Leading Company in Landfill, Public Wastewater Treatment, and Medical Waste Incineration Market Up for Sale

US, Hong Kong, and Singapore Mega Funds Rush In

High Possibility of Domestic Environmental Core Infrastructure Falling into Overseas Fund Hands

Competition among domestic and international private equity (PE) firms to acquire EcoBit, the largest waste disposal company in Korea, is intensifying. As the sale process is underway, with many global private equity firms included in the shortlist, voices are emerging that emphasize the need to protect Korea's waste infrastructure, which holds significant industrial, environmental, and social importance.

According to the investment banking (IB) industry on the 15th, TY Holdings and Kohlberg Kravis Roberts (KKR), who are promoting the sale of EcoBit, recently notified the four shortlisted qualified bidders of the schedule for the final bidding.

The shortlist includes four companies: the U.S.-based Carlyle Group, Hong Kong's Gaw Capital Partners, Singapore's Keppel Infrastructure Trust, and the Korean IMM Investment-IMM Private Equity (IMM PE) consortium. They plan to complete due diligence by early to mid-next month.

EcoBit, a Core K-Infrastructure in the Environmental Sector... What Kind of Business Is It?

EcoBit handles industrial and medical waste, water treatment, and soil remediation projects for major domestic companies, including large corporations. As climate change and environmental issues have come to the forefront, EcoBit's value as Korea's largest waste disposal company and a core industrial and social infrastructure is growing even more.

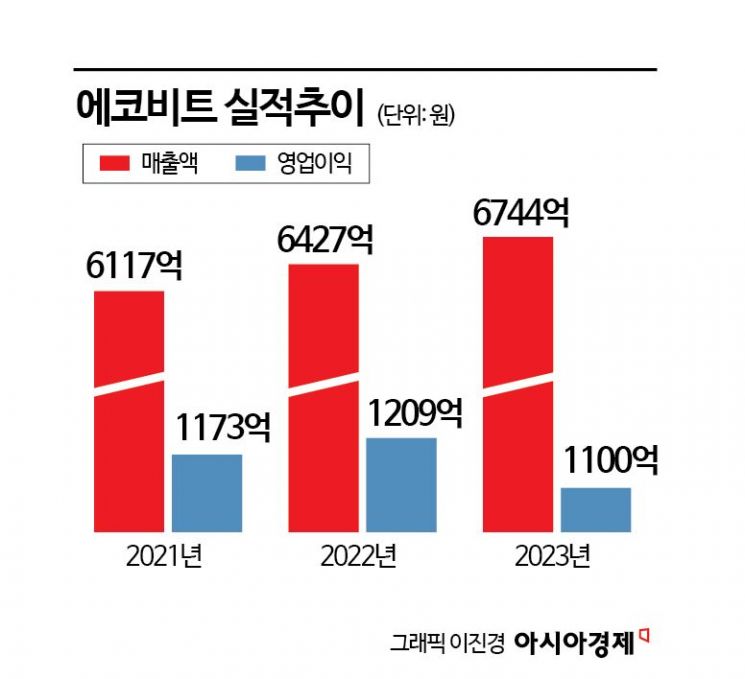

EcoBit's business is divided into four sectors: Green (landfill), Energy (incineration), Water (water treatment), and Future Business (waste battery recycling, soil remediation). It ranks first in the domestic landfill market, public water treatment market, and medical waste incineration market. Its sales have steadily increased each year, with 611.7 billion KRW in 2021, 642.7 billion KRW in 2022, and 674.4 billion KRW in 2023.

The Green business handles landfill disposal of general and designated waste, processing waste generated by about 2,000 clients, including large corporations. It owns eight of the largest landfill sites nationwide, including the Gyeongsang, Jeolla, and Chungcheong regions, with the largest capacity. The incineration business incinerates medical and industrial waste, processing waste into fuel form to produce solid fuel. This fuel is used to operate thermal energy power plants. EcoBit operates a total of 14 business sites domestically. It has vertically integrated by operating medical waste sterilization companies as well as collection and transportation companies.

The Water business operates and manages over 750 environmental basic facilities nationwide, including sewage and wastewater treatment plants. In the future business sector, it focuses on recycling projects that recover and reprocess metal resources accumulated in waste such as waste batteries and electronic scrap, as well as soil remediation projects that restore contaminated soil in areas such as military base relocations and public land. Its subsidiary, EcoBit Pretech, started the secondary battery recycling business in 2017 and holds the record for the largest domestic secondary battery processing volume.

Looking at the Acquisition Candidates... Three Foreign Firms and One Domestic Fund

The acquisition candidates have appointed advisory firms and are putting full effort into the acquisition battle. Carlyle Group has appointed Lazard, a global IB, and Keppel Infrastructure has appointed SC Securities to conduct due diligence. Gaw Capital has formed an advisory team with Samsung KPMG and AT Kearney, while the IMM Investment-IMM PE consortium has assembled advisors including BDA Partners, EY Hanyoung, and Bain & Company.

Gaw Capital, considered a strong acquisition candidate, is known to be backed by Chinese capital. Carlyle Group's deal is led by former Macquarie professionals who have strengths in infrastructure investment. Keppel Infrastructure, whose largest shareholder is Temasek, one of the world's largest sovereign wealth funds, is also a formidable candidate. The domestic capital IMM consortium is noted for its experience in acquiring and operating waste plastic recycling companies.

An IB industry official said, "Given the high future value of the environmental business sector, strong acquisition candidates have participated. Since this is not only a core domestic environmental infrastructure company but also a business that faces various challenges such as NIMBY (Not In My Backyard) phenomena and permits, it is important to find a suitable buyer not only in terms of price but also in terms of operation."

Meanwhile, EcoBit appeared as an asset for sale during the restructuring of the Taeyoung Group, including the workout of Taeyoung Construction. EcoBit is jointly owned by Taeyoung Group's holding company TY Holdings and KKR, each holding 50% of the shares. TY Holdings had borrowed 400 billion KRW from KKR using its shares as collateral.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)