Bank of Korea 'July Consumer Sentiment Survey Results'

Consumer Sentiment Index 103.6... Highest in 2 Years and 3 Months

Home Price Rise Expectations Highest in 2 Years and 8 Months

The consumer sentiment index reached its highest level in 2 years and 3 months as exports continued to grow and expectations for a policy interest rate cut increased. The expected inflation rate, which reflects the forecast for consumer price inflation over the next year, entered the 2% range for the first time in 2 years and 4 months. Expectations for housing price increases were the highest in 2 years and 8 months.

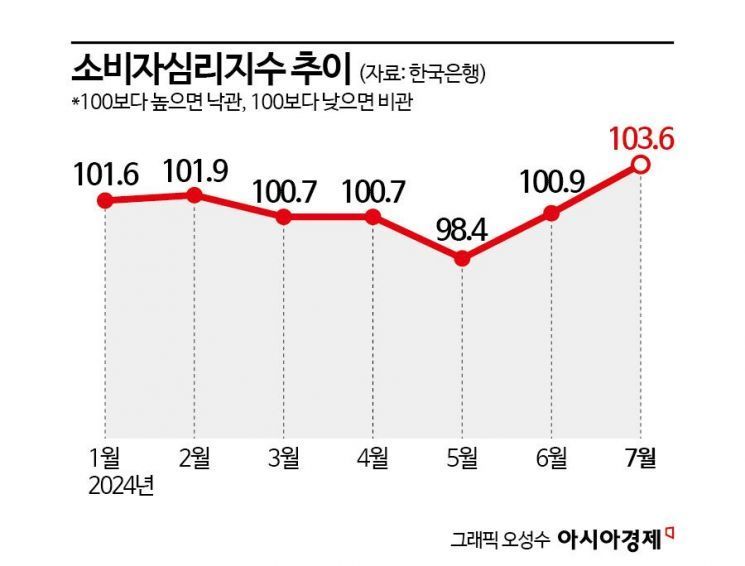

According to the "July Consumer Sentiment Survey Results" released by the Bank of Korea on the 24th, the Consumer Confidence Index (CCSI) for this month rose by 2.7 points from the previous month to 103.6. This is the highest level in 27 months since April 2022 (104.3). The consumer sentiment index had exceeded 100 for four consecutive months from January this year, dipped slightly in May, and rose above 100 again in June.

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Sentiment Index (CSI). A value above the long-term average (2003?2023) of 100 indicates optimistic consumer sentiment, while a value below 100 indicates pessimism.

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea’s Economic Statistics Bureau, said, "Although concerns about sluggish domestic demand such as consumption have recently emerged, the number of younger consumers in their 30s and 40s who plan to increase spending on travel, entertainment, and culture is rising, suggesting signs of recovery ahead." He added, "News of export improvements centered on the IT sector, growing expectations for interest rate cuts by the U.S. Federal Reserve (Fed), and rising stock prices have all contributed to the improvement in consumer sentiment."

The expected inflation rate, which indicates the forecast for consumer price inflation over the next year, was 2.9%, down 0.1 percentage points from the previous month. This is the first time since March 2022 (2.9%) that the expected inflation rate has entered the 2% range.

Hwang explained, "The decline in expected inflation was influenced by the growing perception that the inflation rate will slow down, as the recent Consumer Price Index (CPI) slowdown continues." He added, "However, variables remain, such as adjustments to public utility fee hikes and the recent adverse weather conditions, which could cause agricultural product prices or exchange rates to rise."

Sentiment regarding economic conditions also improved. The Current Economic Conditions CSI rose by 6 points from the previous month to 77. The Future Economic Outlook CSI increased by 4 points to 84.

The Interest Rate Level Outlook CSI fell by 3 points to 95 from the previous month. This was due to the U.S. Consumer Price Index (CPI) falling short of expectations and weakening employment indicators, which led to market interest rates declining amid growing expectations for a rate cut by the U.S. Federal Reserve (Fed).

Housing Price Increase Expectations Highest in 2 Years and 8 Months

Expectations for housing price increases reached their highest level in 2 years and 8 months. The Housing Price Outlook CSI rose by 7 points from the previous month to 115. This is the highest level since November 2021 (116). The postponement of the second-stage Stress Total Debt Service Ratio (DSR) loan regulations, a decline in mortgage interest rates, and rising apartment prices mainly in the Seoul metropolitan area are interpreted as factors leading to increased expectations for housing price rises.

The Price Level Outlook CSI fell by 2 points from the previous month to 144. Despite rising petroleum prices due to a reduction in fuel tax cuts and increased import prices caused by exchange rate rises, the perceived inflation rate slowed due to a deceleration in prices of agricultural products and processed foods.

The main items expected to influence consumer price increases over the next year were public utility fees (54.3%), agricultural, livestock, and fishery products (49.9%), and petroleum products (35%). Compared to the previous month, the response shares for petroleum products (up 11.4 percentage points) and public utility fees (up 1.3 percentage points) increased, while the share for agricultural, livestock, and fishery products decreased by 7.9 percentage points.

This survey was conducted from the 10th to the 17th of this month, targeting 2,500 households in urban areas nationwide (with 2,291 responses).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)