HD Hyundai Electric Fair Value Stock Price Rises 246% Since Early Year

Related Stocks Surge Sharply with Power Equipment Stocks

Lowered Expectations for Secondary Battery, Entertainment, and Fashion Stocks

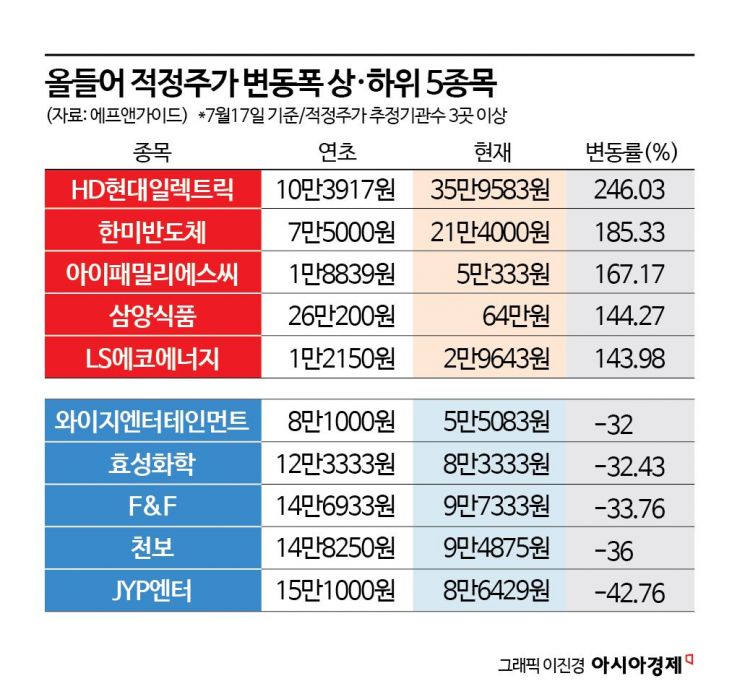

This year, the stock with the highest upward revision in target price by securities firms is HD Hyundai Electric. Due to the surge in power demand driven by artificial intelligence (AI), power equipment stocks have soared this year, leading to a significant increase in their target prices.

According to FnGuide, a financial information provider, as of the 17th, there are a total of 292 companies for which three or more securities firms have estimated a fair stock price. Among them, the fair stock prices of 172 stocks have been revised upward compared to the beginning of the year, while 120 stocks have been revised downward.

The largest upward revision was for HD Hyundai Electric. The consensus fair price (average of securities firms' forecasts) for HD Hyundai Electric was 103,917 KRW at the start of the year, but it has now risen to 359,583 KRW. This represents an increase of 246.03%. The stock price of HD Hyundai Electric has risen more than 270% since the beginning of the year until the day before. Hyeyeong Jeon, a researcher at Daol Investment & Securities, said, "The shortage of ultra-high voltage transformers that began in the U.S. is now expanding to Europe and the Middle East, and the supplier-favored market is expected to continue for a long time. As a result, the valuations of global power equipment companies are continuously being revised upward, and HD Hyundai Electric, which maintains profitability above 15% and continues to increase orders, is in a position where multiple (enterprise value multiples) upgrades are possible." Daol Investment & Securities raised the fair price target for HD Hyundai Electric from 310,000 KRW to 400,000 KRW.

Other stocks with triple-digit percentage increases in fair price compared to the beginning of the year include Hanmi Semiconductor (185.33%), iFamilySC (167.17%), Samyang Foods (144.27%), LS Eco Energy (143.98%), LS ELECTRIC (139.13%), Sejin Heavy Industries (114.29%), and Doosan (108.75%).

Besides HD Hyundai Electric, the target prices for power equipment-related stocks such as LS Eco Energy and LS ELECTRIC have also risen significantly. Dongheon Lee, a researcher at Shinhan Investment Corp., analyzed, "Power equipment demand is expanding mainly in North America due to replacement demand, infrastructure and factory investments, renewables, AI, and data centers. Although there are differences in base effects among stocks, overall, they are showing growth in scale."

Leading stocks Samsung Electronics and SK Hynix, which are driving the stock market with expectations of performance improvement this year and benefits from high-bandwidth memory (HBM) due to AI expansion, also saw their target prices revised upward compared to the beginning of the year. Samsung Electronics' consensus fair price rose 19.41% from 91,917 KRW at the start of the year to 109,760 KRW. SK Hynix's target price increased 73.68% from 156,955 KRW to 272,600 KRW. Donghee Han, a researcher at SK Securities, said, "Considering the continued profit growth in the memory industry, the strong performance of HBM that will form the basis for good results in 2025, synergy from product price increases, and momentum in the second half, the price decline for both Samsung Electronics and SK Hynix is an opportunity. SK Hynix still has ample room for further gains, and Samsung Electronics, which is undergoing upward revisions in forecasts after strong second-quarter results, will be a comfortable choice." SK Securities raised the target prices for Samsung Electronics and SK Hynix by 14% and 21% to 120,000 KRW and 340,000 KRW, respectively.

On the other hand, stocks in secondary batteries, entertainment, and fashion sectors, which have shown weak stock performance this year due to poor business conditions and earnings, saw their target prices significantly lowered. JYP Entertainment's (JYP Ent.) consensus fair price dropped 42.76% from 151,000 KRW at the start of the year to 86,429 KRW, marking the largest decline. Other stocks with large declines include Cheonbo (-36%), F&F (-33.76%), Hyosung Chemical (-32.43%), and YG Entertainment (-32%). Kihoon Lee, a researcher at Hana Securities, analyzed, "The absence of BTS and Blackpink, who have the strongest fandoms, continued the decline in Chinese album sales and human risks, resulting in much worse-than-expected earnings and momentum. Except for SM, all three major entertainment companies experienced annual earnings declines and de-rating (decline in price-to-earnings ratio). The second-quarter results were also weak for various reasons, and momentum in July and August is limited due to the Olympics."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)