners continue to face management difficulties amid high inflation, the expansion of support funds for small businesses has become urgent. On the 28th, empty storefronts were seen scattered throughout the commercial area near Ewha Womans University in Seodaemun-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

As small business owners continue to face management difficulties amid high inflation, the expansion of support funds for small businesses has become urgent. On the 28th, empty storefronts were seen scattered throughout the commercial area near Ewha Womans University in Seodaemun-gu, Seoul. Photo by Kang Jin-hyung aymsdream@

Experts believe that even if the Bank of Korea cuts the base interest rate in the second half, a strong domestic demand recovery will be difficult.

Ryu Jin-yi, an economist at SK Securities, explained, "The increase in bank delinquency rates centered on self-employed individuals who have been directly hit by domestic demand weakness and high interest rates, along with clear signs of slowdown in the domestic employment market, are exerting downward pressure on domestic demand," adding, "Although the government has introduced various support measures for the self-employed since the beginning of the year, given the government's sound fiscal stance and the managed fiscal balance already recording a cumulative deficit of 74.4 trillion won until May, additional policy leeway will inevitably be limited."

Jeong Se-eun, a professor of economics at Chungnam National University, said, "Since the current household debt scale has reached its limit, it will be difficult to stimulate domestic demand except for a few even if interest rates are lowered in the future," adding, "Fundamentally, domestic demand can be revitalized only if distribution aspects such as jobs and income for the lower and middle classes improve."

Kim Sang-bong, a professor of economics at Hansung University, said, "It is generally believed that consumption will increase if interest rates are lowered, but currently, South Korea is experiencing wealth polarization, so even if interest rates are lowered, consumption may not increase," adding, "Fundamentally, the total amount of household debt must be reduced and the issue of asset polarization resolved."

There is also an assessment that the so-called spillover effect, where export growth spreads to domestic demand, will be limited. In a recent report titled 'Analysis of Factors Behind Recent Domestic Demand Weakness: Focusing on Interest Rates and Exports,' KDI analyzed the correlation between exports and private consumption from 2004 to 2024, finding that a 1 percentage point increase in goods exports raises private consumption by up to 0.07 percentage points one quarter later, with the effect spreading for about three quarters. KDI concluded at the end of the report that if interest rate cuts are implemented during the year, domestic demand may recover somewhat faster, but it will be difficult to show sufficient recovery.

According to KDI, the export recovery that began in the second half of last year is estimated to increase consumption and facility investment by 0.3 percentage points and 0.7 percentage points respectively this year, but the accumulated impact of policy interest rates is expected to reduce consumption and facility investment by 0.4 percentage points and 1.4 percentage points respectively this year, continuing to act as a constraint on domestic demand recovery.

Professor Jeong explained, "Considering that consumption and investment remain sluggish despite export recovery, the link between exports and domestic demand, that is, the spillover effect, has been broken for a long time," adding, "If we rely only on semiconductor exports, which have a low employment inducement effect, it will be difficult for the spillover effect to occur to domestic small and medium-sized enterprises."

Professor Na Won-jun of Kyungpook National University said, "Since South Korea's economy is currently dual-structured between exports and domestic demand, the government should actively increase fiscal spending to help the bottom-tier economy, such as self-employed individuals and small and medium-sized enterprises, recover."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)