"Merger Ratio Decided at Market Price Despite Asset Value Being Half

SK Innovation Merger Price Should Have at Least a 10% Premium"

The Economic Reform Solidarity recently commented on SK Innovation's decision to merge with SK E&S, stating, "While this benefits the largest shareholder SK and the family of Chairman Chey Tae-won, who is the largest shareholder of SK (Chairman Chey Tae-won owns 17.73%, and his relatives collectively own 24.50%), the value of SK Innovation's general shareholders' equity will be correspondingly diluted, causing losses."

In a statement released on the 24th, the Economic Reform Solidarity said, "The SK Innovation board of directors set the merger price applying a market price less than half of the asset value, which is a decision favoring the controlling shareholder's interests and infringes on the interests of general shareholders."

Under the current Capital Market Act, in mergers between listed and unlisted companies, the listed company must calculate the merger price based on market price, but if the market price is below the asset value, the asset value can be used instead.

The Economic Reform Solidarity explained, "SK Innovation's company value was evaluated at approximately KRW 10.8 trillion, and SK E&S at about KRW 6.2 trillion. However, if only asset value is considered, SK Innovation is valued at about KRW 23.5 trillion (KRW 245,405 per share), greatly exceeding SK E&S's approximately KRW 3.8 trillion (KRW 82,475 per share). Moreover, SK Innovation's stock price has been at its lowest level in the past three years."

The merger ratio between SK Innovation and SK E&S was decided at 1:1.1917417 (merger price per share: KRW 112,396 : KRW 133,947). This reflects the application of the market price (the arithmetic average of the weighted average prices over the past month, past week, and previous day) for the listed company SK Innovation, and the intrinsic value weighted by asset and earnings value for the unlisted company SK E&S, in accordance with the current Capital Market Act.

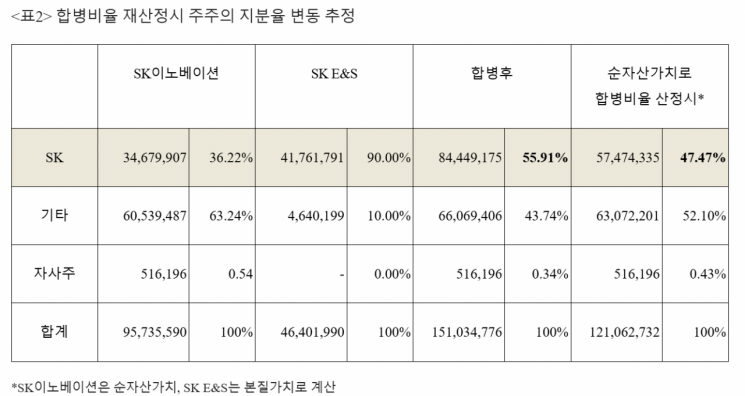

The Economic Reform Solidarity noted, "SK Innovation's largest shareholder is the holding company SK, owning 34.45% of shares, while SK E&S is also majority-owned by SK with a much higher stake of 90%. After the merger of SK Innovation and SK E&S, SK's estimated shareholding in the merged entity is 55.91%. However, if SK Innovation's merger price calculation is changed to net asset value and the merger ratio recalculated, SK's shareholding in the merged entity would decrease by 8.44 percentage points to 47.47%."

The Economic Reform Solidarity argued, "If the SK Innovation board is confident in the synergy from the merger, it should consider the interests of all shareholders and evaluate SK Innovation's merger price based on asset value, setting the merger ratio with SK E&S at 1:0.545820175 (merger price per share: KRW 245,405 : KRW 133,947), or at least apply a 10% premium to SK Innovation's merger price."

Estimated Change in Shareholders' Equity Ratio When Recalculating Merger Ratio

Estimated Change in Shareholders' Equity Ratio When Recalculating Merger Ratio [Image Source=Economic Reform Institute]

Furthermore, the Economic Reform Solidarity pointed out, "Although the SK Group explained the purpose of this merger as an evolution into a comprehensive energy company, the merger's purpose is unclear beyond the possibility that SK E&S's operating profit could ultimately be used to financially support SK On, a subsidiary of SK Innovation."

They argued that if the merger's purpose is to support SK On financially, it would be more efficient for SK Innovation to secure funds through a paid-in capital increase rather than forcing a merger. Concerns about share dilution from the capital increase could be resolved if SK participates in SK Innovation's capital increase using dividend income received from SK E&S.

The Economic Reform Solidarity views this merger and the controversy over Doosan's business restructuring as problems arising from dual listings. They said, "Fundamentally, the issue stems from the harm caused by dual listings of parent companies, subsidiaries, and even grandchild companies on the market. In a reality like South Korea's, where controlling shareholder abuses exist and dual listings of parent and subsidiary companies are common, controversies over infringement of general shareholders' interests during transactions such as mergers among affiliated companies are unlikely to subside."

The Economic Reform Solidarity emphasized the need for systems similar to Japan's, which disclose the significance of holding listed subsidiaries and review and disclose ownership and investment structure improvement plans. They added, "The government and the National Assembly should discuss legislation to expand the majority resolution system for minority shareholders and the duty of loyalty of directors."

Earlier, on the 17th, SK Innovation decided to absorb SK E&S, and on the same day, SK On decided to absorb SK Trading International and SK Entum, both wholly owned subsidiaries of SK Innovation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)