You Can Get a Loan Without Children

Support Interest Rate Raised Up to 4.5%

Bank Additional Interest Rate Reduced by 0.15%p

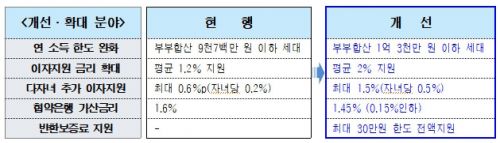

Starting from the 30th of next month, newlywed couples in Seoul with an annual income of 130 million KRW or less can use the city’s jeonse loan even if they do not have children. The support interest rates by income bracket and additional support rates for multi-child households will also be increased.

Seoul City announced on the 25th that it will improve the 'Newlywed Couple Lease Deposit Interest Support' program to expand benefits. This program supports interest payments by the city when newlywed couples without homes residing in Seoul take out lease deposit loans from Kookmin, Shinhan, or Hana Bank, which have agreements with the city.

Considering the overall upward trend in income, the city raised the combined annual income limit for couples from 97 million KRW to 130 million KRW or less. Unlike the government’s newborn special loan, this program can be used even without children.

The support interest rates according to income will also be expanded. Newlywed couples with an average income bracket in Seoul (80.6 million KRW as of 2022) will receive nearly double the current interest support rate of 0.9~1.2%, benefiting from a 2% interest support rate. Newlywed couples with children will see an increase from the existing maximum of 0.6% to up to 1.5%. Applying this standard, they can receive up to 4.5% interest support.

Through cooperation with Kookmin, Shinhan, and Hana Banks, Seoul City also decided to reduce the loan additional interest rate from the existing 1.6% to 1.45%. From new or renewal contract applications onward, couples using the Seoul City newlywed couple lease deposit loan can benefit from an interest rate 0.15 percentage points lower than before. The city explained that this reduction in the loan additional interest rate will generate an annual support effect of approximately 7 to 8 billion KRW.

The loan interest rate for this program is determined by adding the additional interest rate to the COFIX (Cost of Funds Index) 6-month base rate based on the new balance. The user’s burden interest rate is calculated by subtracting the support interest rate from the loan interest rate.

New borrowers from the 30th of next month will also be able to receive support for the lease deposit return guarantee fee up to 300,000 KRW. They can apply through the Seoul Housing Portal after subscribing to the lease deposit return guarantee provided by the Korea Housing Finance Corporation (HF). Required documents for application include a financial transaction confirmation (issued by the loan bank), lease deposit return guarantee certificate and fee receipt, full registry certificate, and resident registration certificate.

Additionally, a new 1% additional interest support benefit has been established for single-parent youth raising children (aged 19 to 39). Single-parent youth can receive up to 3% interest support, combining the existing youth lease deposit interest support (up to 2%) with this additional benefit.

The expanded 'Newlywed Couple Lease Deposit Interest Support' program will be available to new loan applicants and renewal applicants from the 30th of next month onward.

Han Byung-yong, Director of Seoul City Housing Policy Office, said, "We will continue to improve the newlywed couple and youth lease deposit interest support programs and develop incentives to create a stable housing environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)