Temporary Financial Committee Convenes, Decides to Extend Short Selling Ban

Short Selling System to Be Completed by March Next Year

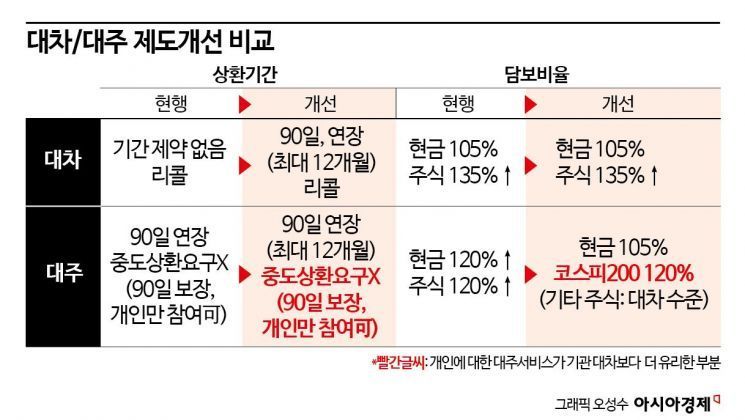

Loan Repayment Period Within 12 Months

No Individual 'Recall'...Collateral Ratio Lowered to 105%

KOSPI200 Stock Collateral Ratio Maintained at 120%

The Financial Services Commission will extend the full ban on short selling until March 30 next year. Last year, the FSC announced that it would impose a full ban on short selling until June 30. During the extended ban period, the electronic system will be finalized, and legal amendments will be pursued.

Once the amendment to the Capital Markets Act is passed, both lending (institutional) and borrowing (individual) transactions will have a unified repayment period of 90 days. The short selling collateral ratio, which was criticized as discriminatory against individual investors, will be aligned to 105% (cash basis), the same as institutional investors. However, for KOSPI 200 stocks, the individual collateral ratio will be maintained at 120%, making it more favorable than the institutional ratio of 135%. In addition, criminal penalties for illegal short selling will be significantly strengthened. Fines for illegal short selling will be increased from 3-5 times to 4-6 times the unfair gains. Furthermore, depending on the scale of unfair gains, life imprisonment may also be possible.

On the 13th, the Financial Services Commission held an extraordinary meeting and resolved to extend the short selling ban period from July 1 to March 30, 2025. On the same morning, the 'Min-Dang-Jeong Council' finalized the 'Short Selling System Improvement Plan' to resolve illegal and unfair issues and protect investors.

◆ Establishment of 'NSDS' System to Preemptively Block Short Selling by March Next Year= First, to block naked short selling by institutional investors, the Korea Exchange will establish an electronic short selling system, called the 'Central Inspection System (NSDS).' NSDS receives balance and over-the-counter transaction information generated from the internal balance management systems of institutional investors and cross-checks this with all trading order details held by the Korea Exchange for institutional investors. Through this, naked short selling will be comprehensively inspected within three days. The Exchange has already started the NSDS construction process and plans to complete it by the end of March 2025.

As part of this, all institutional and corporate investors must establish internal control standards to prevent naked short selling. This also applies to corporations that intend to place small-scale or single short selling orders. The internal control standards include designating a short selling management department, preparing short selling work rules, and the obligation to record and manage short selling internal control information (to be kept for five years). Additionally, the confirmation obligations of securities firms receiving short selling orders will be strengthened.

◆ More Favorable Short Selling for Individuals... Unified 90-Day Repayment Period and 120% Collateral Ratio for Individuals= Short selling is a system where stocks not owned are borrowed to place 'sell' orders, and then the stocks are repurchased from the market within a certain period to repay the loan. If the stock price falls, the short seller profits by buying back at a lower price. Conversely, if the stock price rises, the short seller incurs a loss.

The government will unify the maximum short selling repayment period to 90 days for both institutions and individuals. Although the repayment period can be extended, it must be repaid within 12 months. The 'recall' system, which requires immediate repayment on the settlement date if requested by the lender, will be maintained. However, for the borrowing service (individual investors), the 'recall' does not apply, and a minimum 90-day repayment period is guaranteed.

The collateral ratio for individuals will also be lowered. For individuals, it will be reduced from the existing 120% to 105% (cash basis). For KOSPI 200 stocks, the 120% ratio will be maintained. Since this is lower than the institutional investors' 135% collateral ratio for KOSPI 200 stocks, it becomes more favorable than for institutional investors.

◆ Life Imprisonment Possible for Large Illegal Short Selling Gains... Enhanced Disclosure of Short Selling Balances= The government will also strengthen criminal penalties for illegal short selling. First, fines will be increased from the current 3-5 times the unfair gains to 4-6 times. Enhanced imprisonment penalties will also be introduced. For unfair gains of 500 million KRW or more, imprisonment will be increased. Currently, sentences range from 1 to 30 years regardless of the amount of unfair gains, but with larger unfair gains, life imprisonment will become possible.

Administrative sanctions will also be diversified. Those who engage in illegal short selling or unfair trading practices will face restrictions on trading financial investment products. Appointment as executives of financial companies or listed companies can also be restricted for up to 10 years.

Furthermore, to enhance transparency in short selling, the criteria for 'short selling balance disclosure' will be strengthened to a reporting level. Currently, short selling balances are disclosed if they exceed 0.5% of the issued shares, but now the disclosure threshold will be expanded to 0.01% of issued shares or 1 billion KRW.

Additionally, investors who short sell after the issuance of convertible bonds (CB) or bonds with warrants (BW) but before the conversion price at issuance is disclosed will be restricted from acquiring CBs and BWs. This is to block transactions that exploit short selling to influence the conversion price and gain profits.

The FSC plans to proceed swiftly with all follow-up measures to ensure the 'short selling system improvements' are implemented promptly. It aims to actively negotiate with the National Assembly for legislative discussions targeting legal amendments within this year. The revision of subordinate regulations, such as lowering the collateral ratio for borrowing and strengthening short selling balance disclosure criteria, is expected to be completed by the third quarter of this year. The system overhaul of lending intermediary institutions to limit the maximum lending period will also be completed by the third quarter.

Kim So-young, Vice Chairman of the FSC, said, "We will actively pursue fundamental institutional improvements to prevent the recurrence of illegal and unfair short selling issues," adding, "We will make short selling a sound trading technique that enhances the price discovery function of the market and create a 'trusted capital market' where all investors can participate fairly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)