Metropolitan Area Apartment Sales Up 0.02% and Jeonse Up 0.01%

Seoul Expected to See Transaction Volume Increase for 4 Consecutive Months

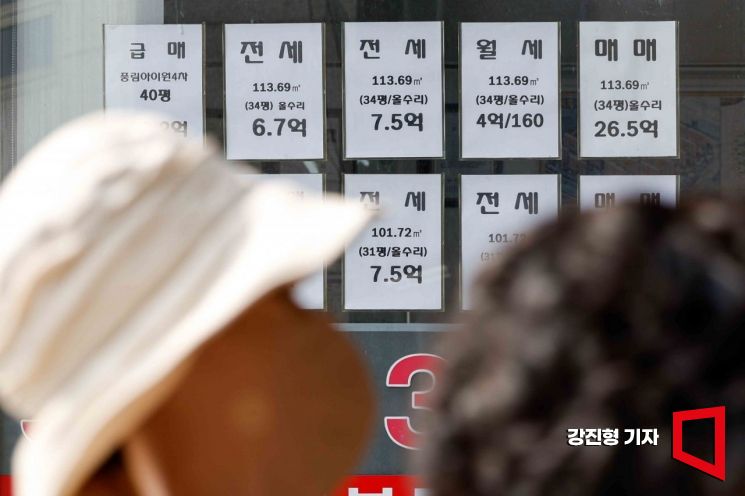

More than half of the jeonse contracts for the 'standard apartment size' in Seoul this year have jeonse prices exceeding 600 million KRW. On the 5th, a real estate office in Seoul displayed jeonse and sale price lists. Photo by Kang Jin-hyung aymsdream@

More than half of the jeonse contracts for the 'standard apartment size' in Seoul this year have jeonse prices exceeding 600 million KRW. On the 5th, a real estate office in Seoul displayed jeonse and sale price lists. Photo by Kang Jin-hyung aymsdream@

The transaction price change rate of reconstruction apartments in Seoul rose by 0.04%. According to the 'July 1st Week Metropolitan Area Apartment Market Status' announced by Real Estate R114 on the 6th, this is the largest increase in about two years since the week of June 24, 2022 (0.05%).

Reconstruction apartments generally have a higher proportion of demand for investment purposes due to expectations of future value appreciation rather than for actual residence. The recent recovery in transaction prices and increase in transaction volume can be interpreted as improved buying sentiment being reflected in the reconstruction market prices.

Since the price movement of reconstruction apartments serves as a barometer for future housing price trends, it may also influence the currently stable general apartment market prices and potentially expand the rate of increase.

The apartment transaction prices in Seoul continued to rise for four consecutive weeks, increasing by 0.02%. Reconstruction apartments rose by 0.04%, and general apartments also increased by 0.02%, expanding the rise compared to the previous week (0.01%). New towns showed no significant price changes, while Gyeonggi and Incheon were adjusted upward by 0.01%.

In Seoul, the number of areas with price increases more than doubled compared to the previous week (from 6 to 14), with larger increases mainly in semi-prime areas. Among the 25 districts, there were no areas with price declines. By individual areas, prices rose in the order of Gwangjin (0.11%), Gangseo (0.11%), Mapo (0.07%), Seocho (0.06%), Seongdong (0.04%), Seodaemun (0.04%), and Dongjak (0.04%). In new towns, Pyeongchon rose by 0.01%, while other areas remained stable (0.00%).

In Gyeonggi and Incheon, prices increased mainly in the southern Gyeonggi region, including Hwaseong (0.04%), Osan (0.02%), Suwon (0.02%), Gunpo (0.02%), Ansan (0.01%), and Incheon (0.01%). On the other hand, Guri declined by 0.01% as areas such as Sutaek-dong Yeongpung Madreville and Topyeong Jugong 5 Complex fell by 1 to 2.5 million KRW.

The jeonse (long-term lease) market saw price increases driven by scarcity of jeonse listings mainly in school district areas and regions close to workplaces. Seoul rose by 0.01%, new towns remained stable (0.00%), and Gyeonggi and Incheon increased by 0.01%.

In Seoul, the largest increases were centered in the northeast and southwest areas. By individual areas, prices rose in Dongjak (0.06%), Gwangjin (0.06%), Nowon (0.04%), Gwanak (0.04%), Dongdaemun (0.03%), Gangseo (0.02%), Yangcheon (0.01%), and Gangnam (0.01%). Mapo was the only area to decline by 0.02%.

New towns recorded stable prices (0.00%) across all areas. Gyeonggi and Incheon saw upward adjustments in Icheon (0.05%), Suwon (0.04%), Hwaseong (0.01%), Gunpo (0.01%), Gwangmyeong (0.01%), and Incheon (0.01%).

A Real Estate R114 official stated, "June apartment transactions in Seoul exceeded 4,100 cases (as of July 4, excluding contract cancellations), and it is expected to comfortably surpass the May transaction volume (4,867 cases)." He added, "Although there is just over a month left in the reporting period, Gangdong, Seodaemun, Seongdong, Gwanak, and Dobong districts have already exceeded May's transaction volume."

He continued, "In Gangdong-gu, transactions of newly built apartments in Godeok and Sangil-dong were active, and in Seodaemun and Seongdong-gu, transactions of quasi-new apartments under 10 years old centered around Namgajwa-dong and Ha Wangsimni-dong were high. In Gwanak and Dobong-gu, the proportion of transactions in complexes priced below 900 million KRW was significant." He explained, "The recovery in transaction prices, rise in jeonse and monthly rent, and effects of policy loans combined to accelerate buying timing for demand aiming to upgrade to prime areas or waiting to purchase their own home before prices rise further."

He also noted, "Supported by this trend, there is a spreading atmosphere of upward movement in asking prices centered on preferred complexes recently." He added, "It is necessary to observe whether chasing purchases accepting asking prices will follow with the arrival of the seasonal off-season such as the rainy season and upcoming vacation period."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)