Increasing Ambishumers Deepen Consumption Polarization

Active in 'Value Consumption'... Otherwise 'Extreme Saving'

In an era of high inflation, the phenomenon of 'consumption polarization' among young consumers is becoming prominent. They are willing to pay high costs for consumption that reflects their personal tastes and values, but exhibit extreme frugality when purchasing items that do not.

According to the Financial Supervisory Service's electronic disclosure system DART on the 22nd, i-i Combine recorded consolidated sales of 608.3 billion KRW and operating profit of 151.1 billion KRW last year. Compared to the previous year's sales (410 billion KRW) and operating profit (67.4 billion KRW), these figures represent increases of 48% and 124%, respectively. Established in February 2011, i-i Combine operates three brands: Gentle Monster, Tamburins, and Nudeike. Gentle Monster specializes in sunglasses and eyeglasses, Tamburins in cosmetics and perfumes, and Nudeike is a dessert brand.

These brands are characterized by unique concepts and high price points. Gentle Monster's flagship model, 'Dada 01,' is priced at 340,000 KRW and has gained popularity for its distinctive bold frame. Tamburins' perfumes cost about 140,000 KRW for 50ml, comparable to prices of overseas luxury perfume brands. Nudeike's signature menu item, the 'PEAK' cake (a squid ink pastry with matcha cream in the center), is often sold out early despite its price of 42,000 KRW.

The popularity of these brands is attributed to providing spaces where consumers can experience experiential consumption. i-i Combine currently operates the future retail space 'House Dosan' in Apgujeong-dong, Gangnam-gu, Seoul, where Gentle Monster, Tamburins, and Nudeike are all located. To maximize consumers' brand experience, the store installs large-scale artworks and opens flagship stores to offer a 'hip' atmosphere.

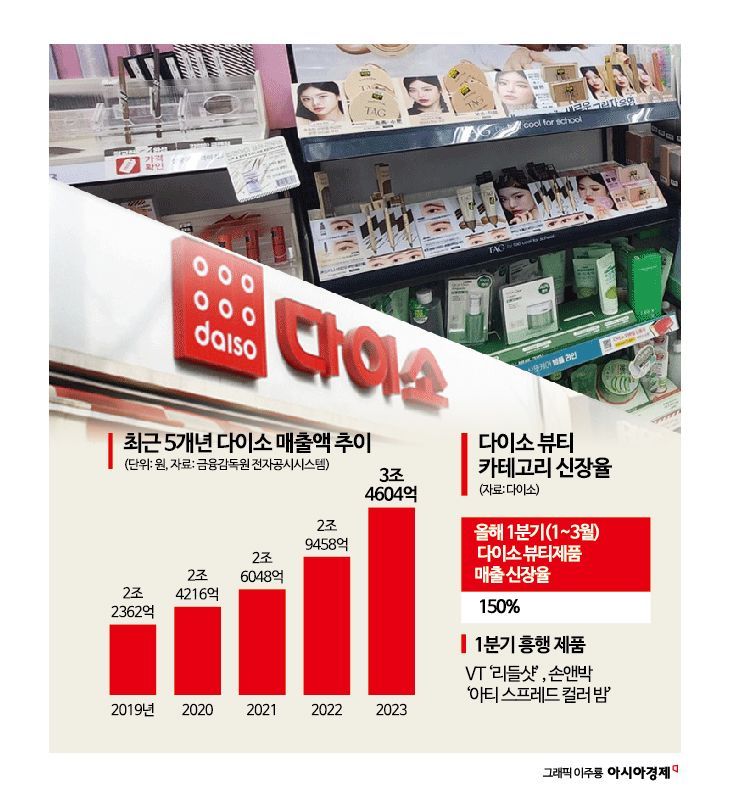

On the other hand, some companies continue to soar by targeting consumers seeking 'cost-effectiveness' in the high inflation era. Daiso has steadily grown sales during this period with its cost-effective strategy. Asung Daiso recorded sales of 3.4604 trillion KRW and operating profit of 261.7 billion KRW in 2023, increases of 17.5% and 9.4%, respectively, compared to 2022.

Initially, Daiso's product lineup focused on household goods, snacks, camping supplies, and hobby items. Recently, however, targeting young consumers with light wallets, it has expanded Daiso-exclusive beauty products through collaborations with beauty brands, strengthening its position in the beauty market.

The convenience store industry has captured consumers by strengthening ready-to-eat meals and low-priced private brand (PB) products during the 'lunchflation' (lunch + inflation) period. As office workers face increased lunch expenses, more consumers seek affordable meals, prompting an increase in 'cost-effective lunch' products. Ready-to-eat meal sales at CU, operated by BGF Retail, increased by 16.4% and 26.1% year-on-year in 2022 and 2023, respectively, and rose 32.8% in the January-April period this year compared to the same period last year.

This consumption polarization phenomenon is related to the rise of consumers with an 'ambisumer' tendency who value value-based consumption. 'Ambisumer' is a compound word combining 'ambivalent,' meaning duality, and 'consumer,' referring to consumers who simultaneously consume both high-priced and low-priced products.

Recently, KB Financial Group Management Research Institute explained in its report 'Consumption Patterns of Ambivalent Consumers Ambisumers' that "cases where a single trend influences the entire society are gradually disappearing, and the influence of various small trends popular among a minority within segmented categories is expanding, with individual values affecting consumption decisions," adding, "The consumption polarization phenomenon of value-conscious ambisumers is expected to continue in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)