Risk Management and Profitability Drive Focus on Large Corporate Lending

From 136 Trillion Won in December Last Year to 158 Trillion Won in June This Year... 22 Trillion Won Increase

SME Loans Up 3.4%, Individual Business Loans Up 1.6% This Year

Financial Authorities Closely Monitor Corporate Loan Growth and Rising Delinquency Rates

Some Major Banks Plan to Strengthen Corporate Loan Risk Management in Second Half

The concentration of corporate loans to large enterprises among major commercial banks is becoming more pronounced. Although the cumulative balance is relatively smaller compared to loans to small and medium-sized enterprises (SMEs) and individual business owners, the growth rate has sharply exceeded 16% since the beginning of this year. This is the result of major commercial banks continuously focusing their efforts on large enterprise lending operations as a risk management measure amid significant uncertainties such as rising corporate delinquency rates.

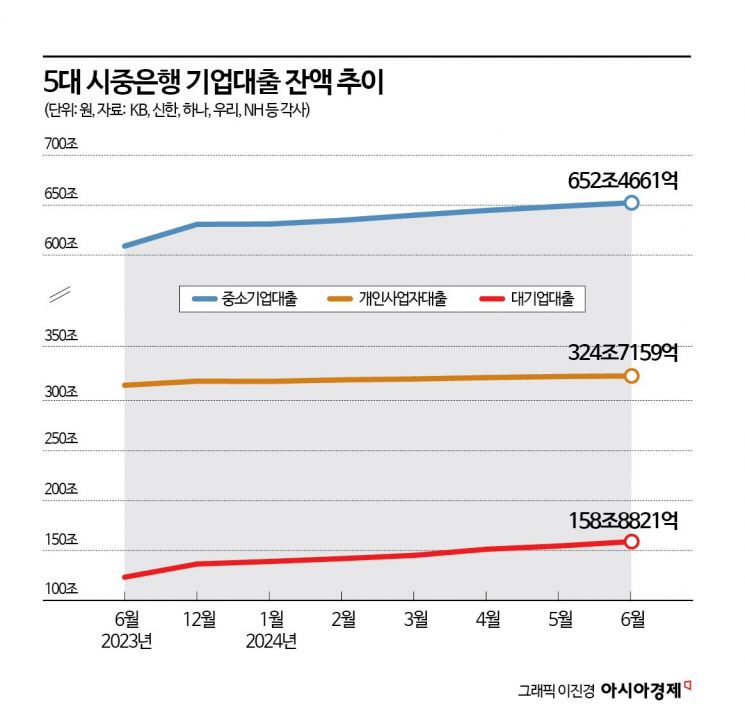

According to the financial sector on the 4th, the outstanding balance of large enterprise loans at the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?has surged by more than 16% since the start of this year. The outstanding balance of large enterprise loans, which was around 136 trillion won in December last year, increased by over 22 trillion won to 158 trillion won as of June this year.

The upward trend in large enterprise loan balances is even more pronounced when compared to the trend in SME loan balances. The outstanding balance of SME loans at the five major commercial banks increased by only 3.4%, from 630 trillion won in December last year to 652 trillion won. In terms of absolute increase, the growth was about 21 trillion won, which is less than that of large enterprise loans.

Among the commercial banks, some have aggressively expanded large enterprise loans this year, with growth rates reaching 20% to 30%. A senior official from a commercial bank explained, "Given the significant economic uncertainties, especially policy uncertainties, all major commercial banks are in the same situation, using this as a means to maintain soundness while generating stable profits."

In fact, the outstanding balance of individual business owner loans, which carry higher risk, increased by only 1.6%, about half the growth rate of SME loans. The balance of individual business owner loans rose from 319 trillion won in December last year to 324 trillion won in June, an increase of approximately 5 trillion won.

While the five major commercial banks are increasing the proportion of large enterprise loans and continuing a business strategy focused on soundness, the overall rising delinquency rates remain a burden. Financial authorities are also closely monitoring the increasing trend in corporate loans alongside household loans, which have expanded due to premature expectations of interest rate cuts and localized rebounds in housing prices.

According to the Bank of Korea, the delinquency rate for corporate loans among large enterprises fell from 0.31% in Q1 2021 to 0.18% in Q1 2022 and 0.09% in Q1 2023, but rose to 0.11% in Q1 this year. The delinquency rate for SMEs also dropped from 0.89% in Q1 2021 to 0.81% in Q1 2022 but surged to 1.73% in Q1 2023 and further increased to 2.72% in Q1 this year.

In response, some commercial banks plan to strengthen corporate loan management from the second half of the year. Hana Bank recently shared guidelines focused on strengthening corporate loan risk management. Although it had aggressively increased corporate loans by leveraging interest rate competitiveness to avoid household loan regulations, concerns over negative interest margins and delinquency rates have begun to emerge. A Hana Bank official stated, "We have started to reduce some corporate loans and plan to further strengthen corporate loan management in the second half of the year."

The KDB Future Strategy Institute assessed, "With the Fed's base rate cuts being delayed, and high exchange rates and inflation increasing corporate cost burdens, concerns over the deterioration of corporate debt repayment capacity are rising," adding, "Monitoring the soundness of corporate loans is necessary." The Bank of Korea also emphasized in its recent Financial Stability Report that "corporate loans expanded during the interest rate hike period could negatively impact banks' profitability," and stressed the need to "thoroughly manage risks by industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)