Chairman Shin Dong-guk "Reorganization into a Professional Management System"

Minority Shareholders Protest Prolonged Management Dispute

Stock Market "Expect Stock Price Recovery if Governance Issues Are Resolved"

The management rights dispute within Hanmi Group continues, increasing the stock price volatility of Hanmi Pharm, a core business company. The securities industry evaluates that the governance issues that have persisted throughout this year are exerting downward pressure on the stock price, but the solid performance and corporate value remain unchanged. They advised caution against the volatility that may occur before the management rights dispute is fully resolved.

Key Figure in Management Rights Mediation, Chairman Shin Dong-guk: "We Will Move to a Professional Management System"

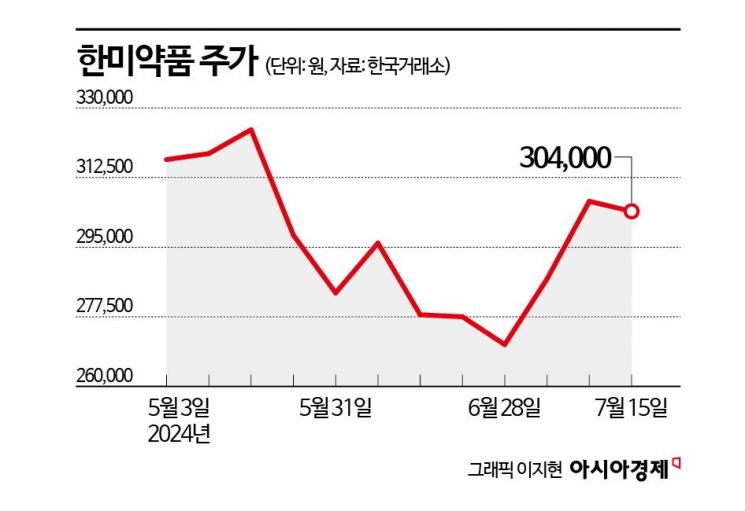

According to the Korea Exchange on the 16th, as of 9:10 a.m., Hanmi Pharm was trading at 301,000 KRW, down 0.99% from the previous trading day.

Hanmi Pharm's stock price has continuously declined since the shareholders' meeting last March, amid the management rights dispute between the Hanmi Group owner family mother and daughter (Chairman Song Young-sook and Vice Chairman Lim Ju-hyun) and the brothers (Inside Director Lim Jong-yoon of Hanmi Pharm and CEO Lim Jong-hoon of Hanmi Science). However, after Chairman Song stepped down from the front line of management and Shin Dong-guk, chairman of Hanyang Precision and the 'key man' in resolving the management rights dispute, declared that Hanmi Group would be reorganized into a professional management system, Hanmi Pharm's stock price surged more than 6% in one day on the 10th.

On the 3rd, Chairman Shin, a hometown junior of the late founder of Hanmi Group, Lim Sung-gi, and the largest individual shareholder of Hanmi Science, signed a stock purchase agreement and a joint voting rights exercise agreement to buy some shares from Chairman Song and Vice Chairman Lim, thus joining hands with the mother and daughter. Previously, Chairman Shin had sided with the brothers and played a decisive role in their victory at the last regular shareholders' meeting. However, it is reported that he made this decision out of disappointment over persistent rumors of share sales after the brothers' management.

After the disclosure of the joint voting rights exercise agreement, the Hanmi Group mother and daughter and Chairman Shin announced, "We will reform the existing owner-centered management system and reorganize it into a field-oriented professional management system." Also, in a statement announcing her resignation, Chairman Song said, "It is my firm belief and the way to uphold the late chairman's will that Hanmi's shares should not be sold to overseas funds and lose Hanmi's identity," adding, "The best solution that Chairman Shin and I have found is this decision."

Meanwhile, on the 10th, the director Lim's side released a press statement jointly with Chairman Shin, saying, "The discord within the family has been dramatically resolved. The two brothers are discussing a hybrid approach that combines responsible management, professional management, and righteous management to leap forward as a global company." However, Chairman Shin drew a line through a media outlet, saying, "It is true that we agreed to unite with the brothers," but clarified that this did not mean discussing the brothers' participation in management and that no detailed decisions had been made.

Frustrated Minority Shareholders... Securities Industry: "Stock Price Recovery Expected Once Management Rights Issue Is Resolved"

As the management rights dispute within Hanmi Group prolongs, minority shareholders are also taking action. According to the industry, about 1,200 minority shareholders who supported the brothers at the last shareholders' meeting are reportedly planning to send a certified letter requesting a meeting with the three founding siblings. They intend to discuss future plans regarding shareholder return policies and other minority shareholder-related measures, which have seen no progress so far, through a meeting with the owner family.

The securities industry analyzes that although uncertainties surrounding management rights remain in Hanmi Group, solid performance and research and development (R&D) momentum also coexist. Jang Min-hwan, a researcher at Hi Investment & Securities, said, "The ongoing management rights dispute has acted as downward pressure on the stock price," but added, "However, the fundamentals as a leading domestic developer of glucagon-like peptide-1 (GLP-1) receptor agonists with continuously growing operating performance have not changed." He continued, "With multiple R&D momentum ahead, a foundation for reorganization will be established," and "At a time when signs of resolving the management rights dispute are appearing, stock price recovery can be expected."

Kim Min-jung, a researcher at DS Investment & Securities, pointed out, "After the owner's management rights dispute, Hanmi Pharm's stock price underperformed even when the bio sector showed strong performance," noting, "During that time, Hanmi Pharm's corporate value actually increased." She analyzed, "The stock price decline due to governance issues is excessive," and added, "The core business remains solid with growth in high-profit products such as Rosuzet and Amozaltan, as well as improved operating profits of subsidiaries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)