Whiskey Imports Down 24.9% YoY in First Half of This Year

Overall Consumption Decline Due to Recession Impact

Value-for-Money vs Premium Whiskey Market 'Polarization'

The upward trend of whiskey, which gained tremendous popularity last year by setting a record for the highest import volume ever, seems to be slowing down. For the first time since the COVID-19 pandemic, the import volume has turned to a decline, reflecting the overall decrease in alcohol consumption due to the economic recession, causing growing concerns in the liquor industry.

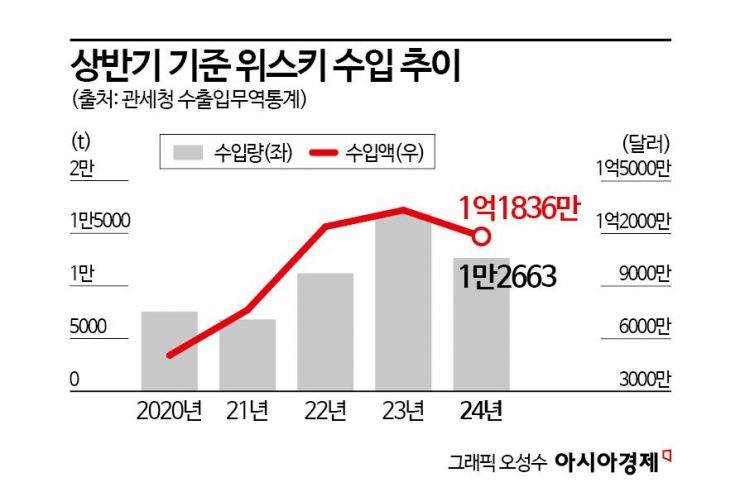

According to the Korea Customs Service export-import trade statistics on the 18th, whiskey imports from January to June this year totaled 12,663 tons, a 24.9% decrease compared to the same period last year (16,864 tons). During the same period, the import value also shrank by 11.2%, from $133.36 million (approximately 165 billion KRW) to $118.36 million (approximately 165 billion KRW).

Both the import volume and import value of whiskey declined compared to the previous year in the first half of the year, halting the upward trend that had continued for several years. The domestic whiskey market has been steadily shrinking due to reduced working hours following the introduction of the five-day workweek and the 52-hour workweek system, as well as the implementation of the Act on the Prohibition of Improper Solicitation and Graft in 2016, which reduced entertainment demand. However, the COVID-19 pandemic brought home drinking and solo drinking into the spotlight as new drinking cultures, leading to a rebound and growth since 2020.

Whiskey imports, which were 7,559 tons in the first half of 2020, increased by 123.1% over three years to 16,864 tons last year, and the import value also nearly tripled from $50.47 million (approximately 7 billion KRW) to $133.36 million (approximately 185 billion KRW). Last year, whiskey imports reached 30,586 tons, a 13.1% (3,548 tons) increase from the previous year (27,038 tons), marking the highest level since related statistics began in 2000.

The ongoing high inflation combined with the economic downturn has reduced consumers' purchasing power, which is believed to have affected the decline in whiskey demand. A liquor industry official said, "The absolute volume of alcohol consumption itself is decreasing recently. Even in busy districts, the streets become deserted after 10 p.m., and the amount of alcohol ordered per table is decreasing as people drink by the glass instead of by the bottle, so the industry's concerns are growing."

Additionally, due to the nature of the domestic market, which is sensitive to trends, the rapid changes in the liquor market trends have led some consumers to shift their interest to other types of alcoholic beverages, negatively impacting the liquor industry.

By country, Scotch whiskey, which holds an overwhelming market share, experienced the largest decline in imports. In the first half of this year, imports of whiskey from the UK, including Scotland, totaled 9,764 tons, down 30.5% from 14,045 tons in the same period last year. Import value during this period also decreased by 11.8% to $95.04 million. Imports and import value of American whiskey, which produces bourbon whiskey, also fell by 5.5% and 8.8%, respectively. On the other hand, imports of Japanese whiskey, represented by 'Yamazaki' and 'Hibiki,' increased by 44.7%, from 503 tons in the first half of last year to 728 tons this year, and imports of Taiwanese whiskey, which produces 'Kavalan,' also rose by 20.2%, clearly showing the ongoing trend toward premiumization and diversification.

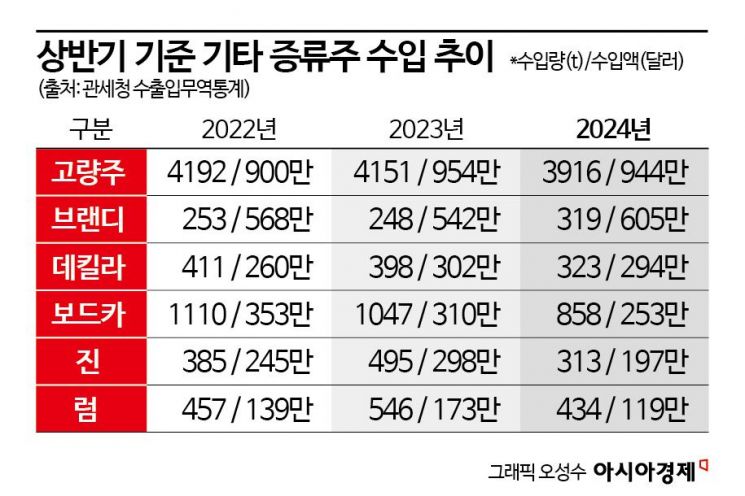

Other distilled spirits besides whiskey, such as vodka, gin, and rum, mostly showed slight decreases. However, imports of brandy, including relatively high-priced cognac, increased by 28.6%, from 248 tons to 319 tons, and import value rose by 11.6%, from $5.42 million to $6.05 million, confirming a recent trend of polarization in consumption between low-priced distilled spirits for highballs and premium high-priced distilled spirits.

The liquor industry expects the decline in consumption of most imported liquors, including whiskey, to continue for the time being. A liquor industry official said, "Usually, when sales of a particular type of liquor decrease, other types compensate, maintaining the overall market size, but recently, there is growing concern that the entire market size itself is shrinking due to the decline in consumption."

However, since summer is traditionally the peak season for the liquor industry and there is potential for an Olympic-related boost this year, some voices suggest the need to monitor the market situation in the second half of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.