Spread of Cost-Effective Consumption, Rising Preference for Indie Brands

Reevaluation of ODM Companies' Value 'In Focus'

Popularity of Unlisted Brands "Proving K-Beauty Sustainability"

Cosmetics stocks, which had been taking a breather amid concerns over a slowdown in export momentum, appear to be rebounding. Securities firms have diagnosed that despite some earnings concerns, the cosmetics industry remains strong. They particularly advised paying attention to the Original Design Manufacturing (ODM) sector that supports the production of small and medium-sized brands.

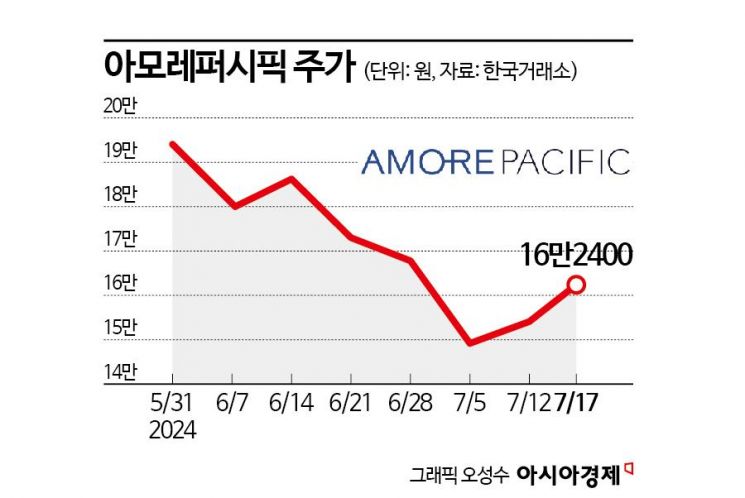

According to the Korea Exchange on the 18th, Amorepacific closed at 162,400 won on the 17th, up 8.41% from the previous trading day. Other cosmetics-related stocks also showed strong gains, including VT (14.4%), iFamilySC (6.8%), C&CI International (5.9%), Silicon2 (4.9%), Manyo Factory (4.0%), Able C&C (3.3%), Korea Kolmar (2.7%), LG Household & Health Care (2.5%), and Clio (2.3%).

In the securities industry, there is an analysis that although there was pressure for profit-taking due to a slowdown in export momentum in the cosmetics sector recently, this was a correction separate from the strong industry conditions. The upcoming Q2 earnings are expected to show some variance by company, but the growth trend is not expected to be disrupted. Jiwoo Oh, a researcher at LS Securities, said, "Recently, demand for cost-effective skincare and sun care products has been rapidly increasing in the U.S.," adding, "K-beauty products, which are affordable yet high quality, are being chosen." He further predicted, "Global ODM companies Cosmax and Korea Kolmar are expected to see double-digit growth in operating profit due to the growth of K-Indie brands and the peak season benefits of sunscreen products," and "Among large brand companies, Amorepacific’s operating profit is expected to increase more than tenfold, boosted by last year’s low base effect and the consolidation of COSRX."

In particular, the trend of cost-effective consumption in the U.S. is expected to continue fueling the boom in the ODM industry. Sojung Cho, a researcher at Kiwoom Securities, said, "Among various business types within the cosmetics sector, attention should be paid to ODM companies," adding, "With high inflation and high interest rates, cost-effective purchasing is trending in the U.S., and this consumer trend could lead to a re-rating of the cosmetics ODM industry." She continued, "ODM companies, which are fully responsible for the production of domestic small and medium-sized brands, inevitably benefit greatly during the boom of indie brands," and forecasted, "The export growth trend of small and medium-sized brands is expected to continue for the time being."

Along with ODM companies, the steady growth of domestic unlisted brands also supports the analysis that the cosmetics industry is thriving. Jiyoon Jung, a researcher at NH Investment & Securities, said, "The simultaneous improvement in profit margins of recently unlisted brand companies and ODM companies is the result of the dual structure of manufacturing and branding in the Korean cosmetics industry aligning with the industry boom," analyzing, "In particular, promising cosmetics companies COSRX and Gudai Global had operating profit margins last year approaching 33% and 49%, respectively, with significantly reduced fixed costs such as labor and depreciation." She added, "The sales growth of unlisted companies is comparable to that of listed companies, and every year, 'rising star' companies emerge," and noted, "The past three years’ performance of unlisted companies ranking high in Olive Young’s category rankings proves that the K-beauty trend is sustainable."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)