Board Approves Merger of SK Inno-E&S and SK Eco-Semiconductor

SK Inno Secures 55.9%, SK Eco Holds 62.1% Majority Stakes

SK Group's holding company, SK Inc., is significantly expanding its stakes in core energy and environmental businesses to pursue 'qualitative growth.'

Through group-wide rebalancing (business restructuring), the company aims to concentrate the capabilities of its subsidiaries, strengthen business competitiveness, and proactively increase stakes in future core businesses to enhance the holding company's corporate value.

On the 18th, SK Inc. held an extraordinary board meeting and approved the agenda items regarding the merger of SK Innovation and SK E&S, as well as the reorganization of semiconductor businesses Essencore and SK Materials Airplus as subsidiaries of SK Ecoplant, the company announced on the 19th.

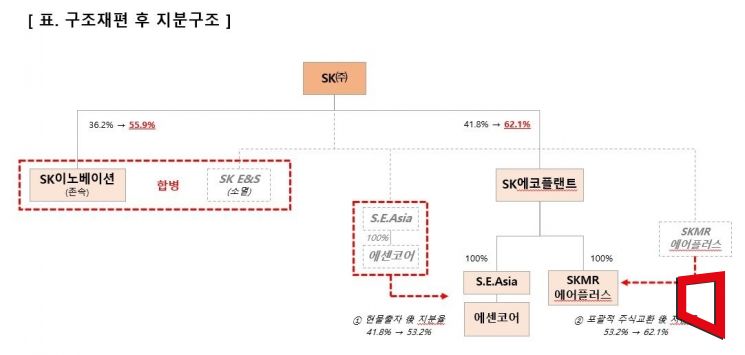

Upon completion of this process, SK Inc.'s stake in SK Innovation will increase from 36.2% to 55.9%, and its stake in SK Ecoplant will rise from 41.8% to 62.1%, both exceeding the majority threshold. By increasing its stakes in energy and environmental businesses, SK Inc. aims to secure business growth outcomes while subsidiaries consolidate their previously dispersed core business capabilities, expecting to achieve financial improvement and a stable profit structure in a short period.

An SK Inc. official stated, "About 80% of the value of the shares held by SK Inc. consists of subsidiary stakes, with the remaining 20% made up of global assets and self-invested portfolios, so the performance of subsidiaries directly affects the holding company's value." He added, "The purpose of portfolio restructuring is ultimately to increase SK Inc.'s corporate value by boldly integrating overlapping areas, generating synergies, and raising the value of subsidiary stakes."

Having established a 'future business portfolio' including energy, semiconductors, artificial intelligence (AI), and bio sectors, SK Inc. plans to drive qualitative growth of its subsidiaries while enhancing the holding company's fundamental roles such as creating synergies among subsidiaries, strengthening group sustainability, and fostering growth sectors.

Additionally, SK Inc. will improve its financial structure through active asset efficiency measures and secure resources for investment as well as shareholder returns, continuing to strengthen its shareholder return policy.

SK Innovation held a board meeting on the 17th and approved the merger with SK E&S. The merger is expected to be finalized on November 1 after approval at an extraordinary shareholders' meeting on August 27. The surviving entity will be SK Innovation. The merger will create a mega energy company with assets exceeding 100 trillion KRW and sales over 90 trillion KRW, making it the largest private energy company in the Asia-Pacific region.

SK Inc. anticipates that as SK Innovation grows into a comprehensive energy company encompassing the entire value chain of energy and electrification businesses, shareholder returns will also expand.

SK REITs (SK Entrusted Management Real Estate Investment Company) will enter the KOSPI market next month. On the 18th, the SK Group headquarters located in Jongno-gu, SK Seorin Building. Photo by Mun Ho-nam munonam@

SK REITs (SK Entrusted Management Real Estate Investment Company) will enter the KOSPI market next month. On the 18th, the SK Group headquarters located in Jongno-gu, SK Seorin Building. Photo by Mun Ho-nam munonam@

Furthermore, SK Inc.'s board decided to strengthen SK Ecoplant's business portfolio by incorporating semiconductor module and industrial gas companies as subsidiaries of SK Ecoplant. The strategy is to establish a stable growth foundation for the environmental business based on the high profitability of the semiconductor business and to secure new growth engines by integrating environmental business with semiconductor-related operations.

SK Inc. will participate in a third-party allotment capital increase by contributing 100% of the shares of the investment purpose company (SPC) S.E.Asia, which owns semiconductor module reprocessing company Essencore, to SK Ecoplant in kind, and exchange 100% of the shares of semiconductor industrial gas manufacturer SK Materials Airplus for new shares issued by SK Ecoplant. As a result, the two semiconductor business subsidiaries of SK Inc. will be reorganized under SK Ecoplant.

Essencore is a semiconductor module company headquartered in Hong Kong. It manufactures and sells memory products worldwide, including DRAM memory modules, SSDs, SD cards, and USBs. SK Materials Airplus manufactures industrial gases such as nitrogen, oxygen, and argon.

SK Inc. expects that the combined capabilities of the three companies will create synergies in eco-friendly recycling and semiconductor infrastructure sectors. SK Ecoplant is anticipated to expand its environmental portfolio and efficiently establish and supply semiconductor industrial gas production facilities. An SK Ecoplant official stated, "This move aims to enhance operational efficiency and strengthen fundamental competitiveness by leveraging each company's strengths," adding, "Since all companies possess stable profit-generating capabilities and future growth potential, we also expect an improvement in financial stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)