Why the Issue Starting from Qoo10 Quickly Spread to Timfro

Consolidating IT and Finance Core Teams While Acquiring Domestic E-commerce

Controlling 'Timpark' While Making Money Simultaneously

The problem started with Qoo10. Last year, some sellers on the overseas direct purchase platform Qoo10 faced issues with delayed settlements. This problem continued into this year, and after May, the delays became severe. The spark moved to WEMAKEPRICE in early July and then quickly spread to TMON. Although TMON is an affiliate of Qoo10, it is a separate legal entity, yet the problem spread rapidly. The common factor behind this was one company: Qoo10 Technology. Established in May 2010, it is an IT subsidiary wholly owned by Qoo10’s Singapore headquarters. This company, responsible for developing and operating the Qoo10 platform, controlled not only the technology of TMON and WEMAKEPRICE but also their finances.

The settlement delay issue that began at Wemakeprice, an online shopping mall operated by Qoo10 Group headquartered in Singapore, is spreading to TMON. On the 24th, a Qoo10 signboard was posted on a building in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

The settlement delay issue that began at Wemakeprice, an online shopping mall operated by Qoo10 Group headquartered in Singapore, is spreading to TMON. On the 24th, a Qoo10 signboard was posted on a building in Gangnam-gu, Seoul. Photo by Yongjun Cho jun21@

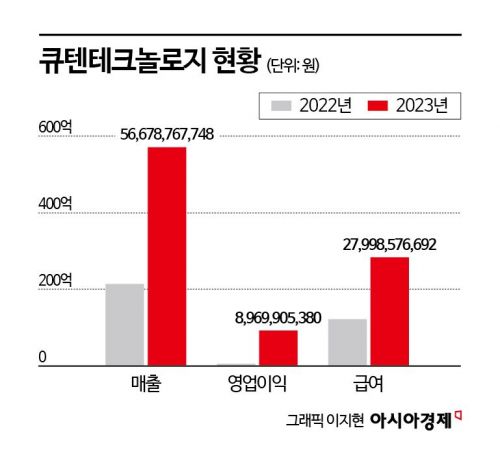

According to Qoo10 Technology’s audit report on the 28th, last year the company generated sales of 30.8 billion KRW from TMON, WEMAKEPRICE, and Interpark. These transactions did not exist the previous year but arose after Qoo10 acquired TMON in 2022 and subsequently WEMAKEPRICE and Interpark Commerce. Thanks to this, sales more than doubled from around 21 billion KRW in 2022 to 56.7 billion KRW last year. Operating profit, which was less than 700 million KRW, surged to nearly 9 billion KRW?a more than 13-fold increase. Until 2022, the company was in a state of complete capital erosion with accumulated losses of 10.7 billion KRW, but this was reduced to 3.9 billion KRW.

What stands out is not only the sales but also the payroll, which increased 2.3 times, indicating a rise in staff numbers. Currently, Qoo10 Technology employs about 700 people. During the same period, WEMAKEPRICE’s total payroll significantly decreased. This is because as Qoo10 successively acquired domestic e-commerce platforms, IT personnel responsible for platform development and operation were consolidated under Qoo10 Technology. Previously, Qoo10 Technology was only responsible for developing the Qoo10 platform, but by transferring IT personnel from each company, it took over platform development and operation for TMON, WEMAKEPRICE, and Interpark Commerce as well. This explains the substantial growth in sales and profits.

The personnel who moved after the Qoo10 acquisition were not limited to the IT department. Financial staff also all moved to Qoo10 Technology. A structure was created where employees of Qoo10 Technology concurrently handle the financial tasks of TMON and WEMAKEPRICE. In fact, TMON and WEMAKEPRICE do not have separate finance departments. Ryu Hwa-hyun, CEO of WEMAKEPRICE, said, "WEMAKEPRICE operates only product planners (MDs) and marketing with in-house staff, while finance and other functions are managed by Qoo10." Even the CEOs had to rely on financial information shared by Qoo10 Technology to understand the situation. If IT forms the backbone of e-commerce platform operations, finance acts as the lifeblood. By extracting both the backbone and lifeblood and placing them in Qoo10 Technology, they were able to control ‘TMEPARK’ at will.

Qoo10 Technology is led by CEO Kim Hyo-jong. A former Gmarket executive, he has been a close associate of CEO Koo Young-bae for nearly 20 years. Until last year, Kim was co-CEO of WEMAKEPRICE and also served as auditor for TMON. Industry insiders see Qoo10 Technology’s exclusive handling of IT for each company as a strategy for efficiency. However, the fact that finance was also centralized in one place has been criticized as an abnormal operation. The strategy to seize and dominate acquired companies became a self-defeating move, as if one falls, all collapse like dominoes. An industry source said, "Qoo10 Technology led the development of domestic e-commerce platforms under Qoo10 and created transaction channels. Considering that it also managed the finances of each company, it could be the core of the recent settlement delay incident."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)