Investment Opportunities in Price Discrepancies Such as Distressed Assets, Overseas Real Estate, and Discounted Corporate Shares

Interest-Bearing Asset Investments Like Senior Loans Remain Attractive

Value-Up Policies Reflected Early in the Market... Sustainability in Question

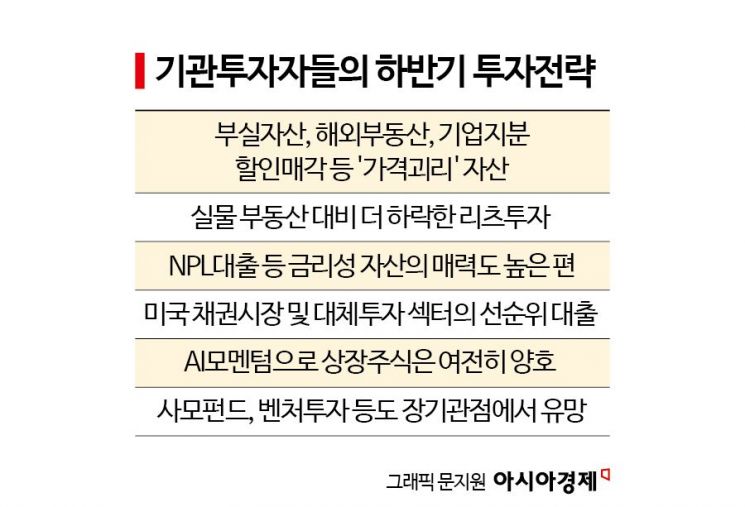

Domestic institutional investors such as pension funds and mutual aid associations are seeking investment opportunities in the second half of this year from 'price-dislocated' assets that have fallen more than their actual value.

The Chief Investment Officer (CIO) of Institution A said, "We are seeing investment opportunities in sectors with increased price merits, such as distressed assets, overseas real estate, and discounted sales of corporate equity."

Due to the persistent high interest rate environment, interest-bearing assets remain attractive. Institutions are expected to focus on senior loan investments in the second half. The CIO of Institution B stated, "In the second half, we plan to focus mainly on senior domestic loan investments." The CIO of Institution C also said, "Investment opportunities in the second half still lie in senior loans across all sectors of the U.S. bond market and alternative investments under the high interest rate environment."

Although there are differences in timing and pace, the prevailing view is that the overall investment environment will improve as three conditions converge: the beginning of the interest rate cut cycle by central banks worldwide, the AI technological revolution, and the full-scale commencement of U.S. IT manufacturing construction investment amid U.S.-China trade tensions. The Chief Investment Officer of Institution B said, "Due to AI momentum and the robustness of the U.S. economy, listed stocks will remain favorable," adding, "Private equity and venture investments are also promising from a long-term perspective." He further noted, "We view private credit, which is expected to benefit from high interest rates and the disintermediation of banks, and REIT investments that have fallen more than physical real estate, positively."

Factors expected to positively impact the domestic economy in the second half include strong growth in the U.S. economy, the full-scale rise of the semiconductor cycle, and the start of interest rate cuts by the Bank of Korea. On the other hand, risk factors mentioned include the resurgence of global inflationary pressures, restructuring of vulnerable sectors such as real estate project financing, and lack of consistency in financial and economic policies.

Institutions: "Government's Value-Up Policy Already Priced In... Sustainability in Question"

Institutional investors believe that expectations regarding the government's ongoing value-up policy have already been priced into the market, and they question its sustainability. While the policy direction is positive, they anticipate difficulties in establishing the legal foundation where shareholder returns and the interests of major shareholders, which are core to value-up, can align.

The CIO of Institution A emphasized, "It is necessary to introduce policies aligned with international standards such as amendments to the Commercial Act, tax law revisions, resumption of short selling, and treasury stock cancellations, as well as to operate policies independently of partisan politics." The CIO of Institution B said, "The core of value-up is enhancing shareholder returns, but tax law revisions such as separate taxation on dividend income, corporate tax benefits for treasury stock cancellations, and easing of inheritance tax rates are challenging," adding, "There are also many disagreements regarding amendments to the Commercial Act, such as director indemnity clauses, so it may not proceed smoothly." The CIO of Institution C stressed, "The first phase of the value-up policy effects in the first half seems to be over, and as we enter the second phase in the second half, effective policies and persistent execution will be crucial."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)