World Gold Council (WGC) Annual Survey Results

60% of Developed Countries Plan to Increase Gold Holdings Over Next 5 Years

Gold Buying Trend Expands Mainly in Developing Countries Like China

Experts Link This to the De-dollarization Trend

A survey has revealed that governments and central banks around the world are aggressively increasing their gold reserves. While non-Western developing countries such as China have been proactive in government-level gold purchases, recent analyses suggest that advanced countries are also joining the trend as the de-dollarization movement becomes more visible.

Countries Around the World Increasing Gold Purchases

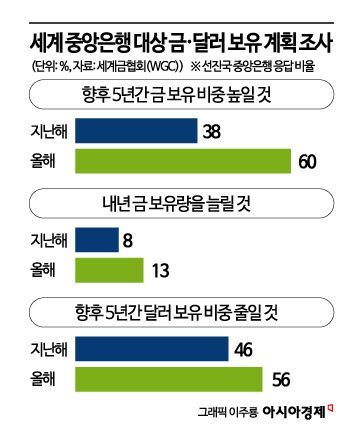

According to the annual survey released on the 18th (local time) by the World Gold Council (WGC), about 60% of central banks in advanced countries plan to increase the proportion of gold in their assets over the next five years. This is a significant increase compared to the 38% response rate in the same survey last year. About 13% of advanced country central banks stated they plan to increase their gold holdings next year.

Gold purchases at the level of central banks worldwide have so far been concentrated in developing countries such as China. Now, this trend is expanding to advanced countries. Experts also link this trend to the de-dollarization phenomenon.

Gold, a representative safe-haven asset, attracts attention whenever uncertainty due to geopolitical risks increases. After the 2022 Ukraine war, when the West, including the United States and the European Union (EU), froze Russian assets as part of sanctions, the risk of financial sanctions when holding foreign currencies was highlighted. Consequently, non-Western countries hurried to purchase gold. Additionally, the Israel-Hamas (Palestinian armed faction) war triggered in October last year further strengthened risk-averse sentiment.

This explains why gold prices have repeatedly hit record highs this year. On the New York Mercantile Exchange, gold futures prices reached a historic high of $2,450 per ounce last month, and are currently trading around $2,343 per ounce.

De-dollarization Expected to Accelerate

As gold purchases by central banks worldwide become a trend, the proportion of dollar holdings by countries is naturally expected to decrease. The WGC reported, “About 56% of advanced country central banks and about 64% of emerging market central banks said they plan to reduce their dollar holdings over the next five years.”

The International Monetary Fund (IMF) confirmed that the dollar’s share in global foreign exchange reserves has declined for three consecutive quarters in the latest data released this month. It dropped from 59.46% in the first quarter of last year to 58.40% in the fourth quarter. The dollar’s share was as high as 70% in 2000 but has been on a downward trend since. The dollar index, which measures the dollar’s value against six major currencies including the euro and yen, stands at about 105, indicating that dollar hegemony is still maintained, but it is lower than the 115 level seen in 2022 when the dollar was called the “King Dollar.”

There is also analysis that many central banks worldwide are rushing to sell dollars and buy gold as the U.S. fiscal deficit increases. According to the “2024?2034 Budget and Economic Outlook Update” released on the 18th (local time) by the U.S. Congressional Budget Office (CBO), the U.S. fiscal deficit this year is expected to reach $1.9 trillion (about 2,600 trillion won). This is a 27% increase from the $1.5 trillion (about 2,072 trillion won) forecasted by the CBO in February and amounts to about 7% of the gross domestic product (GDP).

China’s efforts to internationalize its own currency (yuan) are also considered to contribute to selling dollars.

The Wall Street Journal (WSJ) stated, “Central banks now prioritize gold,” and predicted, “Amid pessimism about the dollar, central banks’ moves to secure gold will continue.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)