Berkshire Reduces BYD Stake from 7% to 6.9%

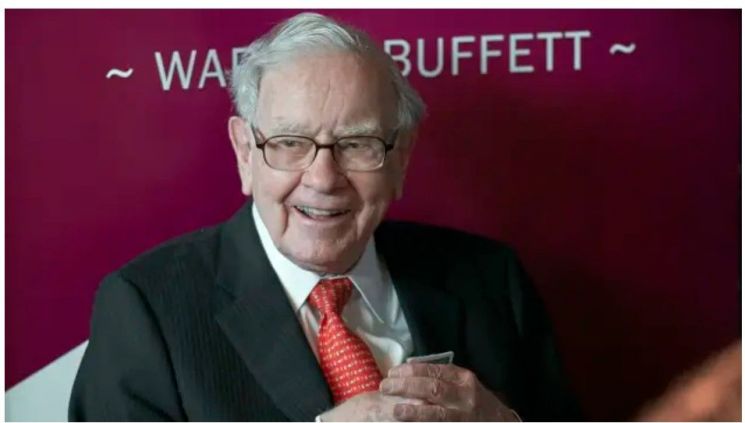

'Investment genius' Warren Buffett-led Berkshire Hathaway has reduced its stake in BYD, China's largest electric vehicle company.

According to foreign media including CNBC on the 16th (local time), Berkshire recently sold an additional 1.3 million shares of BYD on the Hong Kong stock market for $39.8 million (about 55 billion KRW). As a result, Berkshire's stake in BYD decreased from 7% to 6.9%.

Berkshire purchased 225 million shares of BYD in 2008 for $230 million (about 318 billion KRW). As the global electric vehicle market, including China, rapidly grew, Berkshire also earned significant profits from its investment in BYD. BYD's stock price surged nearly 600% from when Berkshire bought the shares in 2008 to its all-time high in 2022. Subsequently, Berkshire sold half of its BYD holdings in 2022 and 2023.

Berkshire's investment in BYD was the idea of Charlie Munger, Berkshire's vice chairman and Buffett's close partner who passed away last year. In 2010, Buffett praised Munger, saying he "deserves 100% credit for BYD."

BYD surpassed Tesla in the fourth quarter of last year to become the world's number one electric vehicle seller. However, as the electric vehicle market growth slowed and Tesla cut vehicle prices, Tesla reclaimed the top spot in electric vehicle sales in the first quarter of this year. Additionally, the imposition of high tariffs on Chinese electric vehicles by the United States and the European Union (EU) is also analyzed to have reduced the investment appeal of BYD.

BYD's stock price closed at $233.4 on the Hong Kong stock market on the 17th, up 1.74% from the previous trading day. It has fallen more than 50% from its peak of $353.5 in June 2022.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)