New Growth Strategy 'Beyond NO.1, Value-Up Project'

High-End Hotel Completion in Jangchung-dong by 2028

Foreign Casino, Infrastructure Reorganization Targeting Super-Gap

Paradise, which moved back to the Korea Composite Stock Price Index (KOSPI) after more than 20 years, is expected to accelerate the enhancement of its corporate value by leveraging the improvement in its core foreigner casino business and adding Korea’s representative luxury hotels.

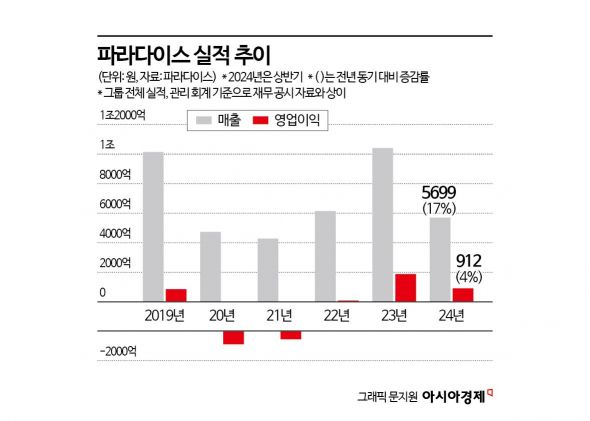

According to Paradise and the securities industry on the 2nd, Paradise Group’s consolidated sales for the first half of this year are expected to increase by 17% year-on-year to 569.9 billion KRW, and operating profit is projected to rise by 4% to 91.2 billion KRW. If this trend continues through the second half, it is highly likely to surpass last year’s record-high performance since its founding in 1972 (sales of 994.2 billion KRW and operating profit of 145.8 billion KRW).

Choi Jong-hwan, CEO of Paradise, is presenting the group's new growth strategy, "Beyond NO.1, Paradise Value-Up Project," at the 'Media & IR Day' held on the 2nd at Paradise City in Yeongjongdo, Incheon.

Choi Jong-hwan, CEO of Paradise, is presenting the group's new growth strategy, "Beyond NO.1, Paradise Value-Up Project," at the 'Media & IR Day' held on the 2nd at Paradise City in Yeongjongdo, Incheon. [Photo by Paradise]

Recovering Cumulative Losses from COVID-19... Performance Rebound

Paradise faced a major setback as its casino operations were shut down 18 times due to COVID-19, resulting in a cumulative operating loss of 136.8 billion KRW from 2020 to 2022. However, last year, the casino division successfully turned around as the influx of Japanese VIP and mass (general customers) quickly recovered. The company’s separately calculated operating profit for last year was 188.1 billion KRW, covering the losses of the previous three years and generating a profit of 51.3 billion KRW. During this period, the operating profit margin rose to 18%, up 10 percentage points from 8% in 2017 before the COVID-19 outbreak.

Under the leadership of financial expert CEO Choi Jong-hwan, the company carried out cost-efficiency measures and implemented a marketing strategy targeting the Japanese market early on, considering the endemic (periodic outbreak of infectious diseases), which the company believes contributed to these results. At the 'Media & IR Day' held at Paradise City in Yeongjongdo, Incheon, CEO Choi explained, “From the second half of 2022, we aggressively promoted company advertisements in Japan and established a branch in Tokyo to strengthen marketing. The so-called ‘revenge consumption’ suppressed by COVID-19 occurred in the Japanese casino market, leading to a sharp recovery in business conditions.”

He added, “For the previous three years, we changed the structure so that entertainment-related expenses required CEO approval before execution. We achieved a turnaround by reducing costs in various ways while increasing sales.”

Paradise moved to the KOSPI on the 24th of last month to induce a corporate value re-evaluation by building a sector similar to competitors operating foreigner casinos and to maximize shareholder value. This marks over 20 years since entering the KOSDAQ market in November 2002. Currently, the four foreigner casinos operated by Paradise at Seoul Walkerhill Hotel, Paradise City in Yeongjongdo, Jeju, and Busan account for about 80% of the group’s total sales. The company plans to focus on forming a unified system among these operations and improving infrastructure to increase corporate value.

Specifically, the company plans to reorganize the facilities and human resources infrastructure of the Busan and Jeju operations, which have been considered less competitive compared to other sites. Next month, a hub lounge concentrating VIP services and competitiveness will be newly established at the international arrivals hall of Seoul Gimpo Airport, and marketing targeting foreign tourists visiting Korea will be strengthened.

To strengthen the Chinese market, which has been slow to recover after COVID-19, Paradise Casino Walkerhill will create a VIP-only gaming area optimized for high-roller games, covering 388.31㎡ (approximately 117 pyeong), scheduled to open in September. Paradise expects this to increase company sales by about 22 billion KRW in 2025 and 32 billion KRW in 2026. Paradise Casino has already introduced wireless identification system (RFID) technology and AI-based interpretation services.

Domestic Landmark, Pioneering High-End Hotels

Paradise aims to leap to the top tier not only in the casino business but also in the hotel sector. As a core task of the group’s new growth strategy, the 'Beyond NO.1, Paradise Value-Up Project,' it plans to build a flagship hotel in Jangchung-dong, Jung-gu, Seoul. Construction is expected to start as early as the end of this year. The hotel will be built on a site of 13,950㎡ (approximately 4,220 pyeong), with 5 basement floors and 18 above-ground floors, and about 200 rooms. The goal is to complete it by 2028, with construction costs estimated between 500 billion and 550 billion KRW. It aims to be a luxury hotel representing Korea, targeting foreign VIP customers.

CEO Choi emphasized, “Based on our successful completion and operation of Paradise City, the largest integrated resort in Northeast Asia, our goal is to pioneer the premium hotel market symbolizing Korea and its capital, Seoul.” The company had already secured the site by spending about 22.9 billion KRW by last year and is currently reviewing ways to raise additional funds. Industry insiders believe Paradise may utilize its secured cash assets.

Paradise Group's flagship hotel planned to be built in Jangchung-dong, Jung-gu, Seoul, with completion targeted for 2028, rendering image [Photo by Paradise]

Paradise Group's flagship hotel planned to be built in Jangchung-dong, Jung-gu, Seoul, with completion targeted for 2028, rendering image [Photo by Paradise]

Paradise’s operating cash flow, which reflects income and expenses from business activities, steadily increased from -35.1 billion KRW in 2021 to 63.8 billion KRW in 2022 and 287.6 billion KRW last year. Meanwhile, the company reduced cash outflows from investing and financing activities to secure liquidity. The company’s year-end cash and cash equivalents grew from 108.7 billion KRW in 2021 to 688.9 billion KRW last year.

CEO Choi stated, “The high-end hotel in Jangchung-dong is a project Paradise is investing in alone, but the company will not finance all the funds by itself. We are continuously communicating with market stakeholders about how to utilize the cash we hold and considering several options.”

Meanwhile, Paradise Segasami, the operator of Paradise City, successfully reduced its borrowings from 725 billion KRW to 500 billion KRW last year through refinancing in cooperation with its joint venture partner Segasami Holdings. Additionally, it secured an extra 30 billion KRW in working capital as a risk response measure. Korea Ratings upgraded the company’s credit rating from 'A-' to 'A.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)