ETF Net Asset Value 150.6057 Trillion KRW

Surpassed 100 Trillion KRW in June Last Year, Increased by 50 Trillion KRW in One Year

Domestic ETF Share Decreases, Overseas ETF Increases

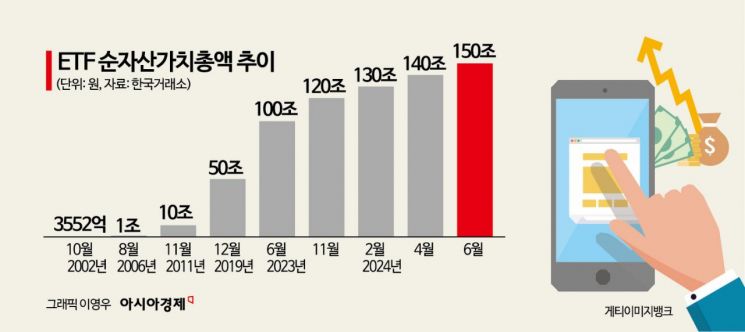

The domestic ETF market size has surpassed 150 trillion won for the first time. The steep growth trend of the ETF market continues through the continuous supply of new products and capital inflow.

According to the Korea Exchange on the 19th, the net asset value of the ETF market reached 150.6057 trillion won the previous day. It reached the 150 trillion won mark one year after surpassing 100 trillion won for the first time in June last year. The net asset value of ETFs surpassed 100 trillion won in June last year, exceeded 120 trillion won by the end of November, and surpassed 130 trillion won in February and 140 trillion won in April this year.

As the market rapidly grows, the number of listed ETFs increased from 812 at the end of last year to 875 currently. The number of newly listed ETFs this year is 69, exceeding 52 at the same time last year. Considering that 160 new ETFs were listed last year, setting a record high, it is expected that this year will break the record again at the current pace.

The ratio of ETF total assets to KOSPI was about 6.8% as of the end of May, up 1 percentage point from 5.7% at the end of last year.

Looking at the total net asset value by product type, the domestic proportion is decreasing while the overseas proportion is increasing. The domestic share was 76.6% at the end of last year but fell to 70.9% by the end of May, while the overseas share expanded from 23.4% to 29.1% during the same period. Kang Song-cheol, a researcher at Eugene Investment & Securities, analyzed, "This year, the market capitalization share of overseas investment ETF products is increasing," adding, "For domestic investment ETFs, the market capitalization share of market representative index products has been continuously decreasing, while the share of bond and interest rate ETFs has increased since last year."

Among the top 10 ETFs by total net asset value, interest rate ETFs accounted for the majority, and ETFs investing in the U.S. market also ranked high in net asset value. As of the end of May, KODEX CD Interest Rate Active (Synthetic) was the largest with 9.1696 trillion won. Its net assets increased by more than 3 trillion won this year alone. TIGER CD Interest Rate Investment KIS (Synthetic) was second with 7.315 trillion won, followed by KODEX 200 (6.0835 trillion won), KODEX KOFR Interest Rate Active (Synthetic) (5.3297 trillion won), TIGER KOFR Interest Rate Active (Synthetic) (3.6999 trillion won), TIGER U.S. S&P 500 (3.5241 trillion won), TIGER U.S. Nasdaq 100 (3.3283 trillion won), KODEX Comprehensive Bond (AA- or higher) Active (2.7427 trillion won), TIGER U.S. Philadelphia Semiconductor Nasdaq (2.4847 trillion won), and KODEX 24-12 Bank Bond (AA+ or higher) Active (2.4707 trillion won).

This year, the U.S. stock market has continued its strong performance, hitting all-time highs, and AI semiconductors had the greatest impact on the stock market in the first half, resulting in high returns for U.S. and semiconductor ETFs. ACE U.S. Big Tech TOP7 Plus Leverage (Synthetic) recorded the highest return among all ETFs with a 113.05% increase this year. TIGER U.S. Philadelphia Semiconductor Leverage (Synthetic) followed with a 98.54% rise, ARIRANG U.S. Tech 10 Leverage iSelect (Synthetic) 92.61%, KODEX U.S. Semiconductor MV 65.27%, and ACE Global Semiconductor TOP4 Plus SOLACTIVE 64.53%, sweeping the top 5 returns among U.S. and semiconductor ETFs.

Despite the steep growth of the market, so-called 'zombie ETFs' that do not have proper trading also exist. As of the 18th, there were 201 ETFs with trading volume less than 10 million won. Among them, 17 had zero trading volume.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)