Samsung Electronics, on the Verge of Losing '80,000-Won Stock Status'

Despite Record Q2 Performance, SK Hynix Drops Below 200,000 Won

Some Analysts See It as a Buying Opportunity

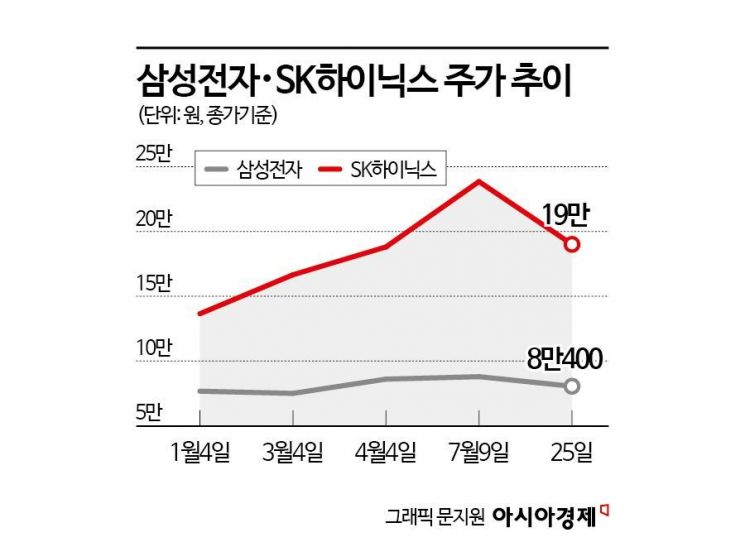

Samsung Electronics and SK Hynix, which were considered beneficiaries of AI leader Nvidia and saw their stock prices rise, are now facing headwinds. Despite both companies posting near 'earnings surprise' results in the second quarter, their stock prices have not been able to avoid a downward trend due to issues stemming from Nvidia. However, there is still ample room for stock price rebounds given the ongoing expectations for a semiconductor market recovery in the second half of the year.

According to the Korea Exchange, Samsung Electronics surged to around 87,000 KRW on the 5th, attempting to enter the 90,000 KRW range. On the 11th, the stock price soared to 88,800 KRW during trading, setting a new 52-week high. This buying momentum was driven by expectations for high-bandwidth memory (HBM) supply. The surprise earnings that exceeded market expectations also played a role in stimulating investor sentiment. Samsung Electronics announced on the 5th that its provisional operating profit for the second quarter increased approximately 1452% year-on-year to 10.4 trillion KRW.

Following the release of Samsung Electronics' second-quarter results, securities firms collectively raised their target prices to 100,000 KRW. According to financial information provider FnGuide, the average target price from 21 securities firms for Samsung Electronics is 111,600 KRW.

However, the momentum for Samsung Electronics to break through the 100,000 KRW mark was hampered by U.S. tech stocks. As U.S. semiconductor stocks fell due to weakness in U.S. tech stocks and comments from former President Donald Trump about the semiconductor industry, Samsung Electronics also declined in tandem. Adding to the woes, foreign media reports on the 24th stated that Samsung Electronics did not meet the fifth-generation HBM3E standard, causing the stock price to drop more than 2%. Currently, SK Hynix is virtually the exclusive supplier of HBM to Nvidia. Furthermore, on the 24th (local time), Nvidia and AMD fell more than 6%, and on the 25th, Samsung Electronics closed at 80,400 KRW, down 1.95% (1,600 KRW) from the previous trading day. This marks the first time in a month since June 25 (80,800 KRW) that the stock price has slipped into the low 80,000 KRW range, nearly relinquishing the "80,000 KRW stock" title.

The situation is similar for SK Hynix. Despite posting surprise second-quarter earnings, SK Hynix gave up the 200,000 KRW level due to negative news from the U.S. SK Hynix recorded its highest-ever quarterly revenue of 16.4232 trillion KRW in the second quarter. Operating profit reached 5.4685 trillion KRW, marking the first time in six years since 2018 that it surpassed the 5 trillion KRW mark. However, despite these strong results, the market responded with selling rather than buying. On the 25th, SK Hynix closed at 190,000 KRW, down 8.87% (18,500 KRW) from the previous day, returning to the June 5 level (193,700 KRW). Like Samsung Electronics, SK Hynix was not immune to the impact of the sharp correction in U.S. tech stocks, including Nvidia, overnight.

This atmosphere is quite different from a week ago. On the 11th, securities firms were raising target prices one after another, citing SK Hynix's leadership in the HBM market. Hana Securities raised its target from 240,000 KRW to 280,000 KRW, Shinhan Investment Corp from 220,000 KRW to 310,000 KRW, and SangSangin Securities from 240,000 KRW to 350,000 KRW. On the 11th, SK Hynix closed at 241,000 KRW, marking its highest price of the year and a 52-week high.

However, securities firms believe that investor sentiment toward the semiconductor sector could recover. Although the decline in U.S. big tech stocks increased volatility in Samsung Electronics and SK Hynix stock prices, the semiconductor market recovery trend remains unchanged. Some even view the current downturn as a buying opportunity. On the day of the price fluctuations, Mirae Asset Securities raised SK Hynix's target price from 240,000 KRW to 260,000 KRW.

Kim Young-geon, a researcher at Mirae Asset Securities, explained, "The expected price of DRAM in 2025 is projected to continue rising by over 40% following this year," adding, "Due to the stronger-than-expected memory price outlook, we have raised operating profit estimates for this year and next year by 23.4% and 62.5%, respectively." However, he expects the market dominance in HBM to shrink.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)