Non-Alcoholic Fatty Liver Disease

'Metabolic Dysfunction-Associated Steatohepatitis (MASH)'

Madrigal's 'Resmetirom'

First FDA-Approved Treatment

Hanmi, Dong-A, Yuhan, DND, and others

Accelerate Development in Korea

Although the number of patients in major countries worldwide is expected to reach 100 million by 2030, the market for metabolic dysfunction-associated steatohepatitis (MASH) treatments, which previously had no therapies, is now opening in earnest. Following the first drug approved by the U.S. Food and Drug Administration (FDA), subsequent drugs are expected to be released one after another, prompting various domestic companies to accelerate their development efforts.

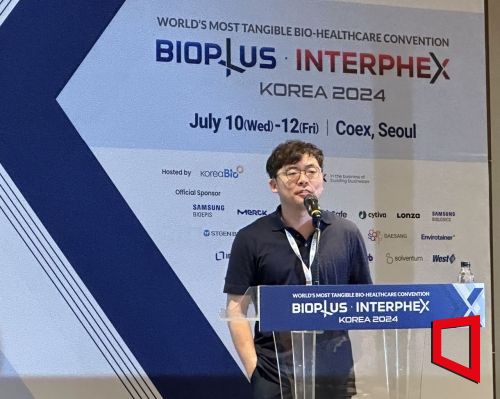

On the 11th, Hyemin Heo, a researcher at Kiwoom Securities, stated at the BioPlus Interphex (BIX) 2024 conference session held at COEX in Gangnam-gu, Seoul, under the theme "Innovation and Investment Opportunities in MASH," that "MASH was called the 'graveyard of development' from an investment perspective," adding, "It is changing starting this year, and will receive even more attention next year," forecasting the MASH treatment market accordingly.

MASH was previously known as non-alcoholic steatohepatitis (NASH). It is a disease where fatty liver develops despite the absence of alcohol consumption, which is the main cause of fatty liver. However, the name was criticized for obscuring the clear cause of the disease, leading to the recent renaming to MASH. At the same time, MASH has been called the "graveyard of big pharma" as leading global pharmaceutical companies have repeatedly failed to develop treatments.

The reason Heo evaluated this year as a "turning point" for the MASH treatment market is because the first MASH treatment was approved by the U.S. FDA in March. The drug, Rezidifra, developed by Madrigal Therapeutics, is the protagonist. Known by its generic name resmetirom, the drug has proven effective in improving liver fibrosis and fatty liver, which are major symptoms of MASH.

Regarding Rezidifra, Heo said, "The price is high, and its effect compared to placebo does not appear dramatic, so sales forecasts have been somewhat downgraded," but added, "It is expected to grow into a global blockbuster (annual sales exceeding $1 billion) by 2026-2027."

With the first treatment released, subsequent drugs are expected to be launched rapidly. Currently, big pharma companies such as Boehringer Ingelheim (Serbodutide) and Eli Lilly (Tirzepatide) are accelerating the development of glucagon-like peptide-1 (GLP-1)-based treatments. GlobalData, a data analysis and consulting firm, predicts that if new drug development progresses, the market size could grow to $27.2 billion (approximately 36 trillion KRW) by 2029.

Isulgi, CEO of DND Pharmatech, is giving a presentation at BIX2024 held at COEX in Gangnam-gu, Seoul on the morning of the 11th.

Isulgi, CEO of DND Pharmatech, is giving a presentation at BIX2024 held at COEX in Gangnam-gu, Seoul on the morning of the 11th. [Photo by Lee Chunhee]

Domestically, companies such as Hanmi Pharmaceutical, Dong-A ST, Yuhan Corporation, and D&D Pharmatech are challenging the development of MASH treatments. Heo said, "The Phase 2 clinical trial results of Hanmi Pharmaceutical's triple-action drug Epocifegtrutide are expected in March next year, and Dong-A ST's DA-1241 Phase 2 results are expected within this year," expressing anticipation that "many interesting data will be released next year."

Among them, Seulgi Lee, CEO of D&D Pharmatech, personally visited the site to introduce the company's development status. The core pipeline, DD01, is a dual agonist that acts on both GLP-1 and glucagon, and recently received FDA approval for a Phase 2 clinical trial plan. Glucagon, a hormone secreted by the pancreas, is known to have efficacy in improving liver diseases.

Regarding the reason for developing such a dual agonist, CEO Lee explained, "Since MASH patients often have obesity and diabetes, it would be ideal to have a drug that can reduce weight and normalize blood sugar levels if possible." Glucagon shows definite efficacy in the liver but does not cause weight loss and raises blood sugar levels, so it was combined with GLP-1 to compensate for these drawbacks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)