Samsung Group ETF Records Solid Returns Outperforming KOSPI This Month

Leading Stock Samsung Electronics Continues to Hit 52-Week Highs

Foreign Buying Focuses on Samsung Group Stocks

Strong Group Earnings and Value-Up Expectations Drive Momentum

As foreign investors concentrate their buying on Samsung Group stocks, Samsung Group ETFs are also showing strong performance. The flagship stock, Samsung Electronics, posted an earnings surprise in the second quarter of this year, and future earnings prospects are positive. As a result, the love call from foreign investors toward Samsung Electronics, which has continued since the beginning of the year, is expected to persist. Other group stocks are also experiencing improved earnings and rising valuation expectations.

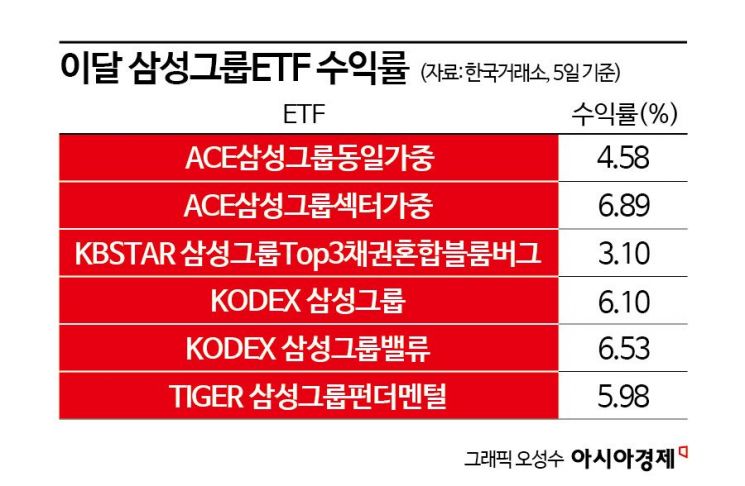

According to the Korea Exchange on the 9th, Samsung Group-related ETFs have recorded returns exceeding the KOSPI as of the 5th of this month. KODEX Samsung Group Value rose 6.53%, ACE Samsung Group Sector Weighted 6.89%, KODEX Samsung Group 6.10%, and TIGER Samsung Group Fundamental 5.98%. During the same period, the KOSPI increased by 2.3%.

This strong performance is attributed to the fact that Samsung Electronics, the leading stock, has been continuously hitting new 52-week highs recently, along with sustained inflows of foreign buying.

Looking at the top foreign net purchase stocks this month, the top four were all Samsung Group stocks. Foreign investors have net purchased over 2 trillion KRW of Samsung Electronics this month, making it the most bought stock, followed by Samsung Electronics Preferred, Samsung Electro-Mechanics, and Samsung Biologics. Additionally, Samsung SDS and Samsung Heavy Industries also ranked high in net purchases. Foreign investors have bought Samsung SDS for nine consecutive trading days and have net purchased Samsung Electronics Preferred and Samsung Biologics for six consecutive trading days each, showing continued buying momentum in Samsung Group stocks.

Given the favorable outlook for Samsung Group stocks, the positive trend in related ETFs is expected to continue.

With Samsung Electronics achieving an earnings surprise in the second quarter, expectations for Samsung Electronics have risen. Securities firms have consecutively raised their target prices for Samsung Electronics following the release of its second-quarter earnings. Kiwoom Securities raised the target price from 110,000 KRW to 120,000 KRW. Hi Investment & Securities adjusted it upward from 91,000 KRW to 101,000 KRW, and Hana Securities from 106,000 KRW to 117,000 KRW. Hyundai Motor Securities, DB Financial Investment, and Yuanta Securities each raised their target prices from 100,000 KRW to 110,000 KRW. Noh Geun-chang, head of the research center at Hyundai Motor Securities, said, "We have raised our operating profit forecasts for this year and next year to 46.2 trillion KRW and 58.5 trillion KRW, respectively, up 12.1% and 15.4%. The company's third-quarter operating profit is expected to reach 14.5 trillion KRW, a level seen during boom periods, indicating further improvement in third-quarter earnings."

Expectations for Samsung Electro-Mechanics are growing in the second half of the year. Park Jun-seo, a researcher at Mirae Asset Securities, said, "We raised the target price from 190,000 KRW to 200,000 KRW, reflecting the upward revision of earnings due to strong sales of multilayer ceramic capacitors (MLCC) in the second half and recovery in the package substrate business with the advent of AI PCs." He added, "Although smartphones have entered a mature industry, structural growth of MLCC is expected as the market share of devices equipped with AI increases." Park Young-woo, a researcher at SK Securities, also said about Samsung Electro-Mechanics, "Attention should be paid to the second half beyond the second quarter," adding, "Improved earnings in the second half are expected based on the seasonal pattern of a weak first half and strong second half, as well as the AI effect on devices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)