Naver Webtoon Nears Nasdaq Listing

Share Dilution and Double Counting of Corporate Value Due to IPO

Must Overcome 'Domestic Market Limit' and Prove AI Monetization and Productivity

As NAVER's sluggish performance continues, attention is focused on whether NAVER Webtoon’s U.S. listing could have a positive impact on a stock price rebound. In the securities industry, there are opinions that NAVER Webtoon’s initial public offering (IPO) could have a short-term negative effect on NAVER’s stock price. However, it is analyzed that if NAVER expands the realm of K-culture and demonstrates its artificial intelligence (AI) technological capabilities through NAVER Webtoon’s U.S. listing, the corporate value could be re-evaluated.

NAVER Webtoon IPO May Have Short-Term Negative Impact

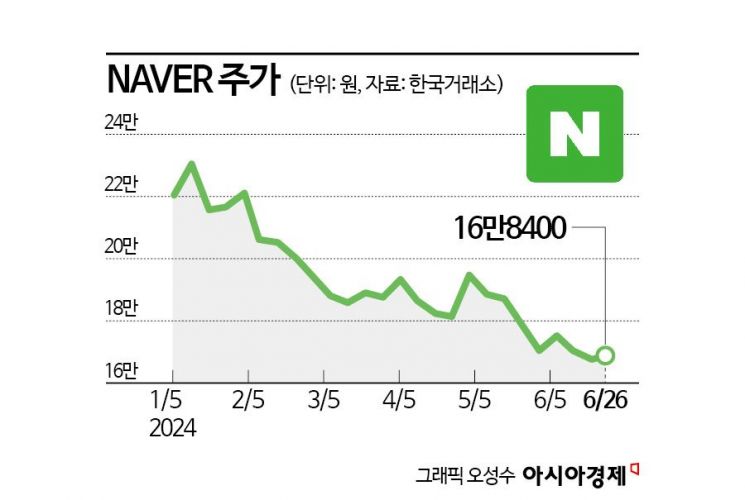

According to the Korea Exchange on the 27th, NAVER closed at 168,400 KRW on the 26th, down 28.5% from the peak in January. This contrasts with the KOSPI index, which rose 10.47% during the same period. NAVER appears to be continuously sidelined by the market, as it does not belong to any of the leading sectors this year, such as AI-related stocks or export consumer goods.

Amid this NAVER stock price slump, investors are paying close attention to the impact of NAVER Webtoon’s IPO on NAVER’s corporate value. According to the financial investment industry, Webtoon Entertainment, NAVER Webtoon’s North American subsidiary, will be listed on the U.S. Nasdaq market on the 27th (local time). Through this listing, NAVER Webtoon plans to further strengthen its position in the global content market and create new growth engines by expanding its intellectual property (IP).

The securities industry analyzes that NAVER Webtoon’s IPO could have a short-term negative impact on NAVER’s stock price. Aram Kim, a researcher at Shinhan Investment Corp., said, “We previously valued NAVER Webtoon’s equity at 4.6 trillion KRW, but due to share dilution and double counting (overlapping valuation of corporate value) discounts from this IPO, we present a valuation of 1.96 trillion KRW.” He added, “The negative impact on NAVER’s stock price could be prolonged if the webtoon market experiences a long period of low growth or if the competitive environment worsens due to new entrants.”

Must Prove AI Technological Capabilities... “Expectations Still Remain”

Experts analyze that if NAVER proves AI monetization after NAVER Webtoon’s listing, its technological capabilities could be re-evaluated. Hyojin Lee, a researcher at Meritz Securities, said, “Due to the labor-intensive nature of the webtoon industry, AI’s impact on productivity improvement is significant. Recently, NAVER has started expanding recruitment for developing an AI chatbot for webtoons based on large language models (LLM).” She added, “If NAVER succeeds in replacing the roles of intermediary companies responsible for proofreading and storyline checking with AI technology, cost reduction will be possible.” She continued, “Expectations for AI territorial expansion based on HyperCLOVA X’s Japanese language learning have effectively been dashed due to the recent Japanese government’s demand for share divestment and are being undervalued due to the ‘domestic market limit.’ However, if NAVER Webtoon’s listing leads to recognition of technological capabilities such as improving authors’ productivity through AI, a re-evaluation of corporate value could be possible.”

Meanwhile, apart from NAVER Webtoon’s new listing, the performance of existing business sectors such as advertising and shopping is expected to remain solid. Changyoung Lee, a researcher at Yuanta Securities, said, “The dwell time on the home feed of NAVER’s initial screen has increased, and advertising revenue is recovering due to the recovery of the advertising market.” He added, “If the U.S. government imposes tariffs on Chinese commerce companies, NAVER Shopping’s advertising revenue could increase due to the balloon effect.” He further noted, “The impact of revenue erosion due to increased direct purchases from China is still minimal.” He also added, “Expectations for increased profitability from AI technology utilization, such as joint development of AI semiconductor chips with Samsung, still remain.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.