Recruiting about 200 people on a first-come, first-served basis, early closure

Dozens raised hands saying "Ask questions"... Hot enthusiasm

"High salaries in growth industries, hope many will challenge themselves"

"Recently, following the listing of Bitcoin spot Exchange-Traded Funds (ETFs), Ethereum is also preparing for spot ETF trading. What are your thoughts on the virtual asset market?"

The 6th Private Equity Fund Concert. From the left, Changhwan Lee, CEO of Align Partners Asset Management; Jonghyuk Choi, CEO of C Square Asset Management; Taehong Kim, CEO of Growth Hill Asset Management.

The 6th Private Equity Fund Concert. From the left, Changhwan Lee, CEO of Align Partners Asset Management; Jonghyuk Choi, CEO of C Square Asset Management; Taehong Kim, CEO of Growth Hill Asset Management.

On the 25th, at Bulls Hall in the Financial Investment Center in Yeouido, Seoul, a participant attending the '6th Private Equity Fund Concert' hosted by the Korea Financial Investment Association posed this question to private equity fund representatives. Kim Taehong, CEO of Growth Hill Asset Management, said, "I definitely believe that virtual assets have value," adding, "the biggest value seems to be that digital assets must be proof of stake." Proof of Stake (PoS) is a consensus algorithm for blockchain networks based on randomly selected validators. It can provide a way to prove ownership of digital assets. Ethereum is a representative virtual asset using the proof-of-stake method. CEO Kim said, "Because it clearly has a future, it is suitable as an investment asset."

Other private equity fund representatives attending the concert also agreed that interest in virtual assets is increasing. Lee Changhwan, CEO of Align Partners Asset Management, said, "Many hedge funds include them as part of their portfolios," and Choi Jonghyuk, CEO of C Square Asset Management, said, "Since more people recognize them as assets, it is necessary to take an interest and study them." In fact, overseas, capital inflows into virtual assets have been active following ETF approvals. Recently, statistics showed that about half of the top 25 hedge funds in the United States hold Bitcoin ETFs. In addition, Q&A sessions were held on topics such as "Are dollar assets more advantageous than Korean won?" and "How can one get a job at a hedge fund?" A remarkable scene unfolded where dozens of people raised their hands simultaneously to get one of the few opportunities to ask questions.

The concert was an event organized by the Korea Financial Investment Association to help university and graduate students understand the private equity fund market and the industry as a whole, and to provide career exploration opportunities. Starting in 2017, this was the 6th edition. It was a session aimed at helping people understand general private equity funds, often called "Korean-style hedge funds." According to the association, about 200 participants were recruited on a first-come, first-served basis, and seats were so popular they sold out instantly. Among the applicants, there were quite a few from regional universities such as Chonnam National University and Chungnam National University. Because it was a rare opportunity to meet private equity fund representatives, some traveled from distant provinces to attend. Meanwhile, some participants (45 people) were given the chance to visit the offices of the private equity fund representatives who gave lectures.

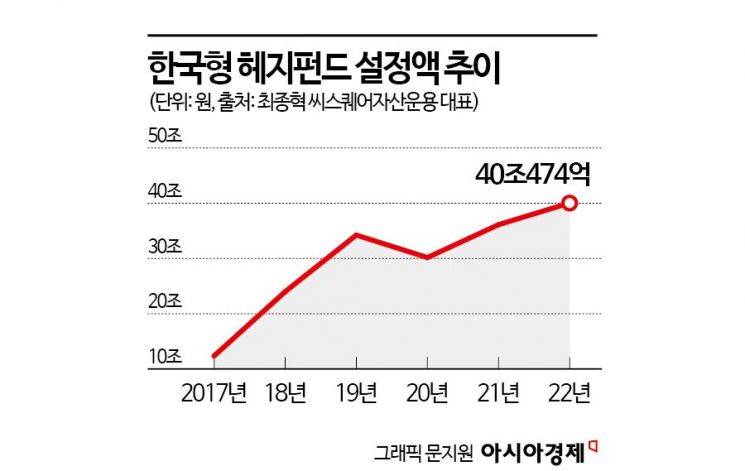

The private equity fund representatives unanimously said, "Private equity fund managers have very high peak annual incomes," and "Korean-style hedge funds are a promising industry." The assets under management of Korean-style hedge funds increased more than threefold in five years, from 12.3699 trillion won in 2017 to 40.0474 trillion won in 2022. Choi Jonghyuk, who gave a lecture on "The Importance of the Hedge Fund Industry in the Era of 100-Year Lifespans," said, "If you ask what growth industries exist in Korea, not many things might come to mind," adding, "The financial investment industry is an important growth industry in the era of 100-year lifespans, and I hope you enter this field with passionate interest." CEO Kim Taehong said, "I understand that doctors in Gangnam earn about 300 to 400 million won, but mid-level or higher fund managers can easily earn that much," adding, "It is one of the few professions where the salary ceiling is open upwards, so it is a career worth challenging."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)