SOS Lab and Hanjung NS See Large Red Candles on Listing Day

Shift Up Results Affect Major Listings in the Second Half of the Year

The closing prices on the listing day of companies recently listed on the KOSDAQ market fell sharply compared to their opening prices. Although trading began with a high increase compared to the public offering price, a common pattern emerged where the gains were given back throughout the trading session. As investors' expectations for IPO stocks gradually lower, the enthusiasm in the initial public offering (IPO) market is expected to cool down compared to the beginning of the year. Large-scale IPO stocks preparing for listing are increasingly likely to fail to receive their desired public offering prices in demand forecasting.

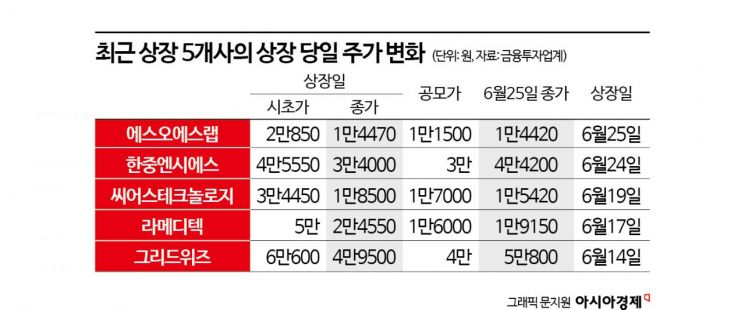

According to the financial investment industry on the 26th, the five companies recently listed on the KOSDAQ market recorded an average return of 58.1% compared to the public offering price on their first day of listing. The five new stocks are SOS Lab, Hanjoong NS, Seers Technology, LaMeditech, and Gridwiz. The average return of the opening price compared to the public offering price was recorded at 100%.

All five companies had closing prices on the listing day that were lower than their opening prices. While investors in the IPO stocks made profits, it is estimated that a significant number of investors who tried to make short-term gains by exploiting the high volatility on the listing day suffered losses.

A financial investment industry official explained, "Newly listed companies consecutively showed long bearish candlesticks with closing prices lower than opening prices," adding, "If the return on the opening price compared to the public offering price continues to decline, it will also affect IPO subscriptions."

According to Eugene Investment & Securities, the average return of the opening price compared to the public offering price for companies listed from January to May this year was 131.0%. This is 31 percentage points higher than the average return of the opening price compared to the public offering price of the recent five companies.

Regardless of the stock price trend on the first day of listing, the enthusiasm for IPO subscriptions remains strong. The space launch startup Innospace conducted a public offering subscription for general investors over two days starting from the 20th, attracting deposits amounting to 8.2836 trillion KRW. The advanced metal manufacturer HVM, which closed its subscription a day earlier, also received deposits exceeding 5 trillion KRW. Even though the expected returns have decreased compared to the past, IPO investments are still recognized as investment destinations with high returns relative to the risk of loss.

However, from the perspective of companies pushing for large-scale IPOs expected to exceed 1 trillion KRW based on the public offering price, they cannot help but pay attention to the recent trends of new stocks. If the public offering size reaches several hundred billion KRW, even a 10% decrease in the public offering price due to demand forecasting results can reduce the raised amount by hundreds of billions of KRW.

The game development company Shift Up is conducting demand forecasting to determine the public offering price. The desired price range per share is 47,000 to 60,000 KRW, with a public offering size of 340 billion to 435 billion KRW. Depending on the demand forecasting results, the raised amount may differ by about 100 billion KRW.

K-Bank and LG CNS are also large-scale IPOs attracting attention in the second half of this year. Depending on the demand forecasting results of Shift Up and the stock price trend after listing, the timing of the appearance of large-scale IPO stocks may be accelerated or delayed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)