Paradise Transfers from KOSDAQ to KOSPI

Hanjung NS Moves from KONEX to KOSDAQ

Paradise Falls 4% on First Day of Listing... Hanjung NS Rises 13%

Paradise Draws Attention with KOSPI200 Inclusion

Hanjung NS Anticipates Growth in ESS Market

The stock prices of companies undergoing prior listings showed mixed results on their first day of trading. Paradise, which moved from the KOSDAQ market to the KOSPI market, showed a decline, while Hanjung NS, which moved from the KONEX market to the KOSDAQ market, saw a significant increase in its stock price.

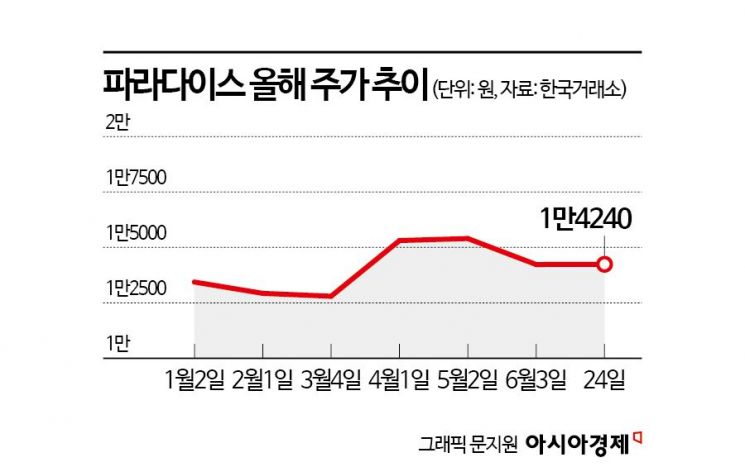

According to the Korea Exchange on the 25th, Paradise closed at 14,240 KRW, down 4.17% from the previous day. The stock price showed weakness due to profit-taking following two consecutive days of gains ahead of its transfer listing to the KOSPI market. Previously, on the 21st, it had risen by 5.99%.

Although it showed weakness on its first day in the KOSPI market, the future stock outlook is positive. This is because its second-quarter earnings are expected to be strong, and there is a high possibility of inclusion in the KOSPI 200 index. Sujin Lim, a researcher at Daishin Securities, analyzed, "Paradise’s second-quarter earnings are expected to show strong results, with sales increasing by 6.5% year-on-year to 293.2 billion KRW and operating profit decreasing by 10.8% to 48.4 billion KRW, exceeding the consensus (average securities firm forecast) by 9%. The company continues stable earnings growth as a result of sustained marketing expansion in its strong Japanese VIP and new markets."

The possibility of inclusion in the KOSPI 200 index is also seen as positive for the stock price. Researcher Lim stated, "Paradise is expected to be included in the KOSPI 200 index based on its current market capitalization, and improved supply and demand will also positively affect the stock price."

On the same day, Hanjung NS, which transferred from the KONEX market to the KOSDAQ market, closed at 34,000 KRW, up 13.33% from its public offering price of 30,000 KRW. During the day, it even rose above 50,000 KRW but ended the session with a reduced gain. Hanjung NS attracted attention as the first case this year of a transfer listing from KONEX to KOSDAQ. During the general subscription held over two days starting from the 10th, about 6.0048 trillion KRW in deposits were collected. Earlier, in a demand forecast targeting domestic institutional investors, it recorded a competition rate of 725.9 to 1, finalizing the public offering price at 30,000 KRW.

The expectation of growth in the energy storage system (ESS) market appears to have contributed to the stock price increase. Hanjung NS is a company that develops ESS components and electric vehicle (EV) parts. Based on its own technology, it mass-produces and supplies core components that make up water-cooled cooling systems to its customers. Cheolhwan Yoon, a researcher at Korea Investment & Securities, analyzed, "With the rapid development of the artificial intelligence (AI) industry and the construction of data centers, global power consumption is surging. As power supply and demand imbalances become more frequent, ESS demand is also rapidly increasing to resolve the time gap between power generation and consumption." He added, "In particular, the cooling system, which is Hanjung NS’s main segment in the ESS industry, is highly important."

With Hanjung NS smoothly entering the KOSDAQ, attention is focused on whether the previously frozen transfer listings of KONEX-listed companies to KOSDAQ will begin to open up this year. Last year, seven companies transferred from KONEX to KOSDAQ, but this year Hanjung NS is the first. Daehyung Cho, a researcher at DS Investment & Securities, said, "It is true that interest in companies transferring from KONEX to KOSDAQ has recently declined. However, Hanjung NS is expected to improve both sales and profitability through the expansion of ESS component sales driven by the mass production of its 5th generation products starting in August and diversification of its customer base. Since there are not many ESS-related listed companies, the stock price is expected to perform well after short-term overhang is resolved."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)